Sherwin-Williams (SHW) to Buy Industria Chimica Adriatica

The Sherwin-Williams Company SHW recently agreed to purchase Italian wood coatings company, Industria Chimica Adriatica S.p.A. (“ICA”). The financial terms of the deal were not divulged.

ICA, which has roughly 600 employees, designs, manufactures and distributes industrial wood coatings used for kitchen cabinets, furniture and decor, building products, flooring and other specialty applications. The entity has annual sales of more than €150 million (roughly $146 million). It has sales and operations globally, including production facilities in Italy and Poland, and also has an interest in the India-based joint venture, ICA Pidilite.

ICA will become part of Sherwin-Williams’ Performance Coatings Group segment. The transaction is expected to be completed by the end of this year.

The acquisition provides Sherwin-Williams with innovative waterborne and solvent liquid coatings technology, including a range of ultra-matt protective coatings and a growing portfolio of BIO water-based coatings products. It also provides numerous opportunities to boost profitable growth in the region and beyond, Sherwin-Williams noted.

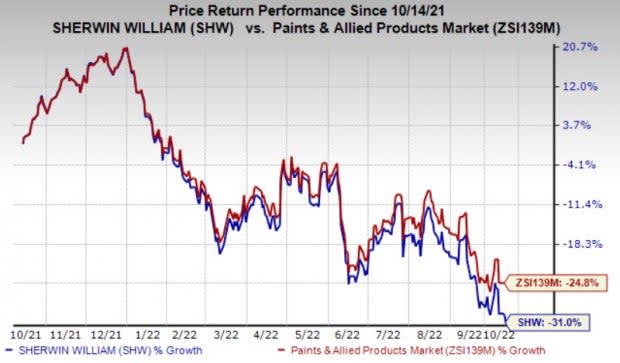

Shares of Sherwin-Williams have lost 31% in the past year compared with 24.8% decline of the industry.

Image Source: Zacks Investment Research

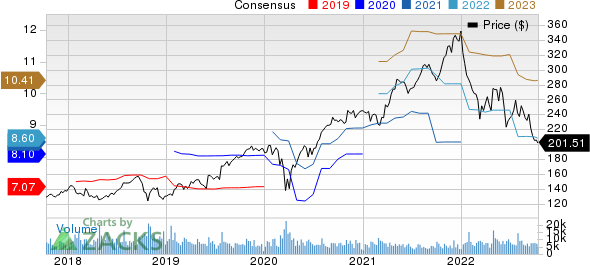

The company, on its second-quarter call, said that it expects consolidated net sales to increase in low to mid-teens percentage year over year in the third quarter. For 2022, it is projected to increase high-single digit to low-double digit percentage.

The company also now expects adjusted earnings per share for 2022 to be in the range of $8.50-$8.80, down from $9.25-$9.65 expected earlier. The downward revision is based on the weaker-than-expected second-quarter results, demand pressure in Europe, China and North American DIY, and inflationary pressure.

The SherwinWilliams Company Price and Consensus

The SherwinWilliams Company price-consensus-chart | The SherwinWilliams Company Quote

Zacks Rank & Key Picks

Sherwin-Williams currently carries a Zacks Rank #3 (Hold).

Better-ranked stocks worth considering in the basic materials space include Albemarle Corporation ALB, Ryerson Holding Corporation RYI and Sociedad Quimica y Minera de Chile S.A. SQM.

Albemarle, currently sporting a Zacks Rank #1 (Strong Buy), has a projected earnings growth rate of 426.7% for the current year. The Zacks Consensus Estimate for ALB's current-year earnings has been revised 22.1% upward in the past 60 days. You can see the complete list of today’s Zacks #1 Rank stocks here.

Albemarle’s earnings beat the Zacks Consensus Estimate in each of the last four quarters. It has a trailing four-quarter earnings surprise of roughly 24.2%, on average. ALB has gained around 9% in a year.

Ryerson Holding, currently carrying a Zacks Rank #1, has an expected earnings growth rate of 74.2% for the current year. The consensus estimate for RYI's earnings for the current year has been revised 3.2% upward in the past 60 days.

Ryerson Holding’s earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, the average being 28.9%. RYI has gained around 29% over a year.

Sociedad has a projected earnings growth rate of 530.7% for the current year. The Zacks Consensus Estimate for SQM’s current-year earnings has been revised 18.8% upward in the past 60 days.

Sociedad has a trailing four-quarter earnings surprise of roughly 27.2%. SQM has rallied roughly 53% in a year. The company currently carries a Zacks Rank #2 (Buy).

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The SherwinWilliams Company (SHW) : Free Stock Analysis Report

Albemarle Corporation (ALB) : Free Stock Analysis Report

Sociedad Quimica y Minera S.A. (SQM) : Free Stock Analysis Report

Ryerson Holding Corporation (RYI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research