SAP Announces Share Buyback Authorization: Major Takeaways

SAP SE SAP floated a new up to €1-billion share repurchase authorization, which it will utilize to fund awards under the “Move SAP” share-based compensation scheme, going ahead.

‘Move SAP’ is the company’s employee incentivization and retention plan for long term designed to adequately compensate personnel who contribute to the company’s success and business growth. SAP had earlier used cash payments to fund these obligations stemming from the Move SAP.

From 2022 onward, the company has decided to make share-based compensation mainly in shares for new awards.

However, SAP noted that all the current outstanding ′Move SAP′ awards would be funded with cash and the settlement methods of the company’s other share-based compensation programs will not be altered.

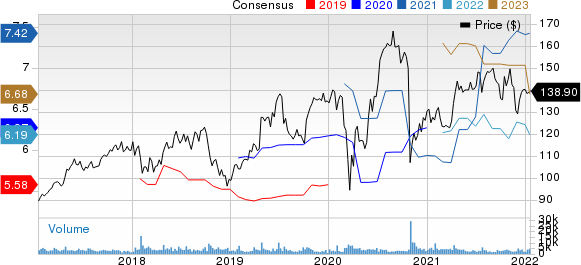

SAP SE Price and Consensus

SAP SE price-consensus-chart | SAP SE Quote

The new €1-billion share repurchase plan is to be executed between Feb 1, 2022, and Dec 31, 2022. Earlier, SAP had repurchased 14 million shares worth $1.5 billion under its 2020 repurchase plan.

Supported by its cash flow strength and a decent cash balance, the company is expected to continue with efficient capital deployment activities in the future, thereby boosting investors’ confidence in the stock.

In third-quarter 2021, the company generated €1.183 billion of operating cash. Free cash flow came in at €881 million. As of Sep 30, 2021, SAP had cash and cash equivalents of €7.943 billion.

On the same day, SAP also strong preliminary results for fourth-quarter 2021 and full-year 2021. SAP’s performance was driven by strength in its cloud business, especially the strong adoption of the company’s “Rise with SAP” solution.

SAP remains confident that robust cloud business and solid uptake of the SAP S/4HANA cloud will drive the momentum throughout 2022. The company is scheduled to announce fourth-quarter 2021 results on Jan 27, 2022.

In the fourth quarter, on a non-IFRS basis, cloud revenues increased 28% (up 24% at constant currency or cc) to €2.61 billion. The current cloud backlog increased 32% (up 26% at cc) to €9.45 billion. The SAP S/4HANA current cloud backlog rose 84% (up 76% at cc) to €1.71 billion.

However, the weak uptake of software licenses and support offerings is a concern for the company. For the fourth quarter, the company noted that non-IFRS software licenses and support revenues of €4.38 billion declined 4% (down 6% at cc) year over year.

Stiff competition and increasing costs to enhance cloud-based offerings are likely to exert pressure on the company’s profitability, at least in the near term. Coronavirus-led reductions in business travel are anticipated to impact Concur revenues for this Zacks Rank #5 (Strong Sell) company.

You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Stocks to Consider

Top-ranked stocks from the broader technology sector include Salesforce CRM, Hewlett Packard HPE and Microsoft MSFT. While Salesforce and Hewlett Packard sport a Zacks Rank #1, Microsoft carries a Zacks Rank #2 (Buy).

The Zacks Consensus Estimate for Salesforce’s fiscal 2022 earnings is pegged at $4.68 per share, up 6.4% in the past 60 days. The long-term earnings growth rate of the company is pegged at 16.8%.

Salesforce’s earnings beat the Zacks Consensus Estimate in all the preceding four quarters, the average surprise being 44.2%. Shares of CRM have increased 6.6% in the past year.

The Zacks Consensus Estimate for Hewlett Packard’s fiscal 2022 earnings is pegged at $2.03 per share, unchanged in the past 60 days. The long-term earnings growth rate of the company is pegged at 5.8%.

Hewlett Packard’s earnings beat the Zacks Consensus Estimate in each of the last four quarters, the average surprise being 14.4%. Shares of HPE have rallied 42.7% in the past year.

The Zacks Consensus Estimate for Microsoft’s fiscal 2022 earnings is pegged at $9.13 per share. The long-term earnings growth rate of the company is pegged at 12%.

Microsoft’s earnings beat the Zacks Consensus Estimate in each of the last four quarters, the average surprise being 14.8%. Shares of MSFT have surged 43.3% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

salesforce.com, inc. (CRM) : Free Stock Analysis Report

SAP SE (SAP) : Free Stock Analysis Report

Hewlett Packard Enterprise Company (HPE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research