Raytheon (RTX) Arm Wins More Than 800 GTF Engine Orders in 2023

Raytheon Technologies Corp.’s RTX arm, Pratt & Whitney, recently announced that its GTF Engine has witnessed a plethora of orders in 2023. The volume of orders from varied customers worldwide has already exceeded the 800 mark since the onset of 2023, signifying the strong global demand for the product.

Pratt & Whitney now has a firm commitment to deliver 10,000 GTF Engines from its order book to more than 90 customers spread over 30 countries. This indicates the wide footprint the product enjoys, buoyed by its ability to provide superior economic and environmental advantages to airline operators, as nations worldwide are concerned about transportation-related emissions and are looking for ways to reduce emissions.

Importance of GTF Engines

An increased focus on sustainability in the aviation industry has unlocked substantial opportunities for a GTF Engine and its wide adoption. In the days ahead, one may expect airlines to increase investments in more fuel-efficient aircraft, explore alternative fuels and implement eco-friendly practices to reduce carbon emissions.

In such a scenario, Pratt & Whitney’s GTF Engine is the optimal pick as it consumes the lowest fuel volume, and its CO2 emissions for single-aisle aircraft are much lower compared with other engines.

RTX’s continuous investment strategy to support the continuous production of the engine will assist the company in meeting such strong demand. The recently announced infrastructural upgrade and capacity expansion in its Georgia business, which supports commercial and military engine programs, are likely to increase the overhaul capacity to 400 GTF Engines per year.

Key Customers of GTF Engines

GTF Engines have already gathered considerable attention in the aviation industry and currently power more than 1,600 aircraft across 64 airlines. The value-added features offered by the engine have led to a very strong customer base in the domestic and international markets. In 2022, the engine was chosen by Cessna SkyCourier, Daher Kodiak 900 and TBM960.

The engine is also part of the highly sought-after fleet of Airbus EADSY and Embraer ERJ. This proclaims the strong buying trend for GTF Engines.

The Airbus A320neo family and Airbus A220 are the two Airbus aircraft models that are equipped with RTX’s GTF Engine and deliver the highest fuel efficiency and the lowest CO2 emission for the family.

Airbus inked a major order to supply 500 of its A320 family aircraft at the Paris Air Show 2023 to Indigo, the biggest order in commercial aviation history. This highlights potential orders for GTF Engines.

Embraer’s E2 family of aircraft, considered to be eco-friendly, is powered by GTF Engines. E2 jets enjoy strong demand due to their fuel efficiency, and less carbon and noise footprint.

As of Mar 31, 2023, Embraer’s E-Jets E2 had 281 orders in the backlog. Considering the valued demand for its E-jet family of aircraft, the company may continue to witness the solid delivery of these jets in the coming quarters as well, highlighting the strong demand for GTF Engines.

Price Movement

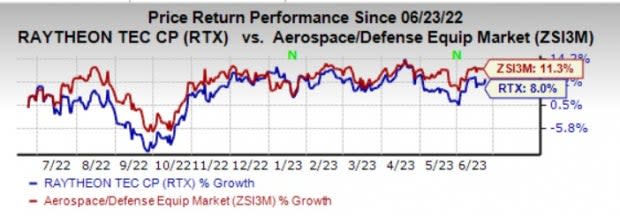

In the past year, shares of Raytheon Technologies have increased 8% compared with the industry’s growth of 11.3%.

Image Source: Zacks Investment Research

Zacks Rank & a Stock to Consider

Raytheon Technologies currently carries a Zacks Rank #3 (Hold). One better-ranked stock in the same industry is Transdigm Group TDG, which sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The long-term (three to five years) earnings growth rate of TDG is projected at 25.1%. The Zacks Consensus Estimate for Transdigm’s 2023 sales suggests a growth rate of 19.5% from the prior-year reported figure. The consensus estimate for its 2023 earnings implies a growth rate of 40.2% from the prior-year reported figure.

The Zacks Consensus Estimate for Transdigm’s 2024 sales calls for a growth rate of 10.9% from the prior-year estimated figure. The Zacks Consensus Estimate for its 2024 earnings indicates a growth rate of 19.4% from the prior-year reported figure.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Embraer-Empresa Brasileira de Aeronautica (ERJ) : Free Stock Analysis Report

Transdigm Group Incorporated (TDG) : Free Stock Analysis Report

Airbus Group (EADSY) : Free Stock Analysis Report

Raytheon Technologies Corporation (RTX) : Free Stock Analysis Report