Ralph Lauren's (RL) Strong Brands & Initiatives Aid Momentum

Ralph Lauren Corporation RL has stayed ahead of the curve, gaining from brand strength and progress on its digital initiatives. The company has been making significant developments in expanding its digital and omnichannel capabilities through investments in mobile, omnichannel and fulfillment. Additionally, the company is progressing well with its “Next Great Chapter Plan,” which positions it for long-term growth.

Elevating and energizing its lifestyle brand, expanding the core business, and focusing on key cities with the consumer ecosystem are its core strategies for driving growth. Management is focused on developing a sustainable and resilient model with multiple drivers, which places it well for long-term growth and value creation.

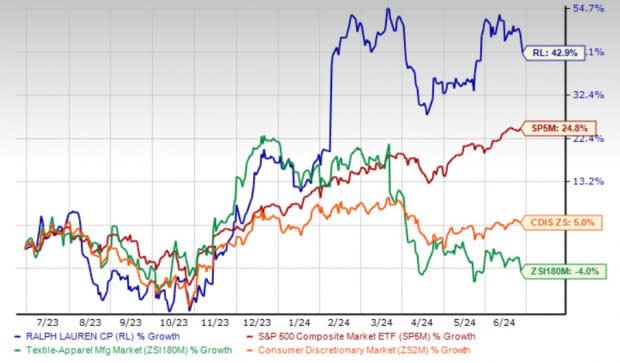

Ralph Lauren has been impressive in the stock market, demonstrating a 42.9% jump in the past year against the industry’s decline of 4%. The Zacks Rank #3 (Hold) company also outperformed the broader sector and S&P 500’s growth of 5% and 24.8%, respectively.

The Zacks Consensus Estimate for RL’s fiscal 2025 sales and EPS indicates increases of 2% and 7.4%, respectively, from the year-ago period’s reported levels.

Image Source: Zacks Investment Research

Insights Into Ralph Lauren’s Key Strategies

RL continues to scale and expand its connected retail capabilities, including virtual selling appointments, “buy online, pick up in store,” and endless aisle product availability. It remains focused on further digital investments to continue the creation of content for all platforms, expand digital capabilities to improve the user experience, and continue to leverage AI and data to serve consumers more efficiently.

Ralph Lauren’s digital businesses, including its directly operated sites, departmentstore.com, pure players and social commerce, have been performing well. The company added more than five million new consumers to its DTC business in fiscal 2024. Its followers on social media grew year over year in the low-double digits to more than 58 million, driven by TikTok, Instagram, Line and Douyin.

In fiscal 2024, the company saw solid direct-to-consumer comps growth, apart from expanding its connected ecosystems across significant markets. Comps were up in the mid-single digits across both its brick-and-mortar stores and digital channels.

The “Next Great Chapter Plan” is focused on creating a simplified global organizational structure and rolling out improved technological capabilities. As part of the plan, it completed the transition of Chaps to a licensed business, thus concluding its portfolio realignment announced last year. The move is likely to enable it to focus on core brands as part of the “Next Great Chapter” elevation strategy.

In addition, the company’s strategy of product elevation, personalized and targeted promotion, disciplined inventory management, and favorable channel and geographic mix bode well.

Setbacks to Counter

Ralph Lauren has been witnessing a tough operating landscape, including foreign currency headwinds, inflationary pressures, and other consumer spending-related pressures. The inflationary headwinds have been resulting in higher compensation, rent and occupancy costs, and elevated marketing investments.

Ralph Lauren has been witnessing a dismal performance across its North America segment’s wholesale channel for a while now. Higher promotions in the North America market and an unfavorable wholesale timing shift have been acting as deterrents.

Although the North America segment’s revenues rose year over year, wholesale revenues dipped 2% year over year. The segment’s digital commerce sales also fell 4%. Additionally, the company’s fiscal 2024 guidance includes caution concerning the wholesale channel, wherein year-to-date demand has been weaker year over year.

Key Picks

Some better-ranked Consumer Discretionary companies are G-III Apparel Group GIII, Crocs CROX and Guess GES.

G-III Apparel is a manufacturer, designer and distributor of apparel and accessories under licensed brands, owned brands and private label brands. It sports a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

GIII Apparel has a trailing four-quarter earnings surprise of 571.8%, on average. The Zacks Consensus Estimate for GIII’s fiscal 2024 revenues indicates an increase of 3.3% from the year-ago period’s reported level.

Crocs, a leading footwear brand for comfort and style, currently has a Zacks Rank of 2 (Buy). CROX has a trailing four-quarter earnings surprise of 17.1%, on average.

The Zacks Consensus Estimate for CROX’s 2024 sales and EPS indicates increases of 4.4% and 5.2%, respectively, from the year-ago period’s reported levels.

Guess designs, markets, distributes and licenses casual apparel and accessories for men, women and children, per the American lifestyle and European fashion sensibilities. GES carries a Zacks Rank #2 at present.

The Zacks Consensus Estimate for Guess’s current financial-year sales suggests growth of 11.7% from the year-ago reported figures. GES has a trailing four-quarter earnings surprise of 31%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ralph Lauren Corporation (RL): Free Stock Analysis Report

Guess?, Inc. (GES): Free Stock Analysis Report

Crocs, Inc. (CROX): Free Stock Analysis Report

G-III Apparel Group, LTD. (GIII): Free Stock Analysis Report