Reasons Why You Should Avoid Betting on GE Aerospace (GE)

General Electric Company GE has failed to impress investors with its recent operational performance due to rising costs and forex woes. These factors are likely to impede GE’s earnings in the quarters ahead.

Let’s discuss the factors that might continue taking a toll on this Zacks Rank #4 (Sell) company.

Steep Costs: GE Aerospace has been dealing with the adverse impacts of the high cost of sales and operating expenses. In the first quarter, its cost of sales jumped 8.4% year over year to $11.6 billion, while selling, general and administrative expenses increased 5.9% to $2.3 billion. Also, research and development expenses increased 17.6% to $507 million. The company incurred high costs and expenses related to certain projects and restructuring activities.

Despite improvement, supply-chain challenges, such as the availability of raw materials and labor shortages, especially in the defense market, continue to weigh on GE Aerospace’s operations. While pricing actions are driving the company’s margin performance, raw material cost inflation, especially at shorter cycle businesses, is partly offsetting it.

Forex Woes: Geographical diversification helps GE Aerospace’s businesses to flourish. However, international presence keeps the company exposed to the risk of adverse currency fluctuations. This is because a strengthening U.S. dollar may require the company to either raise prices or contract profit margins in locations outside the United States. Thus, adverse currency movements are a worry.

Dip in Consumer Confidence: Any dip in consumer confidence — a key determinant of the economy’s health — may seriously affect spending. The company’s customers, particularly from the utilities and power sectors, remain sensitive to macroeconomic factors, including interest rate hikes, credit availability and more, which is likely to negatively impact their sentiment. This may adversely affect its growth and profitability.

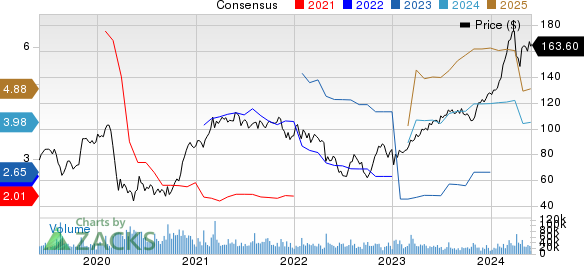

Southbound Estimate Revisions: In the past 60 days, the Zacks Consensus Estimate for GE’s 2024 earnings has been revised 12.9% downward.

GE Aerospace Price and Consensus

GE Aerospace price-consensus-chart | GE Aerospace Quote

Stocks to Consider

Some better-ranked companies from the Conglomerates sector are discussed below:

Carlisle Companies Incorporated CSL presently sports a Zacks Rank #1 (Strong Buy). It has a trailing four-quarter average earnings surprise of 17%. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for CSL’s 2024 earnings has increased 6.5% in the past 60 days.

ITT Inc. ITT currently carries a Zacks Rank #2 (Buy). It delivered a trailing four-quarter average earnings surprise of 6.5%.

In the past 60 days, the Zacks Consensus Estimate for ITT’s 2024 earnings has inched up 1%.

Griffon Corporation GFF presently carries a Zacks Rank of 2. It delivered a trailing four-quarter average earnings surprise of 33.5%.

In the past 60 days, the Zacks Consensus Estimate for GFF’s 2024 earnings has increased 4.8%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

GE Aerospace (GE) : Free Stock Analysis Report

ITT Inc. (ITT) : Free Stock Analysis Report

Carlisle Companies Incorporated (CSL) : Free Stock Analysis Report

Griffon Corporation (GFF) : Free Stock Analysis Report