Reasons to Retain FLEX Stock in Your Portfolio at the Moment

Flex Ltd FLEX is benefiting from higher demand for its solutions across the end markets like automotive, health and industrial verticals.

For fiscal 2023 and fiscal 2024, the company’s revenue estimates are pegged at $28.9 billion and $29.8 billion, suggesting year-over-year growth of 11% and 3.2%, respectively.

The Zacks Consensus Estimate for fiscal 2023 and fiscal 2024 earnings stand at $2.16 and $2.37 per share, suggesting year-over-year growth of 10.2% and 9.84%, respectively. The long-term growth rate stands at 13.7%.

For second-quarter fiscal 2023, Flex expects revenues between $7 billion and $7.4 billion. It expects adjusted earnings of 48-54 cents per share. The adjusted operating income is projected between $315 million and $345 million.

For second-quarter fiscal 2023, the consensus estimate for earnings and revenues is pegged at 51 cents per share and $7.2 billion, suggesting year-over-year growth of 6.3% and 15.6%, respectively.

Flex raised its revenue outlook for fiscal 2023. It now expects revenues between $28.4 billion and $29.4 billion. It expects adjusted earnings of $2.09-$2.24 per share. The adjusted operating income margin is projected to be in the range of 4.6-4.8%.

FLEX has outpaced estimates in all the trailing four quarters, delivering an earnings surprise of 17.6%, on average.

The company also has an impressive VGM Score of B. This style score consolidates all the essential metrics from a company’s financial statements to get a true sense of the quality and sustainability of its growth.

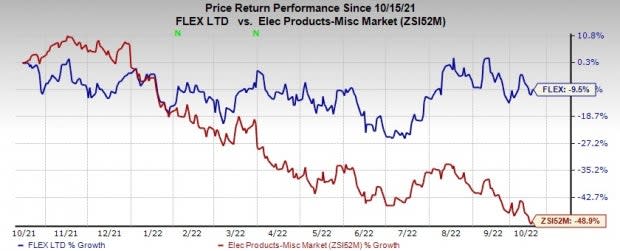

The stock has proved to be more resilient to volatility than the Zacks sub-industry it belongs to. In the past year, FLEX has lost 9.5% compared with a 48.9% decline of the Zacks sub-industry.

Image Source: Zacks Investment Research

Strong Fundamentals

Based in Singapore, Flex provides supply chain, technology innovation and manufacturing solutions to various industries across several end markets. The company is witnessing strong demand in the automotive and industrial sectors.

The company is investing in high-growth markets like next-generation mobility, digital healthcare, cloud expansion, robotics, smart living and automation, among others. This bodes well for the long haul.

The company expects demand to remain strong in the automotive sector owing to the launch of next-generation mobility products, particularly in electric vehicles. In the industrial sector, increasing product ramp-ups in production and packaging, renewables, and data center power are likely to drive demand for solutions. Moreover, the health solutions segment is expected to gain traction owing to the recovery of elective procedures.

Acquisitions, over time, have been Flex’s most favored mode for expanding its manufacturing footprint and penetrating new end-markets. Acquisitions like Bose facilities, Mirror Controls International (MCi), Alcatel-Lucent facility, and NEXTracker expanded its footprint in audio systems, automotive, telecom and smart solar tracking solution markets.

In December 2021, the company acquired Anord Mardix, which specializes in critical power solutions, from private equity firm Bertram Capital for $540 million. The acquisition is likely to aid the company to expand its presence in the industrial sector.

However, supply chain-induced component shortages and higher freight and logistics costs continue to be a headwind, affecting the profit margins of this Zacks Rank #3 (Hold) stock.

Stocks to Consider

Some better-ranked stocks from the broader technology space are Pure Storage PSTG, Blackbaud BLKB and Synopsys SNPS. Pure Storage and Blackbaud currently sport a Zacks Rank #1 (Strong Buy), whereas Synopsys carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks.

The Zacks Consensus Estimate for Pure Storage’s 2022 earnings is pegged at $1.18 per share, rising 24.2% in the past 60 days. The long-term earnings growth rate is anticipated to be 35.5%.

Pure Storage’s earnings beat the Zacks Consensus Estimate in the last four quarters, the average being 171.8%. Shares of PSTG have gained 0.9% in the past year.

The Zacks Consensus Estimate for Blackbaud’s 2022 earnings is pegged at $2.55 per share, unchanged in the past 60 days. The long-term earnings growth rate is anticipated to be 3%.

Blackbaud’s earnings beat the Zacks Consensus Estimate in the last four quarters, the average being 8.5%.

The Zacks Consensus Estimate for Synopsys’ 2022 earnings is pegged at $8.85 per share, up 4.5% in the past 60 days. The long-term earnings growth rate is anticipated to be 16.2%.

Synopsys’ earnings beat the Zacks Consensus Estimate in the last four quarters, the average being 3%. Shares of SNPS have lost 6.1% of their value in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Flex Ltd. (FLEX) : Free Stock Analysis Report

Synopsys, Inc. (SNPS) : Free Stock Analysis Report

Blackbaud, Inc. (BLKB) : Free Stock Analysis Report

Pure Storage, Inc. (PSTG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research