Should You Retain Regency (REG) Stock in Your Portfolio Now?

Regency Centers Corp.’s REG well-located premium shopping centers in the affluent suburban areas and near urban trade areas, where consumers have high spending power are poised well to ride the growth curve. Moreover, a healthy balance sheet position will likely support its growth endeavors.

However, growing e-commerce adoption and efforts of online retailers to go deeper into the grocery business raise concerns. A high interest rate environment adds to its woes.

What’s Aiding it?

Regency has been focusing on building a premium portfolio of grocery-anchored shopping centers. Such centers are usually necessity-driven and attract dependable traffic. Also, its portfolio has a good tenant mix, which helps generate steady rental revenues.

Regency has a high-quality open-air shopping center portfolio with more than 80% grocery-anchored neighborhood and community centers. Further, the company’s focus on necessity, service, convenience and value retailers serving the essential needs of the communities provides it with a strategic advantage.

To enhance its portfolio, REG has been undertaking acquisitions and developmental activities. In May 2024, it acquired the Compo Shopping Centers in the heart of Westport, CT. The acquisition of this 76,000-square-foot retail destination is part of the company’s efforts to expand in the Northeast. As of Mar 31, 2024, Regency’s in-process development and redevelopment projects had estimated net project costs of $547 million. Given its prudent financial management, it is well-poised to capitalize on growth opportunities.

Further, Regency enjoys financial flexibility and focuses on further strengthening its balance sheet position. This retail REIT had more than $1.7 billion of liquidity as of Mar 31. The company also enjoys a large pool of unencumbered assets, which provides it easy access to the secured and unsecured debt markets and maintains its availability on the line. As of Mar 31, 87.6% of its wholly owned real estate assets were unencumbered. Further, the company’s favorable investment-grade credit ratings from Moody’s and S&P Global render it access to the debt market at favorable costs.

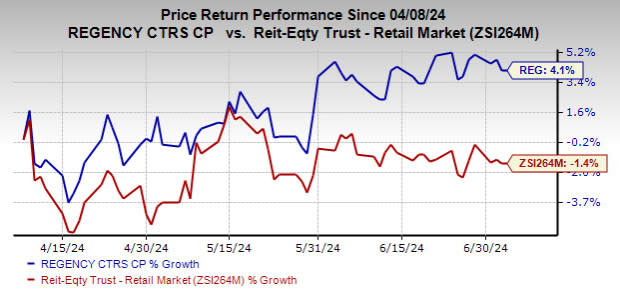

Over the past three months, shares of this Zacks Rank #3 (Hold) company have gained 4.1% compared with the industry’s 1.4% decline.

Image Source: Zacks Investment Research

What’s Hurting it?

Over recent years, the adoption of e-commerce by consumers has lowered the demand for the retail real estate space. Particularly, the recent efforts of online retailers to delve deeper into the grocery business have reduced the demand for physical stores and intensified competition. Owing to this, retailers are either opting for store closures or filing for bankruptcy, thus adding to concerns.

A high-interest rate environment is also a concern for Regency. Elevated rates imply high borrowing costs, which can hinder its ability to acquire or develop its real estate holdings. As of Mar 31, the company’s consolidated debt was approximately $4.42 billion. Further, with high interest rates still in place, the dividend payout might seem less attractive than the yields on fixed-income and money market accounts.

Stocks to Consider

Some better-ranked stocks from the retail REIT sector are Kite Realty Group Trust KRG and Realty Income O, each currently carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for KRG’s 2024 funds from operations (FFO) per share has been revised a cent northward over the past two months to $2.05.

The consensus estimate for O’s current-year FFO per share has been revised marginally upward over the past month to $4.21.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO), a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Regency Centers Corporation (REG) : Free Stock Analysis Report

Realty Income Corporation (O) : Free Stock Analysis Report

Kite Realty Group Trust (KRG) : Free Stock Analysis Report