Renewable Business to Aid Gibraltar (ROCK), Inflation a Risk

Gibraltar Industries Inc. ROCK is well poised to benefit in 2022 and beyond, given its solid Three-Pillar strategy as well as the U.S. administration’s endeavor to boost renewable energy and infrastructure of the country.

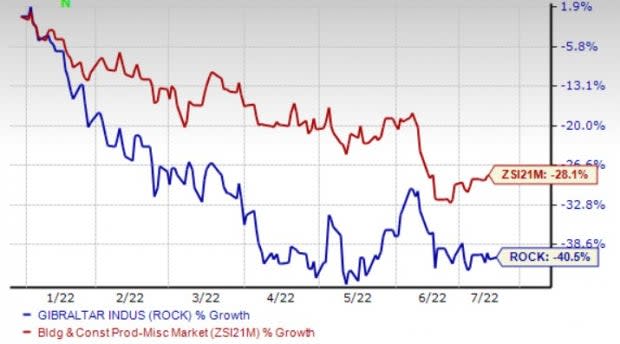

However, material and labor-supply related challenges, delays and disrupted solar project schedules due to panel supply issues continue to be headwinds. Shares of Gibraltar have lost 40.5% year to date, underperforming the industry’s 28.2% decline.

Nonetheless, the Zacks Consensus Estimate for 2022 and 2023 earnings of $3.30 and $3.61 per share indicates 18.7% and 9.2% year-over-year growth, respectively. The solid growth rate depicts the stock's promising future.

Image Source: Zacks Investment Research

Let’s delve deeper into the major driving factors.

Strong Renewable Prospects: Although the segment’s revenues decreased in first-quarter 2022 due to ongoing industry panel supply issues, subsequent field project inefficiencies and additional structural steel inflation, the backlog rose 41% year over year, driven by solid end-market demand. This solid backlog level depicts a strong visibility of growth.

One of the most remarkable trends in the energy sector is the meteoric rise of renewables. According to the U.S. Energy Information Administration, the U.S. solar capacity has risen from less than 5 GW in 2012 to more than 65 GW in 2022. This upward trajectory of planned renewable energy projects reflects a resilient future ahead for companies like Gibraltar.

In early June, U.S. President Joe Biden permitted duty free solar panels into the United States from Cambodia, Malaysia, Thailand and Vietnam. This should benefit ROCK as its solar panel customers will get panels and supply to the community solar projects.

Thee-Pillar Strategy: Gibraltar is progressing well, operationally as well as financially, on the back of its three-pillar growth strategy. The strategy is focused on three core tenets - Business Systems, Portfolio Management and Organizational Development. The first pillar, i.e., Business Systems combines two of its previous strategic pillars, namely, operational excellence and product innovation. The second strategic pillar comprises Portfolio Management and Acquisitions. Through this pillar, the company is focused on optimizing its business portfolio. During 2021, the company’s 30% revenue growth was mainly attributable to 21% contributions from acquisitions. Lastly, the third pillar of the strategy is Organizational Development. The Organizational Development primarily focuses on talent development, design and structure of organization.

Stable View: Based on the ongoing business dynamics, Gibraltar still expects revenues of $1.38-$1.43 billion, suggesting year-over-year growth of 3-6.7%. Adjusted earnings are likely to be in the range of $3.20-$3.40 per share, indicating a 15.1-22.3% year-over-year rise.

Hurdles to Cross

Inflation: There are three core materials that ROCK uses across the company which includes steel, aluminum and resin. The company experienced mixed scenario for these materials. According to the company, average steel prices are expected to rise during the end of third-quarter 2022 and then start to level off and/or decline (as per the April report from IHS Markit). Meanwhile, Aluminum prices are expected to rise at least through Q3. It remained high throughout the year due to the Russia/Ukraine conflict and Russia's role in the global aluminum supply chain.

During the first quarter of 2022, the company continued to witness higher costs related to labor and material. Also, the company had to face challenges regarding the supply of raw materials as well as logistic management. The company expects these issues to continue during most of 2022.

Zacks Rank

ROCK currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Better-Ranked Stocks in the Construction Sector

Primoris Services Corporation PRIM, currently carrying a Zacks Rank #2 (Buy), provides a wide range of construction, fabrication, maintenance, replacement and engineering services.

PRIM’s 2022 earnings are likely to rise 19.4%. The company’s earnings estimates have increased to $2.59 from $2.49 per share over the past 60 days.

KBR, Inc. KBR, currently carrying a Zacks Rank #2, provides scientific, technology, and engineering solutions to governments and commercial customers. Its mission-critical government services, high-end and differentiated government business work, strong margin performance, proprietary technology solutions and a significant increase in backlog (particularly in Government Solution) are expected to boost 2022 earnings.

KBR’s 2022 earnings are likely to rise 7.9%. The company has seen a 0.4% upward estimate revision for 2022 earnings in the past 60 days.

Toll Brothers Inc. TOL, currently carrying a Zacks Rank #2, mostly offers luxury homes and its communities are located in prosperous suburban areas with easy access to major cities.

TOL’s expected earnings growth rate for fiscal 2022 is 53.7%. The consensus mark for its fiscal 2022 earnings has moved up to $10.19 per share from $9.87 in the past 60 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

KBR, Inc. (KBR) : Free Stock Analysis Report

Toll Brothers Inc. (TOL) : Free Stock Analysis Report

Gibraltar Industries, Inc. (ROCK) : Free Stock Analysis Report

Primoris Services Corporation (PRIM) : Free Stock Analysis Report

To read this article on Zacks.com click here.