Chancellor to unveil stamp duty holiday to kickstart economy

Home buyers will today be offered an emergency stamp duty holiday as the centrepiece of the Government's coronavirus recovery plan to be unveiled by Rishi Sunak.

The Chancellor is expected to raise the threshold for the tax and temporarily exempt the first £500,000 of any property price to boost the economy and save buyers up to £15,000

The move, which is part of a multi-billion pound package to revive the post-Covid economy and create thousands of jobs, will benefit seven out of ten house buyers in England and Northern Ireland. It will come into effect immediately. Mr Sunak will also use his mini-budget to unveil a £2 billion scheme to get hundreds of thousands of 16 to 24-year-olds into work by directly paying their wages for six months.

He said that young people “bear the brunt” of recessions and are at particular risk from the coronavirus crisis because they work in sectors “disproportionately hit” by lockdown, such as catering and hospitality.

The Chancellor will follow Boris Johnson’s “New Deal” speech last week with a statement titled A Plan for Jobs as he tries to pull the UK out of the deepest recession in generations.

It will fill in details which were missing from Mr Johnson’s speech, setting out how the Government intends to stimulate the economy and create jobs to replace those lost during the Covid-19 pandemic.

It is being billed as the second part of a three-stage plan to rescue the economy, which began in March with business loans and the furlough scheme and will be completed in the autumn with a full Budget and spending review.

The Chancellor’s statement, officially called the summer economic update, will include a plan to create tens of thousands of jobs making homes more energy efficient, but it will be his decision to cut stamp duty that is likely to prove the most eye-catching announcement.

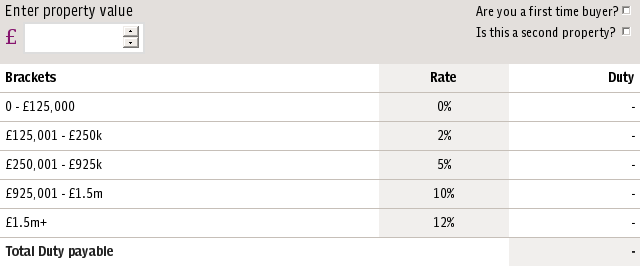

Boris Johnson has said in the past that he wants to permanently scrap stamp duty on all properties under £500,000 and reduce the top rate, which applies to homes costing more than £1.5m, from 12 per cent to seven per cent. The Chancellor’s announcement will lead to speculation that it could be the first move towards realising Mr Johnson’s aim, for which The Telegraph has long campaigned.

Whitehall sources indicated on Tuesday night that the temporary stamp duty “holiday”, likely to last between six months and a year, will apply to all home purchases under £500,000, cutting a maximum of £15,000 off the cost of moving home. It would save £2,460 on the £248,000 cost of the average home.

First time buyers - who already pay no stamp duty on the first £300,000 of the price of a home - will save up to £10,000 if they buy a property costing £300,001 to £500,000.

Home sales are a huge driver of the wider economy because of the money homeowners spend fitting out their new properties, but in April only 38,060 home sales were completed, the lowest level since HMRC began compiling figures in 2005 and less than half the number for the same month last year. Data released by Halifax on Tuesday revealed that house prices fell for the fourth month in a row in June, the first time that had happened since 2010.

It is understood that Mr Sunak had considered restricting the stamp duty cut to first time buyers only, but with just 51,000 people buying first homes that attracted stamp duty last year he decided to widen the scheme.

Last year 704,000 people bought homes costing £125,000 to £500,000, raising £3.2billion in stamp duty for the Treasury. A one-year stamp duty cut would cost the Treasury a similar amount, while a six-month tax break would cost £1.6bn.

House buyers currently pay nothing on properties costing up to £125,000, 2 per cent on the next £125,000, 5 per cent on the portion from £250,000 to £925,000, 10 per cent on £925,001 to £1.5m and 12 per cent on anything over £1.5m. Powers to set stamp duty are devolved in Scotland and Wales.

There had been reports that Mr Sunak would use his mini-budget to announce a stamp duty cut that would only take effect after the full budget in the autumn, but Government sources said that was “never the plan”.

Mr Sunak will also unveil an unprecedented scheme, called Kickstart, to create hundreds of thousands of jobs for people aged 16-24 by directly paying their wages for six months.

The £2bn fund, which will apply to the 500,000 young people currently claiming Universal Credit, will be used to pay them the National Minimum Wage for 25 hours per week, which can be topped up by employers to give them a better hourly rate or more hours. Employers will also receive £1,000 to cover their own administrative costs.

The first jobs will begin in the autumn and the scheme will run until December 2021, though it is likely to be extended if it proves a success.

Mr Sunak said: “Young people bear the brunt of most economic crises, but they are at particular risk this time because they work in the sectors disproportionately hit by the pandemic.

“We also know that youth unemployment has a long-term impact on jobs and wages and we don’t want to see that happen to this generation.

“So we’ve got a bold plan to protect, support and create jobs – a plan for jobs.”