Rise in Fee Income to Aid First Republic's (FRC) Q1 Earnings

First Republic Bank FRC is slated to announce first-quarter 2021 results, before the opening bell, on Apr 14. The company’s revenues and earnings are expected to have improved year over year.

In the last reported quarter, the company’s earnings surpassed the Zacks Consensus Estimate on higher net interest income (NII) and fee income. However, rise in expenses and elevated provisions were the undermining factors.

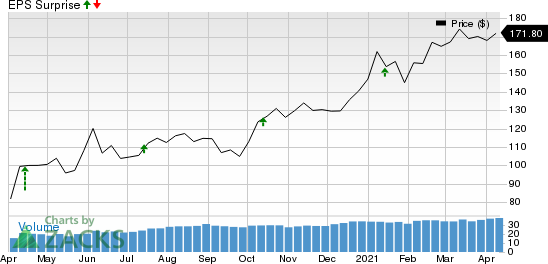

First Republic has an impressive earnings surprise history. Its earnings surpassed the consensus estimate in each of the trailing four quarters, the positive surprise being 17.3%, on average.

First Republic Bank Price and EPS Surprise

First Republic Bank price-eps-surprise | First Republic Bank Quote

Factors to Influence Q1 Results

Soft Loan Growth: Per Fed’s latest data, loan demand, particularly residential real estate loans (nearly 70% of First Repubic’s total loan portfolio), during the first quarter remained weak on account of slow revival of the economy.

Fall in NII: Low interest rate environment, along with muted loan demand, is likely to have hurt First Republic’s NII and net interest margin in the to-be-reported quarter. However, steepening of the yield curve (the difference between short and long-term interest rates) is likely to have offered some support.

The Zacks Consensus Estimate for average interest-earning assets of $137.6 billion for the quarter indicates a 21.2% improvement from the year-ago reported number. The consensus estimate for NII of $733 million suggests 2.5% decline on a year-over-year basis.

Rise in Non-Interest Income: Continued strength in equity markets led to rise in asset prices, thereby supporting the company’s investment advisory fees (comprising almost 60% of total fee income). The consensus estimate for the same is pegged at $106 million, suggesting a rise of 7.1% from prior-year quarter.

The first quarter witnessed significant market volatility on a number of factors. This, along with higher client activity, is likely to have offered some supported to trading revenues. The consensus estimate for brokerage and investment fees of $12.8 million indicates 19.1% decline from the year-ago quarter’s reported number.

Overall, fee revenues are expected to have increased in the quarter. The consensus estimate for the same is pegged at $167 million, suggesting a 1.8% rise year over year.

Higher Expenses: First Republic’s investments in opening new offices to enhance community presence or digital initiatives might have kept costs elevated in the quarter. Also, the company continues to invest in developing infrastructure and risk management practices.

Asset Quality: With the gradual economic improvement following the coronavirus pandemic, First Republic is likely to have released reserves in the first quarter that it had taken to cover losses from the effects of the pandemic.

The consensus estimate for non-performing assets is pegged at $181 million, which indicates a 43.7% rise from the prior-year quarter. Likewise, the Zacks Consensus Estimate for non-performing loans of $180 million suggests a 44% jump.

Earnings Whispers

Our proven model shows that First Republic doesn’t have the right combination of the two key ingredients — positive Earnings ESP and a Zacks Rank #3 (Hold) or better — to increase the odds of an earnings beat.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Earnings ESP: Earnings ESP for First Republic is -0.38%.

Zacks Rank: The company currently carries a Zacks Rank of 3.

The Zacks Consensus Estimate for earnings of $1.53 for the to-be-reported quarter has been revised slightly lower over the past 30 days. Nonetheless, it suggests a rise of 27.5% from the year-ago reported figure. Also, the consensus estimate for sales of $1.08 billion indicates an increase of 18.1% from the year-ago reported figure.

Major Banks That Warrant a Look

Here are major bank stocks you may want to consider, as according to our model these too have the right combination of elements to post an earnings beat this quarter.

The Earnings ESP for Wells Fargo WFC is +5.32% and it carries a Zacks Rank of 3, at present. The company is scheduled to report quarterly numbers on Apr 14.

JPMorgan JPM is slated to report quarterly results on Apr 14. The company has an Earnings ESP of +0.33% and currently carries a Zacks Rank of 3. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Bank of America BAC is slated to report quarterly earnings on Apr 15. The company, which carries a Zacks Rank of 3 at present, has an Earnings ESP of +0.49%.

These Stocks Are Poised to Soar Past the Pandemic

The COVID-19 outbreak has shifted consumer behavior dramatically, and a handful of high-tech companies have stepped up to keep America running. Right now, investors in these companies have a shot at serious profits. For example, Zoom jumped 108.5% in less than 4 months while most other stocks were sinking.

Our research shows that 5 cutting-edge stocks could skyrocket from the exponential increase in demand for “stay at home” technologies. This could be one of the biggest buying opportunities of this decade, especially for those who get in early.

See the 5 high-tech stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

JPMorgan Chase & Co. (JPM) : Free Stock Analysis Report

Bank of America Corporation (BAC) : Free Stock Analysis Report

Wells Fargo & Company (WFC) : Free Stock Analysis Report

First Republic Bank (FRC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research