Private equity bidders circle the AA

A bidding war has erupted over the AA as a trio of private equity firms circle the roadside rescue company.

The breakdown firm said it is in talks with three possible buyers which include Platinum Equity Advisors, Warburg Pincus, and a joint approach from Centerbridge Partners and TowerBrook Capital Partners.

Each has offered to take the 115-year-old company private and pump in fresh cash to pay down some of its £2.7bn mountain of debt.

Bosses at the business - best known for its 2,700 bright yellow roadside assistance vehicles - said they could also raise money from existing investors.

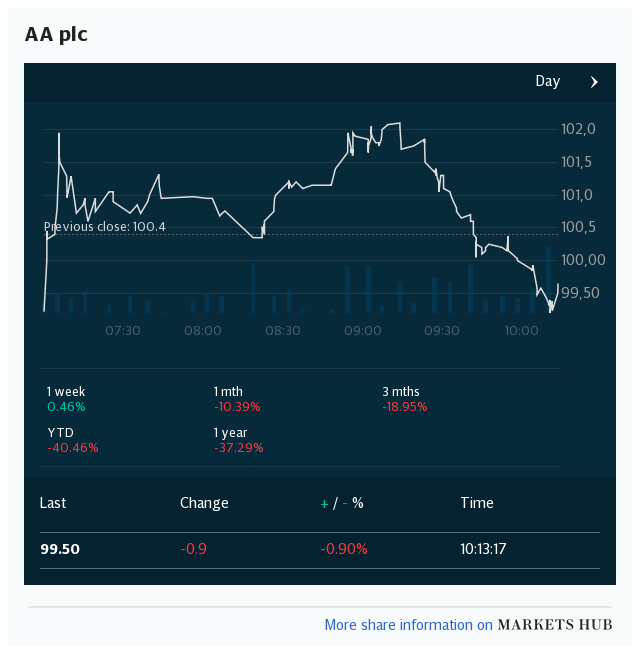

AA shares climbed almost 13pc to 28.25p. They are still down more than 50pc since the start of the year after the lockdown brought road travel to a crashing halt.

The AA said that trading has been resilient despite the pandemic and it expects performance this year to be only slightly below the previous one.

But bosses admitted it continues to be weighed down by a heavy debt burden which dates back to a previous period under private equity ownership before the company floated. It belonged to CVC and Permira before going public in 2014.

The AA is also embroiled in a £200m legal battle with former chief executive Bob Mackenzie, who was sacked three years ago after hitting another senior manager in a hotel bar. Mr Mackenzie is suing for wrongful dismissal and claims he was suffering from anxiety and depression at the time.

Around £913m of the company's borrowing is due to be repaid in the next two years and it said that debt reductions are a key priority.

In May, the company said that pre-tax profits had doubled to £107m in the year to January on revenues up 2pc at £995m.

A decline in membership was also halted, with numbers rising by 0.2pc to 3.2 million.