Should You Shop For A Mortgage Or Property First In Malaysia?

There's plenty of information out there about buying a home, but many are still struggling to understand what needs to be done, and how to prioritise which ones need to be done first.

As purchasing a property is one of the biggest financial decisions and a huge commitment in your life, it is important for you to take the right step for, well, the financing!

If you are from the wage earner group in Malaysia, you will be probably be spending most of your life paying off the monthly instalments (the usual tenure is 35 years).

It'll be wise for you to carry out necessary research beforehand, so that you'll have comprehensive knowledge about home loan basics in Malaysia and the important things to know when applying for one.

Ask any expert, they will tell you that it is best to start looking for the right mortgage which you can afford first, BEFORE deciding to sign those legal papers.

Why Should You Shop For Your Mortgage Beforehand?

By deciding to look for the right mortgage, you will be able to roughly know how much you can afford to borrow, and you can then plan your new home search accordingly.

If you are serious in sealing that deal, you should also get pre-approved for the home loan that suits your eligibility and affordability.

This will help you save time, and overall, speeds up the home buying process. Or else, if you were to apply and get rejected, it can actually affect your credit score rating!

Now, there are several benefits to getting pre-approved for your mortgage financing first:

1) Time saving

You don’t have to wait weeks for the bank's approval when you have finally made a decision to buy, as you already know that you can afford the particular property you are interested in.

This means that you can immediately secure the home of your dreams, and not lose out to someone else who was already pre-approved!

2) Able to make an offer with confidence

If you’re looking to make an offer on a home, you don’t have to guess whether you can afford it or not. The bank's pre-approval is all the guarantee you need to know that you'll be able to afford the monthly repayments.

3) You will be a ‘low-risk’ buyer

Obtaining a mortgage pre-approval before deciding on purchasing a home will not only give you the confidence you need, but the seller as well.

This is because a pre-approval will let the seller know your qualifications that have been checked in advance. He/she will have peace of mind that your offer will not fall through as everything has been verified.

We have designated tools that help you check your eligibility and affordability, through the PropertyGuru affordability calculator, free of charge!

What Is An Expert's Opinion On This?

According to Kent Keyu, founder of Redefined Mortgage Specialist Sdn Bhd, buyers should get comprehensive information on their eligibility BEFORE they even start looking for their dream home.

In terms of affordability, Kent said that most of his clients want to know about their chances for a loan approval, before placing a booking.

“We will interview them and once that has been done, along with our advice, the client will know what is their eligibility.”

He said that if the client is not able to get the loan amount that they wanted, they will help to provide other solutions, which will be on a case-to-case basis.

“I advise property buyers to survey for a suitable home loan before they decide to shop for a property. This is to avoid any hassle down the road, when you are really going to submit your documents,” he said.

He noted that having a mortgage specialist will make it easier for the buyers too, as they will be able to skip the process of calling all the banks in Malaysia one by one to survey every home loan package available.

“We are dealing with 14 banks in Malaysia, and we also advise based on the current market rate, so we are able to help our clients in realising which bank is offering the best rate in town.”

Additionally, Kent said that apart from the interest rates, the clients will be advised on the packages available in the market, such as semi-flexi, full-flexi (suitable for business people), and term loan.

To ensure the home loan application process goes smoothly, a good credit rating is important. This score will ensure the buyer's eligibility and success in obtaining the home loan they desire.

What Is A Good Credit Rating For Homebuyers?

It is all about the way you have been managing your finances, especially if you are the type of a person who puts extra effort in clearing your payments on time, and monitoring your Debt Service Ratio (DSR)!

First up, your DSR. Generally speaking, a higher ratio will lower your chances of getting the desired loan amount for your home purchase, as you may be considered a risk to the bank.

This is because your bank has calculated that it's a higher chance of you not being able to service your monthly payments.

The rule of thumb is that you should be able to put aside one-third of your nett income to pay for your housing loan monthly repayment.

DSR will be a crucial indicator for the banks to assess if you are within your financial limits, and are eligible to get a housing loan based on the applied mortgage margin.

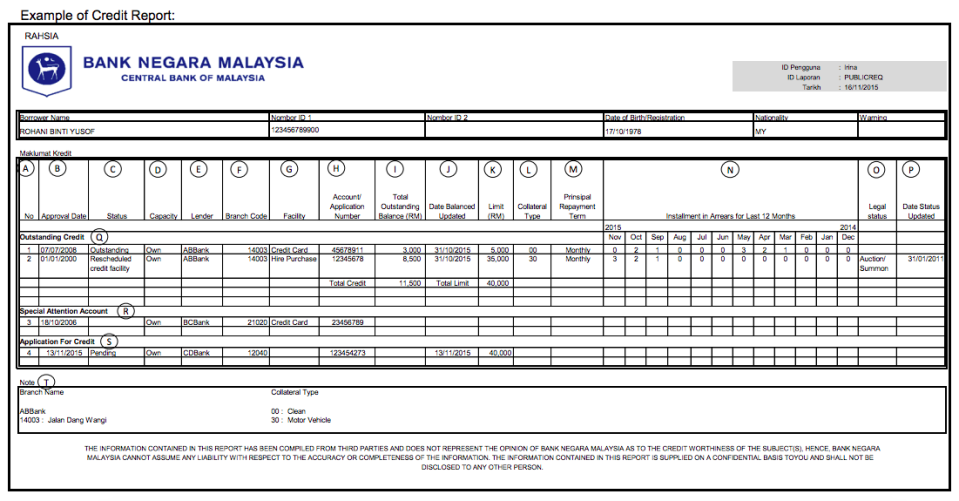

Another important matter you need to know as a buyer before shopping for the best mortgage, is your CCRIS (Central Credit Reference Information System) report.

CCRIS is a system that collects all relevant credit information on borrowers from participating financial institutions, and supplies the information back to them.

This is one of the sources of information used by the banks to help them establish a view of the credit histories of potential and/or current borrowers.

In simpler terms, the CCRIS report paints a picture of your creditworthiness, through a recorded financial history.

It used to be quite a hassle to obtain your CCRIS report as you have to go through Bank Negara Malaysia’s physical process.

Now, it has been made more convenient as you can obtain it online. You can register directly with eCCRIS and then you can check it at your leisure.

Apart from taking into account your monthly salary and commitments, typically a bank will also look into your monthly repayment habits and legal status.

If anything is out of the ordinary, the bank will be hesitant in approving your loan application. Speak to your home loan officer to find out the best way to get your housing loan approved.

The Other Types Of Costs Involved In A Home Purchase

Apart from the price of the property, it is important for you to remember that there are other costs that you need to bear, in order to own the desired unit.

When it comes to financial commitments, we have that one question in our mind, “What will be my monthly commitments?”. However, you should also ask yourself this: “What do I have to pay NOW?”.

For example: If the house you would like to purchase has a selling price of RM500,000, with a 90% margin housing loan, you will be needing to incur these costs (estimations):

SPA (Sale and Purchase Agreement) Legal Fees – About RM5,000

Loan Agreement Legal Fees – About RM4,500

Stamp Duty on MOT (Memorandum of Transfer) – About RM9,000

Loan Stamp Duty – About RM2,250

In addition to the down payment that you have to place (normally 10% of the property's selling price), other charges that will be incurred include the following:

Life insurance cover for your mortgage (MRTA/MLTA/MRTT/MLTT)

Fire insurance, quit rent, and assessment rates (payable annually)

Maintenance fee and sinking fund (for strata-type properties that come with shared facilities, like condominiums and townhouses)

Loan interest (factored in as part of your monthly loan instalment)

If you have been dreaming about owning a home and you are financially ready, 2021 may just be the best time to go for it.

This is because there’s an oversupply of property and it is currently a buyer’s market. You will be able to bargain, and interest rates are already at an all-time low.

BUT, make sure you do the right thing to save yourself from heartache and messing up your credit score: Shop for a mortgage first!

Relevant Guides:

Malaysians Share The Surprising Reasons Why Their Home Loans Were Rejected

What Is A Townhouse: 5 Pros And Cons Of Choosing To Live In One

What Is Earnest Deposit In Malaysia, And Why Is It Usually 2%?

Disclaimer: Information provided on this website is general in nature and does not constitute financial advice.

PropertyGuru will endeavour to update the website as needed. However, information can change without notice and we do not guarantee the accuracy of information on the website, including information provided by third parties, at any particular time.

Whilst every effort has been made to ensure that the information provided is accurate, individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial planner or your bank to take into account your particular financial situation and individual needs.

PropertyGuru does not give any warranty as to the accuracy, reliability or completeness of information which is contained in this website. Except insofar as any liability under statute cannot be excluded, PropertyGuru, its employees do not accept any liability for any error or omission on this web site or for any resulting loss or damage suffered by the recipient or any other person.