Ryanair (RYAAY) Resumes Service From Belfast With 12 New Routes

Ryanair Holdings RYAAY announced its plans to restart operating flights from the Belfast International Airport. The European carrier will be resuming operations with 12 new routes from next summer, operating 115 flights per week. The routes include Alicante, Faro, Barcelona Girona, Milan Bergamo and Malaga, coupled with domestic services to East Midlands, Edinburgh, London Stansted and Manchester.

Ryanair’s Belfast-based fleet will include two aircraft, generating 60 aviation jobs apart from creating multiple other indirect vacancies at Belfast International. The move also increases the number of destinations available from the airport to more than 70 domestic and international ones. As a result, passengers will get more traveling choices.

Further, George Best Belfast City Airport has announced new services to Cardiff and Southampton with Aer Lingus Regional, operated by Emerald Airlines. Michelle Hatfield, Corporate Services director at Belfast City Airport, said: “As one of the largest airline partners at Belfast City Airport, the addition of more Aer Lingus Regional services is fantastic for both business and leisure passengers wishing to travel to the UK."

Per Ryanair’s Management, reduced aviation taxes and competitive airport charges have encouraged them in their latest move to launch close to 80 weekly domestic flights to/from East Midlands, Edinburgh, London Stansted and Manchester. Notably, declining aviation taxes boost traffic growth and increase connectivity.

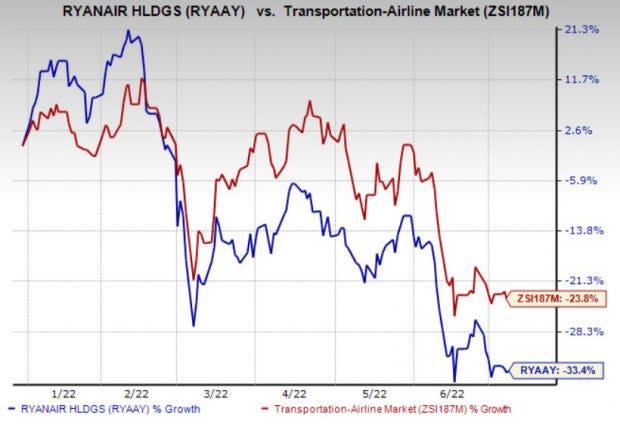

The latest move reflects Ryanair’s growth-oriented plans over the upcoming years and should boost traffic at the Zacks Rank #4 (Sell) European carrier. Notably, shares of RYAAY have lost 33.4% year to date compared with 23.8% loss of the industry it belongs to.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks in the broader Zacks Transportation sector are Kirby KEX, Golar LNG Limited GLNG and C.H. Robinson Worldwide CHRW, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Kirby has an expected earnings growth rate of 278.57% for the current year. KEX delivered a trailing four-quarter earnings surprise of 7.7%, on average.

KEX has a long-term earnings growth rate of 12%.

Golar LNG delivered a trailing four-quarter earnings surprise of 42.1%, on average. The Zacks Consensus Estimate for GLNG’s current-year earnings has improved 16.7% over the past 90 days.

Shares of GLNG have gained 59.2% over the past year.

C.H. Robinson has an expected earnings growth rate of 15.9% for the current year. CHRW delivered a trailing four-quarter earnings surprise of 17.1%, on average.

C.H. Robinson has a long-term earnings growth rate of 9%. Shares of CHRW have gained 8.8% over the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ryanair Holdings PLC (RYAAY) : Free Stock Analysis Report

C.H. Robinson Worldwide, Inc. (CHRW) : Free Stock Analysis Report

Kirby Corporation (KEX) : Free Stock Analysis Report

Golar LNG Limited (GLNG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research