3 Types Of Homeownership Costs In Malaysia: Quit Rent, Parcel Rent, And Assessment Rates

The role of Quit Rent and Assessment Rates are both important parts of your household finances.

But these costs are often overlooked when it comes to understanding charges that relate to property in Malaysia. So what do you need to know?

These two payments form part of Malaysia’s land tax system. The owners of qualifying properties are legally liable for these charges under Malaysia’s established system of law.

That means you better pay up, or well… you’ll pay for it! Here’s what that means in terms of who, why, and when you have to pay your quit rent and assessment rates.

Who Has To Pay The Quit Rent?

Quit rent is imposed on owners of any landed property in Malaysia, which includes both freehold and leasehold land. As long as you own the property, you will have to pay quit rent every year, even if the property is sitting idle and not in use!

[PropertyTip]Quit rent, or <i>’cukai tanah’, </i>is a form of land tax collected by your state government for property in Malaysia.[/PropertyTip]

It’s assessed and imposed by the local state government, via the country’s Land Office.

Quit rent also applies to strata buildings. This payment has traditionally been charged to the Joint Management Body (JMB) of these buildings, who pass on the costs through maintenance fees.

Recent changes indicate a shift towards including this land tax as part of a separate charge billed direct to owners.

The National Land Code sets out in law the obligation of all landed property owners to pay quit rent annually to the relevant Land Office.

Each state will have a set date by which Quit Rent must be paid, although most states operate on a 31 May cut-off. If you want to know where to check and pay land tax for all states in Malaysia, refer to the full list here!

No matter where you live, it’s good to regularly check your land tax so you can get the latest information and find out if you’ve missed any payments.

How Much Quit Rent Do I Have To Pay?

Quit rent is assessed as a chargeable rate related to the total amount of land included as part of a property. In other words – it is assessed per square foot (psf) of landed property.

[PropertyTip]The chargeable rate varies from state to state, and even by property type.[/PropertyTip]

That means it’s important to check your own quit rent rates with the relevant Land Office (or your state government) to understand what you might have to pay.

If you’re looking for a guideline figure – a landed property in Kuala Lumpur has historically been charged at a rate of RM0.035 psf.

So a 2,500 sq ft property would have a chargeable quit rent of RM87.50. Quit rent is unlikely to be more than RM100 for most properties. Here’s how to calculate quit rent:

Square foot of property x Price per square foot = Quit rent

2,500 sq ft x RM0.035 psf = RM87.50

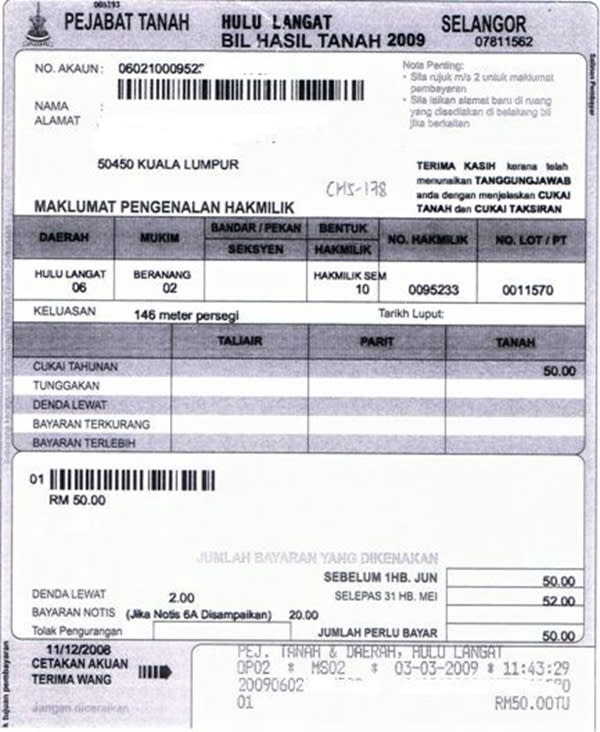

Example of a quit rent bill:

How About Parcel Rent?

Until recently, quit rent also applied to strata properties, which are properties that are organised by splitting said properties into ‘parcels’.

This usually refers to apartments and condominiums, but some types of landed properties may fall into this category too, such as townhouses.

While purchasers are the owners of their ‘parcel’ under this arrangement, common areas like swimming pools are still owned by the developer.

For strata properties, the quit rent used to be charged to the joint management body (JMB) of these properties, who passed on the costs through maintenance fees.

However, in June 2018, a new land tax was created for strata properties in Selangor to replace the quit rent, called parcel rent. This new parcel rent is now a separate charge billed directly to owners.

This change was created with the intention to ease the sale and transfer of ownership of strata properties.

Under the old system, any owner who wants to sell or transfer the ownership of a parcel would run into trouble if the Land Office records show that other parcel owners in the property have not paid their quit rent.

Penang also implemented the parcel rent system in 2019, with Kuala Lumpur implementing it from 1 January 2020.

While this change was meant to be an improvement on the old system, many people were shocked to find that their parcel rent went up dramatically after this conversion!

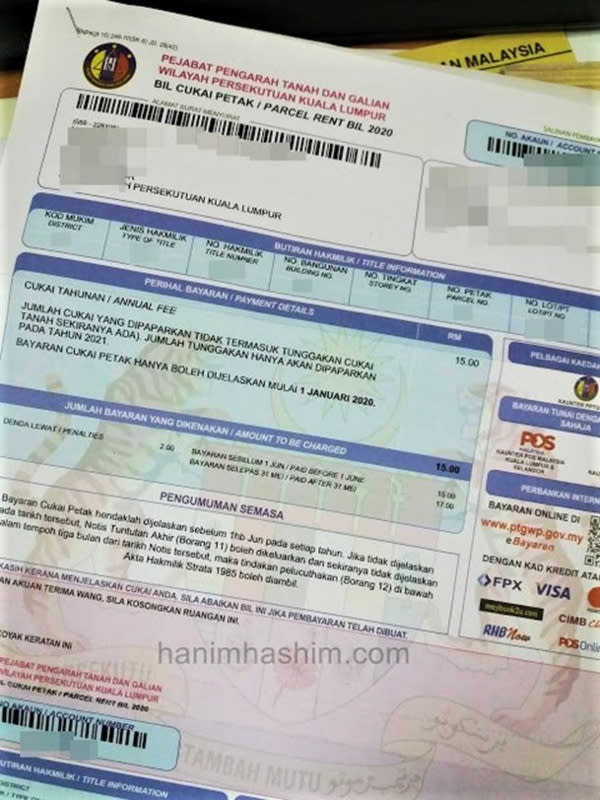

Here’s an example of a parcel rent bill:

So Why Is Parcel Rent More Expensive Than Quit Rent?

Under the old system, the quit rent for one property would be split amongst each parcel.

For example, if an apartment building consists of 10 equal-sized parcels covering an area of 10,000 sq ft, the quit rent, at a rate of RM0.05 psf, would come to RM500.

Splitting this amount across 10 parcels, each parcel owner would just need to pay RM50 per year.

However, under this new system, each parcel owner would have to pay for the entire square footage of the building!

So the new parcel rent for each parcel of the same building would be RM500 per year!

Many people were understandably unhappy about this, but at least this system allows the Land Office to individually monitor defaulters.

Now, defaulters will not cause trouble for other parcel owners who have been diligently making their payments.

What Are Assessment Rates?

Assessment rates, or ‘cukai pintu/cukai taksiran’, is a local land tax collected by local councils to pay for developing and maintaining local infrastructure and services.

This tax is essentially a charge to maintain the local area. It helps pay for things like:

Lighting by the side of roads

Cleaning of parks

Collecting municipal waste

Other miscellaneous tasks that make for a well-maintained and pleasant place to live

Example of an assessment rate bill:

Who Has To Pay The Assessment Rates?

All property owners must pay assessment rates, from residential properties such as bungalows, to industrial buildings like factories and manufacturing sites.

Basically if you own a property in Malaysia, you owe assessment rates. As the property owner, you are liable to pay these charges, even if you’re renting out your property.

If a building is empty, you would still be due payment on assessment rates, but you may apply for a refund and remission rates.

You must notify the local authority in writing within 7 days of your property becoming unoccupied, otherwise remission rates apply from the date a letter is received.

Some states offer assessment rates exemptions for low- and medium-cost housing, and it’s worth checking the local rules to understand if you’re exempt.

How Much Do I Have To Pay For Assessment Rates?

Assessment rates are calculated based on the estimated annual rental value of your property.

Once that figure is assessed, you are charged a set percentage rate of that amount by the relevant local authorities.

So how much might you be charged? The actual amount varies from state to state, but a guideline figure for Malaysia is 4% of the annual rental value of your residential property.

The assessed rental value also varies by property type and specifications, meaning a small flat (quite rightly) gets charged less than a luxury landed bungalow. How does that look in practice?

Say the monthly rental value of that particular landed property is estimated as RM4,000. Your annual rental estimate would be 4,000 x 12 for a total value of RM48,000.

Then taking 4% of that (the rate applying to landed property), and you would owe RM1,920 annually.

Since assessment rates are collected over two payments across the year, you would owe RM960 per payment (based on the simplified example above).

Payments can vary by state, but usually fall on the last day of February, and the last day of August.

Of course just to make it tricky, Johor likes to do things a bit differently!

Be sure and check with your local authority to ensure you understand your specific rights and obligations as relates to these land tax rules.

What Happens If You Don’t Pay Quit Rent, Parcel Rent, Or Assessment Rates?

You have a legal obligation to pay your quit rent, parcel rent, and assessment rates. That means if you fail to pay, you’re likely to receive a financial penalty.

First, a notice for payment will be issued. A penalty charge on arrears is likely to be imposed if you fail to pay. If you fail to pay the penalty and original tax, an arrest warrant can be issued.

The Council is then empowered to confiscate your belongings, and impose an additional 10% charge for the issuing of a warrant.

In the most extreme circumstances, a warrant authorises your local authority to:

Seize any loose items available in the building or property

Auction the building or land with an appointed auctioneer

Tenants, beware! In some cases your own property could be liable for seizure in the event your landlord fails to pay their land tax bills.

Make sure to pass on any calls to pay immediately to your landlord to avoid any problems. If they default on their arrears, your possessions may be at risk.

How To Pay Your Quit Rent, Parcel Rent, Or Assessment Rates

Now that you know how much you have to pay, here comes the next question: where and how do you do so?

Depending on which state you’re in, there are several methods to pay your quit rent, parcel rent, and assessment rates.

Offline and in-person

– Land Registry Office

– Local district council

– Post officesOnline

– Pos Online

– Online banking platforms such as Maybank2u, CIMB Clicks, and AmOnline

– The Land Registry Office’s official online platform (for certain states)

If you’re paying online, do note that each Land Registry Office only accepts payments from selected banks! The best way would be to check the list of accepted banks on their website:

Relevant Guides: