Base Rate (BR), Base Lending Rate (BLR), Standardised Base Rate (SBR): All You Need To Know

Owning your first home is a key milestone. However, if you’re a property buyer liaising with your banker, you may be confused by the flurry of numbers and jargon being mentioned.

For example, you may be wondering what the terms ‘BR’ and ‘BLR’ actually mean. Soon, there will also be a ‘SBR’. Well, wonder no more as we dive into these important terms!

Before 2015: Base Lending Rates (BLR)

Prior to 2015, the interest rate was referred to as the Base Lending Rate (BLR). This percentage was determined by Bank Negara Malaysia (BNM) based on how much the cost would be to lend money to other financial institutions in Malaysia.

Derived through a blanket formula that applies across the board, the BLR was determined after reviewing the Statutory Reserve Requirement (SRR).

The purpose of implementing the BLR system back then was to ensure a fixed and somewhat predictable interest rate across all banks in Malaysia.

[PropertyTip]If you buy a property using Islamic loans, your BLR was referred to as the Base Financing Rate.[/PropertyTip]

The process was pretty transparent and you could find the latest rates online. Packages across the different banks are usually rather similar.

2015 To July 2022: Base Rates (BR)

The new BR system, which came into effect in January 2015, made things more competitive for financial institutions.

The BR is basically an interest rate that the bank refers to, before it decides on the interest rate to apply to your home loan.

It is calculated against each bank’s cost of funds and Statutory Reserve Requirement (SRR), along with the borrower’s credit risk, liquidity premium, operating cost, and profit margin.

In short, banks in Malaysia can now determine their own interest rate based on a formula set by the central bank, and using the BNM rate as a benchmark.

Although the formula is set by Malaysia’s central bank, each bank is able to package better deals for its customers without intervention from BNM, depending on business vitality and type.

For example, if the bank is performing well in the consumer banking sector, they would be able to offer more attractive home loan packages.

Why Do Base Rates Change, And How Does That Affect Me?

As mentioned above, many factors impact how banks decide their Base Rates. Most importantly, you need to know that the BR is pegged to BNM’s Overnight Policy Rate (OPR).

Despite that, do know that unlike the previous BLR, banks can adjust their respective BR, even when there is no change in the OPR?

The OPR is the minimum interest rate at which banks lend money to each other. Hence, when the OPR is cut, banks will lower their BR accordingly. When BR is reduced, so will the cost of borrowing for us consumers.

This means that for average Malaysians like you and me, we get to enjoy lower interest rates on our loans. This would then be the best time to take out a loan or refinance an existing one – whether it’s a personal, auto, or home loan.

In this regard, fluctuations in the BR will affect the property market too. With a lower BR, home loans will subsequently be offered with lower interest rates.

The BR also hinges on whether the bank bases the loan agreement on a fixed interest rate or a floating one.

With a fixed interest rate property loan, the BR is predetermined, and the bank has taken on the risk of future fluctuations.

Usually, the banks will charge a premium in place of the risk. So, a floating rate property loan is generally cheaper than a fixed one.

Here’s a table of the latest Base Rates, BLR, and Indicative Effective Lending Rates (taken from BNM), which may come in handy for you:

Latest Base Rates and BLR Updated on September 2022

Affin Bank Berhad | 3.45 | 6.31 | 4.05 |

Alliance Bank Malaysia Berhad | 3.32 | 6.17 | 3.86 |

AmBank (M) Berhad | 3.10 | 5.95 | 3.75 |

Bangkok Bank Berhad | 3.72 | 6.37 | 4.92 |

Bank of China (Malaysia) Berhad | 3.05 | 5.85 | 4.05 |

CIMB Bank Berhad | 3.50 | 6.35 | 4.25 |

Citibank Berhad | 2.90 | 6.05 | 3.70 |

Hong Leong Bank Malaysia Berhad | 3.13 | 6.14 | 4.00 |

HSBC Bank Malaysia Berhad | 2.89 | 5.99 | 4.00 |

Industrial and Commercial Bank of China (Malaysia) Berhad | 3.02 | 5.95 | 3.97 |

Malayan Banking (Maybank) Berhad | 2.50 | 6.15 | 3.75 |

OCBC Bank (Malaysia) Berhad | 3.08 | 6.01 | 3.95 |

Public Bank Berhad | 3.02 | 6.22 | TBA |

RHB Bank Berhad | 3.25 | 6.20 | TBA |

Standard Chartered Bank Malaysia Berhad | 2.77 | 5.95 | 4.00 |

United Overseas Bank (Malaysia) Berhad | 3.36 | 6.32 | 4.11 |

The Effect Of The New Base Rate On Home Loans Approved Before 2015

You may be wondering: How will the new Base Rate system affect you if you’ve been paying your home loan for the past eight years?

Since the loan agreement was signed prior to the new rule, the interest rate for home loans approved prior to 2015 will prevail.

It also depends on the agreement that you signed with the bank. If you’d like to take advantage of more attractive packages offered by the bank or other financial institutions, you’ll need to speak to your banker on refinancing options.

Currently, it’s a requirement for all banks to display both BLR and BR on their websites and bank branches.

August 2022 Onwards: Standardised Base Rate (SBR)

On 11th August 2021, BNM released a revised Reference Rate Framework, which stated that a Standardised Base Rate (SBR) will be replacing the BR as the reference rate for new retail floating-rate loans.

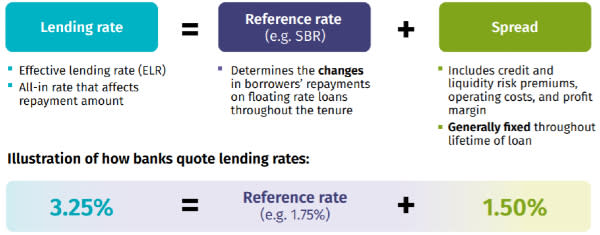

But what does that mean, and how will this change affect you? First off, we need to understand how banks determine the interest rate on your loan (also known as a ‘lending rate’).

Based on the image above, the lending rate is made up of the reference rate (which determines the changes in your monthly installments throughout the loan’s tenure) as well as the spread (how much money the bank makes vs how much it gives out).

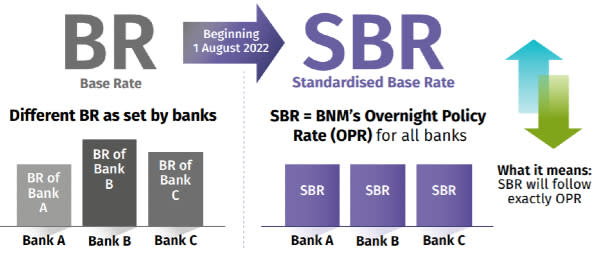

So previously, when the BR was used, the change in your home loan’s interest rate would be determined by the bank internally.

As each bank was allowed to set its own BR, that meant every bank had a different set of numbers, and different methods of calculation.

Imagine just how confusing that would be when you wanted to compare the different interest rates before signing up for one!

Now, with the SBR coming into play, the banks will all use a standardised rate that is linked directly to the OPR’s movement.

For example, if the OPR goes up by 0.5%, the SBR will also go up by 0.5%. Every bank gets a single rate to refer to, and no longer will there be varying methods of calculations in the market.

How Will The Standardised Base Rate In Malaysia Affect Your Home Loan?

To put it simply: This move is expected to allow consumers the benefit of comparing lending rates easier and to ensure more transparency.

Heightened transparency would translate to better-informed consumers, thereby benefiting both property owners and consumers in Malaysia.

With only one rate which is driven by the OPR, consumers would thus be able to better understand the reason behind loan repayment changes when the interest rates change as well.

In addition, consumers would also be able to easily compare the lending rates of each bank if they’re shopping for a new home loan, so they can see which one has the best spread for them.

So, if you’ve been paying for your current home loan for the past decade (existing borrowers) and are worried about how your repayments will be affected, don’t worry!

This will only have an effect for those who will be taking on a loan starting from 1st August 2022. Anything before that will still be priced against the BR or BLR.

Latest Fixed Deposit Rates Updated 17th August 2021

OPR cuts will also negatively affect Fixed Deposit (FD) rates. An OPR cut will reduce the FD rates, so one can expect a drop in interest earnings.

Keep in mind however, that the final rate is dependent on the individual bank, amount deposited, type of FD and many other factors.

Check out this table below for the latest conventional Fixed Deposit Rates from all banks.

Affin Bank Berhad | 1.65 | 1.70 | 1.85 |

Alliance Bank Malaysia Berhad | 1.80 | 1.80 | 1.85 |

AmBank (M) Berhad | 1.65 | 1.70 | 1.55 |

Bank Simpanan Nasional (BSN) | 1.80 | 1.85 | 2.20 |

Bank of China (Malaysia) Berhad | 1.75 | 1.80 | 1.90 |

CIMB Bank Berhad | 1.70 | 1.80 | 1.85 |

Citibank Berhad | 1.10 | 1.30 | 1.30 |

Hong Leong Bank Malaysia Berhad | 1.55 | 1.60 | 1.60 |

HSBC Bank Malaysia Berhad | 1.55 | 1.60 | 1.65 |

India International Bank | 1.40 | 1.30 | 1.30 |

Malayan Banking (Maybank) Berhad | 1.70 | 1.80 | 1.85 |

OCBC Bank (Malaysia) Berhad | 1.45 | 1.60 | 1.75 |

Public Bank Berhad | 1.75 | 1.80 | 1.85 |

RHB Bank Berhad | 1.70 | 1.80 | 1.85 |

Standard Chartered Bank Malaysia Berhad | 1.50 | 1.60 | 1.60 |

United Overseas Bank (Malaysia) Berhad | 1.55 | 1.65 | 1.75 |

What Else Should You Look Out For When Buying A Property?

Remember that depending on the liquidity and financial records of the bank, the BR can be reviewed at any time, even if there are no changes made to the OPR.

Also, note that the bank has the discrepancy to decide on the amount of interest to apply to a certain group of people, based on their level of credit risk.

If a borrower has a bad credit rating, the bank may or may not impose a higher interest rate.

While the BR is a key area to consider, here’s a list of other important things to note before purchasing your new home:

Your Debt Service Ratio (DSR): This ratio will determine how much income you can set aside every month to service your loan.

The reputation, liquidity, and financial stability of the bank: It’s always prudent to perform research beforehand on the bank you intend to loan from.

Tenure of the loan and lock-in period: The bank will establish the time period for you to pay off the loan. While this may vary, banks generally set a tenure of 30 years. An Early Termination Penalty is usually imposed for early settlements, including loan refinancing.

Mortgage Reducing Term Assurance (MRTA): It may be wise to consider getting an MRTA. This is essentially an insurance on your home loan, which helps reduce and pay off the home loan in the event of your injury, disability, or death.

Maintaining your current BLR in Malaysia: Since most residential property loans signed before 2015 will continue to be referenced by its BLR until the loan matures, write to your bank to request a stay of action.

Relevant Guides:

What A First-Time Home Owner Needs To Know About Down Payments

SPA, Stamp Duty Malaysia, And Legal Fees For Property Purchase

How To Calculate Your Affordability – Now vs Later

Disclaimer: Information provided on this website is general in nature and does not constitute financial advice.

PropertyGuru will endeavour to update the website as needed. However, information can change without notice and we do not guarantee the accuracy of information on the website, including information provided by third parties, at any particular time.

Whilst every effort has been made to ensure that the information provided is accurate, individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial planner or your bank to take into account your particular financial situation and individual needs.

PropertyGuru does not give any warranty as to the accuracy, reliability or completeness of information which is contained in this website. Except insofar as any liability under statute cannot be excluded, PropertyGuru, its employees do not accept any liability for any error or omission on this web site or for any resulting loss or damage suffered by the recipient or any other person.