RELX Expands Globally With Cloud Hosting Facility in Australia

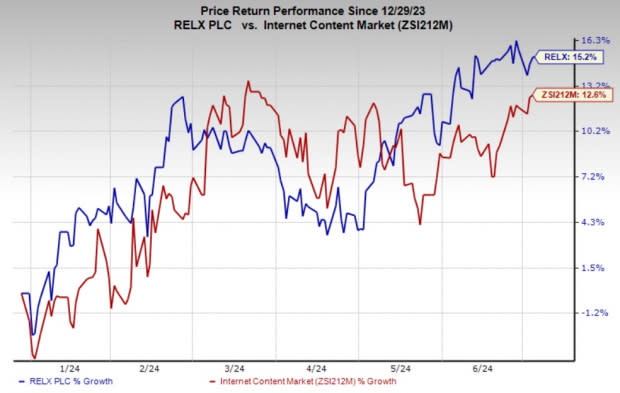

RELX RELX has returned 15.2% in the year-to-date period compared with the Zacks Internet - Content Industry’s growth of 12.5%. The rise in share price suggests investors’ confidence in RELX’s finances and the secular growth across its segments.

RELX’s subsidiary, LexisNexis Risk Solutions, recently expanded its footprint in the Asia-Pacific region by launching a cloud hosting facility in Australia. LexisNexis Risk Solutions will be able to increase its market share among the local enterprises of Australia by complying with the country’s local data regulations.

Moreover, the hosting service is certified with ISO 27001, CSA and HIPAA to enable customers to integrate multiple information sources through the cloud. This move will also ensure better service quality, lower latency and enhanced performance of LexisNexis Risk Solutions’ products.

LexisNexis Risk Solutions started its Asia-Pacific journey by launching a data center in India. With this new local cloud hosting service in Australia, LexisNexis Risk Solutions will be able to improve its offerings by ensuring faster load time and response rate ensuring a better customer experience throughout this region.

Image Source: Zacks Investment Research

RELX Innovates Offerings Through Cloud

RELX’s LexisNexis Risk Solutions is also migrating its applications and infrastructure to the Microsoft MSFT Azure cloud. This migration is executed keeping several factors in the company’s long-term agenda.

The cloud environment will allow LexisNexis Risk Solutions’ customers to benefit from dynamic scalability, faster prototyping and deployment, continuous patch updates and increased flexibility in operations. Microsoft Azure cloud will enable the risk solutions company to accelerate product deployment and advance innovations.

LexisNexis Risk Solutions is a critical contributor to RELX's overall financial performance. In the past five years, LexisNexis Risk Solutions' business has continuously increased, aiding RELX’s top line. The business unit contributed 34% to RELX’s 2023 total revenues.

RELX’s other subsidiary, LexisNexis Legal & Professional, a global provider of legal, regulatory and business information and analytics, also leverages cloud services, such as Amazon’s AMZN Amazon Web Services (“AWS”) and Amazon Bedrock.

LexisNexis Legal & Professional is leveraging Amazon’s AWS and Bedrock to create AI use cases on conversational assistant and legal information summarization, drafting legal memos and analyzing legal documents. With these cloud innovations in place, RELX is poised to capitalize on emerging opportunities.

The Zacks Consensus Estimate for RELX’s 2024 earnings has been revised upward by a penny to $1.55 per share in the past 30 days.

Competition and Macroeconomic Challenges

RELX’s LexisNexis portfolio includes many products that have comparable offerings from industry leaders. In the legal analytics space, LexisNexis competes directly with Thomson Reuters TRI. Meanwhile, its risk management portfolio faces competition from major players, such as IBM and Oracle.

Thomson Reuters’ products, including Thomson Reuters CLEAR, Risk Management Solutions, Practical Law, Legal Tracker and Westlaw, compete with RELX. Moreover, other products like IBM Security, IBM Financial Crimes Insights and Oracle Risk Management Cloud also compete against RELX’s LexisNexis product line.

Like any other IT solution provider, RELX is also affected by softening IT spending globally, mainly due to geopolitical volatility and high inflation rates across the nations.

Conclusion

With the launch of a new local cloud hosting platform in Australia, the company will be able to ensure the enhanced performance of LexisNexis Risk Solutions in the Asia-Pacific region.

This enhancement aligns with RELX’s broader goal of integrating cutting-edge technologies to deliver superior value to its clients, further solidifying its competitive edge and contributing to its sustained financial growth.

On its latest earnings call for the fourth quarter of 2023, RELX reported that the risk management business unit’s robust fundamentals are helping the company to grow. The legal segment, on the other hand, is improving on the back of its persistent shift in business mix toward higher-growth legal analytics.

Currently, the company carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Thomson Reuters Corp (TRI) : Free Stock Analysis Report

RELX PLC (RELX) : Free Stock Analysis Report