Raytheon (RTX) Wins $13.4M Contract to Support MTS Sensors

Raytheon Technologies Corp. RTX recently clinched a modification contract to provide support services for the Multi-Spectral Targeting System (“MTS”) class of sensors. The Missile Defense Agency, Redstone Arsenal, AL, awarded the deal.

Details of the Deal

Valued at $13.4 million, the contract includes engineering services in support of the life-cycle sustainment of MTS class sensors and aims at obtaining technical capability and necessary resources to operate, maintain, repair and upgrade units. The support services will also include spare parts support, platform integration support, test equipment support and fielding and software/firmware updates.

With the latest modification, the contract value has increased from $12 million to $25.4 million.

The work related to the deal will be carried out in San Diego, CA, and is scheduled to be completed by Jan 10, 2024.

Significance of MTS

Raytheon Intelligence & Space's MTS combines electro-optical/infrared laser designation and laser illumination capabilities in a single sensor package. The MTS product family of sensors provides detailed intelligence data from the visual and infrared spectrum to support the U.S. military, civilian and allied missions worldwide.

Fueled by cutting-edge digital architecture, MTS brings long-range surveillance, target acquisition, tracking, range finding and laser designation to the Griffin missile and Paveway laser-guided bomb, as well as all tri-service and NATO laser-guided munitions. It also boasts features of multiple fields of view, electronic zoom and multimode video tracking.

Due to MTS’ remarkable features, RTX witnesses a steady inflow of orders involving the sensors. Raytheon has delivered more than 3,000 MTS sensors to the U.S. and international armed forces and integrated 44 variants of the system into more than 20 rotary-wing, unmanned aerial systems and fixed-wing platforms.

The latest contract win is a testament to the fact that MTS’ order inflow remains strong. This shall boost Raytheon’s revenues from the sensor business.

Growth Outlook

The paradigm of the defense structure needs to be continuously upgraded with innovative technologies due to the ever-changing defense needs of nations worldwide. Hence, it is imperative to mention that combat sensors play a critical role in the military’s surveillance and are thus expected to witness increased demand.

Per a report from the Markets and Markets research firm, the military sensor market is projected to witness a CAGR of 5.9% over the 2021-2026 period. With such a strong product portfolio of sensors, RTX may enjoy the perks of probable strong demand. Defense majors who have carved out a position in the sensor market and may benefit from the increased demand are as follows:

General Dynamics’ GD Intelligence Systems designs and develops high-performance sensors to gather data across the sea, land, air, space and cyber domains. Its advanced analysis and exploitation tools help draw actionable intelligence from large streams of data and deliver it to the user.

General Dynamics developed TACLANE Trusted Sensor software that can be used in several network topologies as an in-line HAIPE sensor or a separate secured network sensor. Therefore, it can act as an Intrusion Detection System or Intrusion Prevention System.

General Dynamics has a long-term earnings growth rate of 10.2%. Shares of GD have returned 10.3% in the past year.

Lockheed Martin’s LMT infrared sensor systems provide advanced precision targeting, navigation, threat detection and next-generation intelligence, surveillance and reconnaissance capabilities. Some of LMT’s sensors are LONGBOW Sensors, IRST21 sensor system, Legion Pod, etc.

Lockheed Martin has a long-term earnings growth rate of 5.5%. Shares of LMT have returned 13.2% in the past year.

Northrop Grumman NOC is an industry leader at the forefront of the design, development and deployment of some of the world’s most cutting-edge sensors and systems. Its product range includes JADC2, EO/IR sensors, G/ATOR, etc.

Northrop boasts a long-term earnings growth rate of 2.2%. NOC shares have appreciated 26.2% in the past year.

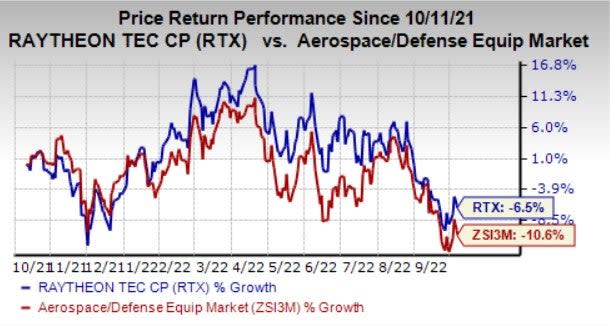

Price Performance

Shares of Raytheon Technologies have declined 6.5% in the past year compared with the industry’s decline of 10.6%.

Image Source: Zacks Investment Research

Zacks Rank

Raytheon Technologies currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Lockheed Martin Corporation (LMT) : Free Stock Analysis Report

Northrop Grumman Corporation (NOC) : Free Stock Analysis Report

General Dynamics Corporation (GD) : Free Stock Analysis Report

Raytheon Technologies Corporation (RTX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research