PerkinElmer (PKI) to Post Q4 Earnings: What's in the Cards?

PerkinElmer, Inc. PKI is slated to release fourth-quarter 2022 results on Feb 14, before market open. In the last reported quarter, the company delivered an earnings surprise of 2.03%. Its earnings beat estimates in each of the trailing four quarters, the average surprise being 12.82%.

Q4 Estimates

Currently, the Zacks Consensus Estimate for fourth-quarter revenues is pegged at $1.07 billion, indicating a decline of 21.3% from the year-ago reported figure. The consensus mark for earnings stands at $1.66 per share, indicating a decline of 35.2% from the prior-year quarter.

On its third-quarter earnings call, PerkinElmer expected fourth-quarter revenues of $1.06-$1.07 billion and adjusted earnings of $1.65-$1.67 per share.

Lower COVID Revenues Likely to Have Hurt Diagnostics

PerkinElmer’s Diagnostics business is likely to have continued its declining trend in the fourth quarter of 2022. In the last reported quarter, sales of this segment declined 39% primarily due to a drop in demand for COVID-related products. However, demand for non-COVID products was strong in the third quarter, which is likely to have partially offset lower COVID-related revenues for the segment in the soon-to-be-reported quarter.

Another Revenue Driver

In the third quarter, the Discovery & Analytical Solutions business grew 23%, driven by continued robust demand for PerkinElmer’s preclinical discovery business and strength in its informatics franchise. This trend is likely to have continued in the fourth quarter.

Meanwhile, continued supply-chain challenges and restrictions due to lockdowns in some countries are likely to have fueled material costs during the fourth quarter, hurting margins. However, productivity initiatives, volume leverage and strict cost-control measures are likely to have benefited the company’s fourth-quarter gross and operating margins. Product introductions are likely to have improved the product mix and, thereby the gross margin.

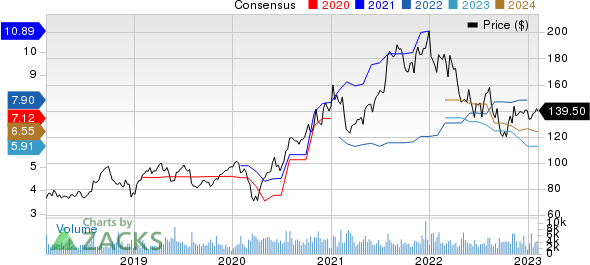

PerkinElmer, Inc. Price and Consensus

PerkinElmer, Inc. price-consensus-chart | PerkinElmer, Inc. Quote

Other Factors to Consider

In September last year, PerkinElmer launched a unique benchtop platform, Cellaca PLX Image Cytometry System, to create a single automated workflow for evaluating multiple Critical Quality Attributes of cell samples. In November, PerkinElmer launched fully-automatable assays to aid researchers working on gene therapies for various serious diseases.

The FDA approved PKI’s T-Cell Select reagent kit to automate T-SPOT.TB test workflow for in-vitro diagnostic (IVD) use in September. The EONIS SCID-SMA assay kit for IVD use for the simultaneous detection of spinal muscular atrophy was approved by the FDA in November 2022.

These developments are likely to have positively impacted the company’s Diagnostics segment in the fourth quarter. This, in turn, is expected to get reflected in the company’s to-be-reported quarter’s results.

However, PerkinElmer’s exposure to international markets increases the risk of foreign exchange volatility. The fluctuations in currency exchange rates are likely to have weighed on the company’s international sales in the to-be-reported quarter.

PerkinElmer signed an agreement last year to divest its Applied, Food and Enterprise Services (“AES”) businesses with an investment firm, New Mountain Capital, in August for up to $2.45 billion in total consideration. The deal is expected to close in the first quarter of 2023. Investors are likely to ask questions on the capital deployment strategy, following the sale during the earnings call.

What Our Quantitative Model Suggests

Per our proven model, the combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. That is not the case here as you will see.

Earnings ESP: PerkinElmer has an Earnings ESP of 0.00%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: The company carries a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

Stocks Worth a Look

Here are some medical instrument stocks worth considering as these have the right combination of elements to post an earnings beat this quarter.

OPKO Health OPK has an Earnings ESP of +15.09% and a Zacks Rank of 1.

OPKO Health’s stock has declined 46.2% in the past six months. OPK topped earnings estimates in the last reported quarter. It has a negative four-quarter earnings surprise of 94.17%, on average.

Penumbra PEN has an Earnings ESP of +11.11% and a Zacks Rank #1.

Penumbra’s stock has gained 67.5% in the past six months. PEN beat earnings estimates in the last reported quarter. It has a four-quarter earnings surprise of 37.56%, on average.

ShockWave Medical SWAV has an Earnings ESP of +5.01% and a Zacks Rank of 2.

ShockWave Medical’s stock has declined 27.2% in the past six months. SWAV beat earnings estimates in the last reported quarter. It has a four-quarter earnings surprise of 146.10%, on average.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

PerkinElmer, Inc. (PKI) : Free Stock Analysis Report

OPKO Health, Inc. (OPK) : Free Stock Analysis Report

Penumbra, Inc. (PEN) : Free Stock Analysis Report

ShockWave Medical, Inc. (SWAV) : Free Stock Analysis Report