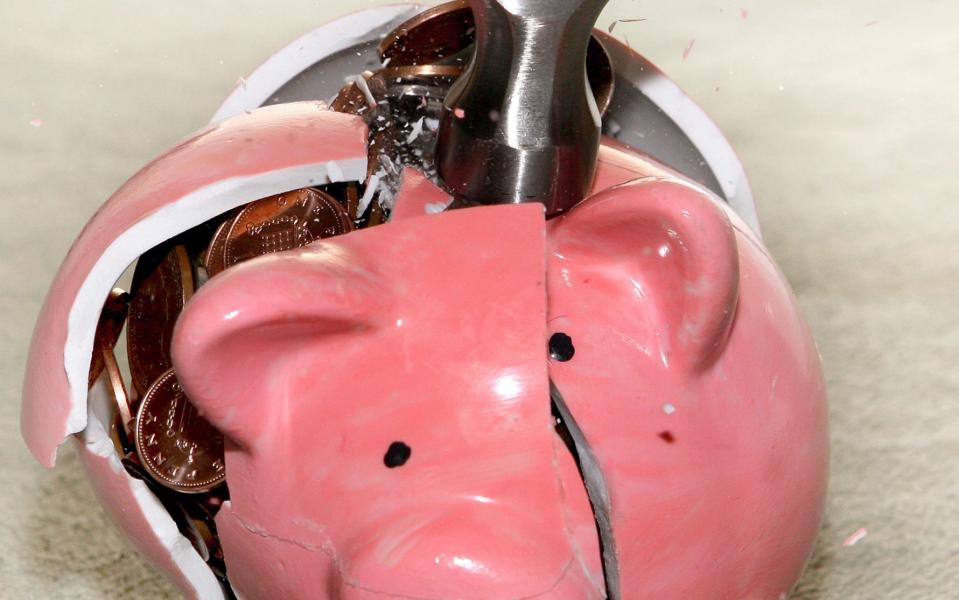

Piggy banks raided by a quarter of parents during lockdown, survey finds

Piggy banks have been raided by a quarter of parents struggling to pay the bills during lockdown, a survey has found.

According to polling of 2,000 parents by Direct Line Life Insurance, buying food was among the most common reasons for 23 per cent of respondents saying they had dipped into their children’s savings.

Charities have previously warned that lockdown has been tough for many families who have seen their incomes reduce either through furlough or redundancy.

However, others were able to boost their savings because they no longer spent money on commuting and other costs were reduced.

But the research by the insurer found that covering utility bills, childcare costs, clothing, travel, and mortgage payments, rent or debts had also been motivations for parents using children’s savings.

Chloe Couper, business manager at Direct Line Life Insurance, said: "The impact of the coronavirus pandemic has been severe and unfortunately means many families are facing tough financial decisions.

"Widespread redundancies, furloughing and pay reductions have resulted in many households across the country having to cope on a lower income and try to reduce their spending.

"While it is understandable that parents feel they need to utilise any savings they and their children have to cover costs, this could have a negative long-term impact on their children if this money was being set aside for things like university fees or property deposits."

Just over a quarter of parents have had to stop regularly setting aside money for their children since the start of lockdown in March, the survey also found.

On average, parents used to set aside around £130 a month for their children, Direct Line said.

People who are struggling to keep up with their regular bills may be able to take a payment holiday under measures designed to help households whose finances have been temporarily affected by coronavirus.