Questor: after a 90pc paper loss in March our William Hill tip is back in the running. Hold

Sell your losers and run your winners is a strategy preached by many a successful professional money manager, and this column must admit that it can sometimes be too forgiving when the share price of one of its selections starts to slide.

However, patience can be rewarded, provided that the company’s competitive position remains strong, its financial resources sufficient to see it through any near-term difficulty, and the valuation low enough to offer both protection from falls and the potential for gains.

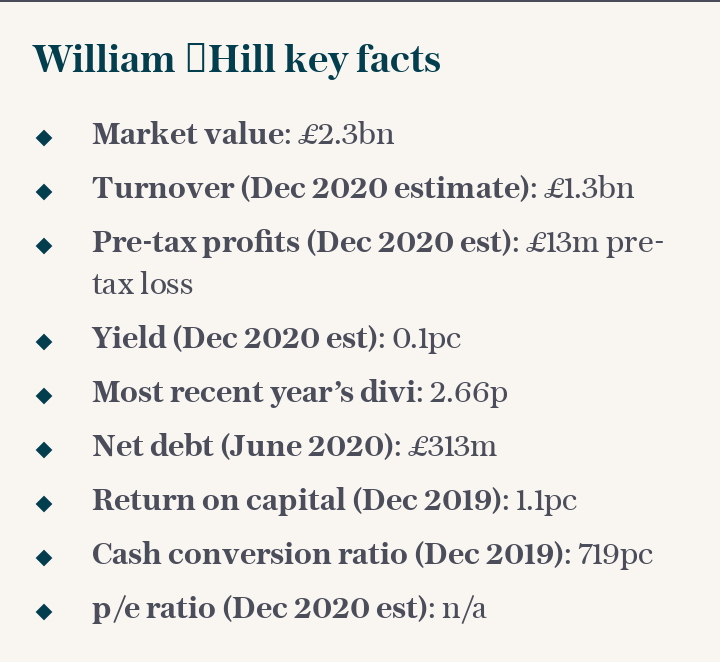

Down at 37p in March, a loss of nearly 90pc on bookmaker William Hill was staring this column in the face. But our decision not to sell has paid off, at least so far.

Helped by a timely waiver of the covenants on its debt in May, a programme designed to cut costs and preserve cash, and June’s £224m fundraising at 128p a share, William Hill’s borrowings look much less onerous, especially as those covenants will not be tested now until next year and the firm has £672m in cash on hand, according to first-half results released last month.

The resumption of sporting activity around the globe is a further positive development, to give punters a chance to back their opinions with their stakes.

Trading has been sufficiently strong in the early stages of the second half to permit Hills to return the £24.5m in furlough cash it received from the Government, thanks in part to further advances in online revenues, an area where the company has traditionally been seen as a bit of a laggard relative to GVC, Flutter and others.

Best of all, William Hill continues to make progress in America, which remains a market of huge potential following the repeal in 2018 of the Professional & Amateur Sports Protection Act and the legalisation of sports wagering, albeit at the discretion of individual state legislatures.

Sign up to our Business Briefing newsletter for a snapshot of the day’s biggest business stories

Read Questor’s rules of investment before you follow our tips

Hills was already well-placed in America, as it was the leading regulated player in Nevada and had a relationship with New Jersey’s Monmouth Park racetrack before the law changed. It has since built on that position via exclusive partnerships with CBS Sports and the casino group Eldorado.

The latter has since acquired Caesars Entertainment to create America’s largest casino group and the newly created entity has just struck a deal with the US sports broadcaster ESPN, greatly enhancing William Hill’s reach both online and across 170 retail sites in 13 different states.

As a result, Hills continues to cement its strong position in the burgeoning US market and is doing so with little additional marketing spending, as it leverages existing relationships and technologies.

The gambling industry will not appeal to all investors, not least on ethical grounds, and key risks remain, notably any further cancellation of major sports because of a second wave, higher taxes and ongoing regulatory scrutiny.

Even a minor whiff of a betting scandal in the US, for example, could set that market back years, as anti-wagering campaigners would doubtless press for new laws as they evoked memories of the 1919 baseball World Series, thrown by the Chicago White Sox in exchange for cash.

However, momentum in the US is building and Hills’ prime spot here could well merit a higher valuation over time for the shares.

Questor says: hold

Ticker: WMH

Share price at close: 214.4p

Update: Keystone Law

A resumption of dividend payments at Keystone Law bodes well and shows how adeptly the “challenger” legal firm is adapting to new working conditions as most principals and support staff work remotely.

Moreover, recruitment remains strong, cash flow is robust and the number of new instructions is almost back to pre-pandemic levels.

As ever, the only real concern remains valuation. A forecast price-to-earnings ratio of 36 for 2021, according to consensus analysts’ forecasts, means the stock is best suited to risk-tolerant investors who seek growth or momentum plays.

The payment of two interim dividends speaks of confidence in the future so stay on the right side of the law.

Questor says: hold

Ticker: KEYS

Share price at close: 477.5p

Russ Mould is investment director at AJ Bell, the stockbroker

Read the latest Questor column on telegraph.co.uk every Sunday, Tuesday, Wednesday, Thursday and Friday from 6am.