Riverview Bancorp (RVSB) Rewards Investors With Buyback Plan

Riverview Bancorp, Inc. RVSB has announced a share repurchase program. Under this, the company is authorized to buy back up to $5 million worth of shares in the open market or in privately negotiated transactions.

The repurchase plan is effective Jun 21, 2021 and will continue until the completion of the authorization or the next six months, whichever is earlier.

Additionally, the company’s board of directors authorized management to enter into a trading agreement with Keefe, Bruyette & Woods, Inc. in accordance with Rule 10b5-1 of the Securities Exchange Act of 1934. This will help Riverview Bancorp buy back shares under the above-mentioned plan. Per this agreement, Keefe, Bruyette & Woods will have the authority to repurchase shares on the company’s behalf.

Earlier, in February 2020, Riverview Bancorp had announced a plan to repurchase 0.5 million shares. This program was completed in April last year.

Further, the company has been paying regular quarterly dividend of 5 cents per share since January 2020, when it had hiked the payout by 11.1%. Considering the last day’s closing price of $6.78, the company’s dividend yield currently stands at 2.95%.

Supported by its earnings strength and solid liquidity position, Riverview Bancorp is expected to continue with efficient capital deployment activities. Through this, it will keep enhancing shareholder value.

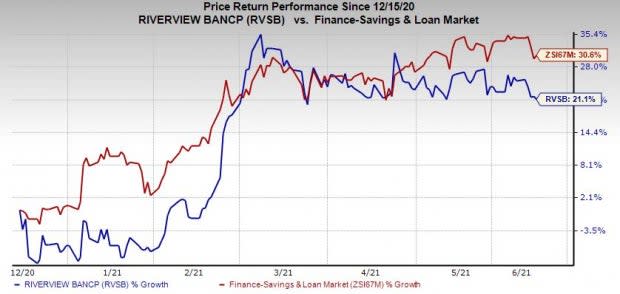

Over the past six months, shares of the company have gained 21.1% underperforming 30.6% rally by the industry it belongs to.

Image Source: Zacks Investment Research

Currently, Riverview Bancorp carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Share Buybacks Announced by Other Banks

In April 2021, City Holding Company CHCO announced a new plan, authorizing the buyback of up to 1 million shares, with no expiration date. Also, UMB Financial Corporation UMBF approved a repurchase plan for up to 2 million shares.

Further in May, SB Financial Group, Inc.’s SBFG board of directors authorized the repurchase of 750,000 shares, which accounts for nearly 10% of its common shares. The authorization expires on Mar 31, 2022.

Bitcoin, Like the Internet Itself, Could Change Everything

Blockchain and cryptocurrency has sparked one of the most exciting discussion topics of a generation. Some call it the “Internet of Money” and predict it could change the way money works forever. If true, it could do to banks what Netflix did to Blockbuster and Amazon did to Sears. Experts agree we’re still in the early stages of this technology, and as it grows, it will create several investing opportunities.

Zacks’ has just revealed 3 companies that can help investors capitalize on the explosive profit potential of Bitcoin and the other cryptocurrencies with significantly less volatility than buying them directly.

See 3 crypto-related stocks now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

UMB Financial Corporation (UMBF) : Free Stock Analysis Report

Riverview Bancorp Inc (RVSB) : Free Stock Analysis Report

City Holding Company (CHCO) : Free Stock Analysis Report

SB Financial Group, Inc. (SBFG) : Free Stock Analysis Report

To read this article on Zacks.com click here.