Seizing Opportunity: 3 Momentum Stocks to Buy

Opportunity in October

I recently wrote a piece called “October: Where Bear Markets Go to Die,” which you can read here. Within the article, I divulged a mind-blowing statistic. That is, a whopping 50% of bear markets have ended in October! Beyond the tendency of stocks to bottom in October, US equities have some other positive headwinds including, strong seasonality trends, a breakdown in safe-haven plays like the dollar, base structures forming in quality growth stocks, and an abundance of fear.

Capitalize on a Potential End-of-Year Rally

If you believe that October will spell the lows for US equities like I do, the next step is to find ways to attain alpha, or in other words, outperform. In case you missed it, I wrote about the key elements to focus on to outperform equities in my commentary “Focus on 5 Elements to Achieve Alpha.” Below are 3 momentum stocks to own into year-end for potential super performance:

Palantir

Palantir (PLTR) is a unique company that specializes in software, security, and artificial intelligence (AI) solutions. The company’s largest customers are government and financial institutions. Government use cases include counterterrorism, intelligence analysis, and security and privacy.

Palantir helps organizations integrate vast and diverse datasets from various sources. PLTR’s software is known for being able to handle massive volumes of data while simultaneously being able to make connections between disparate data sets. In other words, the company helps organizations to simplify and make sense of complex data sets. The company’s software is highly coveted because it takes the data and translates it into interactive visualizations.

UK Contract Win is a Bullish Catalyst

Earlier this week, Palantir landed a major contract worth $400 million with England’s National Health Service. Not only will the contract boost Palantir’s Q4 earnings, but the company may be able to parlay the win into even more business down the road.

Momentum Monster

Palantir is a top performing stock this year having gained 159% year-to-date. In strong uptrends, the first base structure tends to be an area of high reward-to-risk. PLTR is rounding out the right side of its base and is attempting to break out on heavy volume – a sign of accumulation.

Image Source: TradingView

Arista Networks

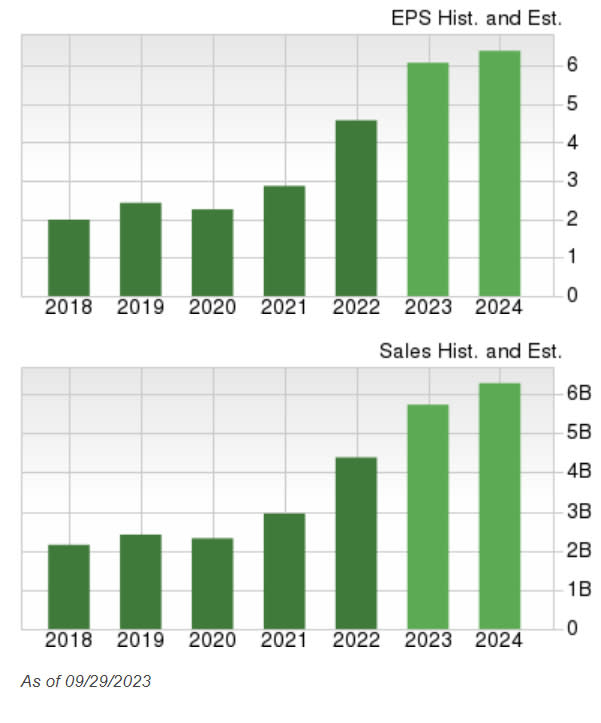

Zacks Rank #2 (Buy) stock Arista Networks (ANET) provides cloud networking solutions for data centers and cloud computing environments. While many growth stocks suffered last year, ANET’s business continued to grow rapidly and steadily. Over the past three quarters, the company has delivered year-over-year earnings growth of 72%, 69%, and 59% on high double-digit revenue growth.

Image Source: Zacks Investment Research

Catching a Ride on the AI Train

Such rapid growth is not easy to find and even more challenging to maintain. That said, ANET’s management team is not content with resting on their laurels.

As artificial intelligence (AI) becomes increasingly prevalent in our daily lives, it is expected to generate massive amounts of data to be stored, analyzed, and processed. This is where data centers come in and where Arista Networks is uniquely positioned.

The influx of these incredible amounts of data will lead to a necessity for data center expansion. Arista’s computer network switches accelerate communications among data centers allowing them to “hyper scale”.

Super Micro Computer

Zacks Rank #1 (Strong Buy) stock Super Micro Computer Inc (SMCI), also known as Supermicro, is a San Jose-based technology company that designs and manufactures high-performance server and storage solutions. The company’s products are used various up-and-coming, high-growth industries, including enterprise IT, big data, cloud computing, internet of things (IoT), and artificial intelligence (AI).

Stock Pullback is an Opportunity as Supply Issues are Fixed

Investment in AI is contributing to explosive demand for SMCI’s servers. However, shares pulled back in August mainly because the company could not meet that high demand. SMCI’s current server production is enough to generate a maximum of $15 billion in revenue annually, but with the addition of a new Malaysian production facility (which goes live in 2024), SMCI will be able to double its production. SMCI also benefits from its server partnership with the undisputed AI leader, Nvidia (NVDA). Though SMCI owns less than 10% of the server market currently, its coveted partnership with NVDA should help the company eat into competition such as Dell Technologies (DELL).

High Growth + High Efficiency: A Winning Combination

High earnings growth is only meaningful with strong operational efficiency. A high return on equity (ROE) indicates that management efficiently uses shareholder equity to generate profits. SMCI’s ROE of 35 dwarfs the S&P 500’s ROE of 25.

Image Source: Zacks Investment Research

Bottom Line

October is the month when stocks tend to bottom. Investors who want to capitalize and generate alpha should examine the three momentum stocks mentioned.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Dell Technologies Inc. (DELL) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Super Micro Computer, Inc. (SMCI) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Palantir Technologies Inc. (PLTR) : Free Stock Analysis Report