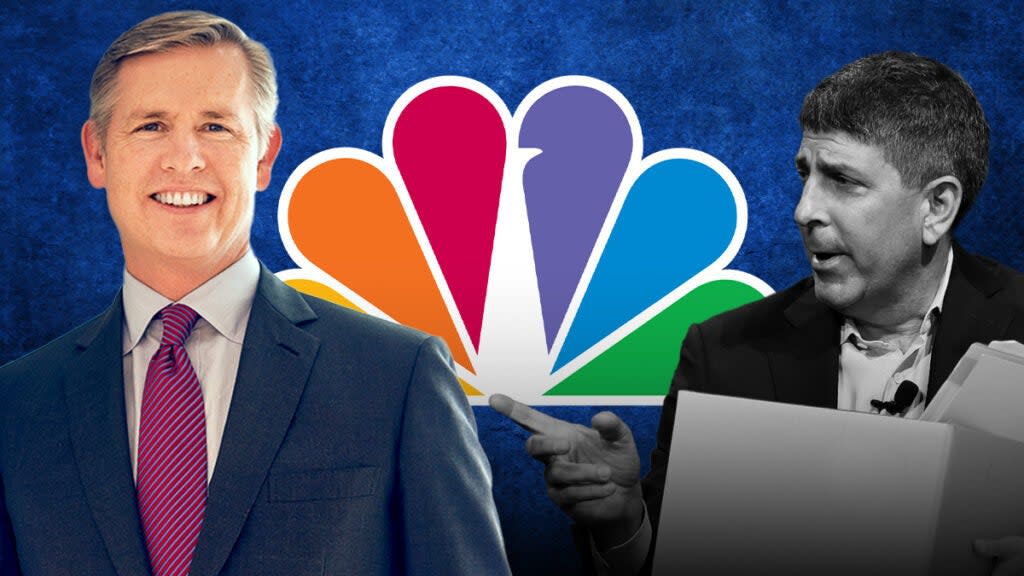

Peacock Growth, Hulu Sale, Stability? Mike Cavanagh Is Taking On All of NBCU’s Headaches

Mike Cavanagh won’t have time to get settled in his new role directly overseeing NBCUniversal before he faces a testy crowd of analysts when Comcast reports its first-quarter 2023 earnings Thursday. They’ll be primed to grill the company president on his plans to get the media operation growing again.

The former CFO is no stranger to Wall Street, and he’s a trusted right hand to Brian Roberts, the company’s chairman and CEO. But he’s not a familiar figure in Hollywood or New York media circles, and that makes the challenges he faces following the abrupt ouster of NBCUniversal CEO Jeff Shell all the more daunting.

Wall Street is expecting the media conglomerate to report Q1 earnings of 82 cents per share on revenue of $29.4 billion — both of which represent significant year-over-year declines. Ahead of the release of its quarterly results, Comcast shares have climbed approximately 3% year to date but have been trading flat since news of Shell’s termination broke.

Also Read:

Comcast President Mike Cavanagh Permanently Replaces Jeff Shell as NBCUniversal Boss

NBCU’s executive shakeup comes at a time of transition for legacy studios. Cavanagh will serve as Shell’s permanent replacement, an insider confirmed to TheWrap, offering the organization a measure of stability, though. His title as president of the parent company won’t change, though Shell’s direct reports will now report to Cavanagh.

One high-ranking distribution executive told TheWrap that Cavanagh is a “safe pick” and a “well-known Comcast guy in the inner circle” during a time when the company may be looking to make more acquisitions.

A high-level Hollywood insider told TheWrap that the company has “always been known for being diligent about promoting from within” and that it made sense to put in a “reliable, drama-free replacement.”

“The job that Shell had was more of a business job than a creative job,” the insider added. “They need business and entertainment savvy.”

Cavanagh’s choices

The stability of Cavanagh — with his institutional knowledge — is a good thing for the company as there will be enough drama from Comcast’s strategic challenges in a rapidly changing media environment.

“Over the past five years, we’ve seen declines in theatrical revenue, DVD revenue, broadcast revenue, and cable revenue. At the same time, costs are escalating, especially as they try to ramp up streaming services,” Loyola Marymount University associate professor of finance David Offenberg told TheWrap. “The CEOs of all of these companies need to figure out how to manage these transitions well to preserve morale within the company and preserve shareholder value.”

Offenberg noted that Comcast earnings are down over 30% from 2019 and their costs are up as they try to gain viewership for Peacock. The streaming service, which has surpassed 20 million subscribers, posted an operating loss of $978 million in the fourth quarter of 2022, widening from a loss of $559 million in the prior-year period. Peacock’s revenue climbed to $660 million during the fourth quarter from $335 million during the same period last year. Executives have said that they anticipate Peacock’s losses will peak at around $3 billion in 2023.

Also Read:

Wall Street Wants Streamers to Make More Money – but Consumers Want to Pay Less | Chart

The biggest problem with Peacock is that it remains much smaller than other streamers. Comcast still has a passive stake in Hulu, the streaming service it helped start 15 years ago and that’s now controlled by Disney. Either Disney or Comcast can force the sale of Comcast’s one-third stake to Disney under an agreement the companies reached in 2019, but it’s possible Comcast could negotiate with Disney to buy the rest of Hulu to bolster its position in streaming, too. All of that Cavanagh will need to wrestle with.

“It is important to remember that NBCUniversal is still a profitable business, and Cavanagh is faced with the challenge of keeping it that way,” Offenberg added. “Right now, Cavanagh must reassure markets that he is up to the challenge of transitioning NBCU to the new version of itself that will compete and profit over the next decade. He has particularly tough choices to make regarding the futures of Hulu and Peacock.”

Stefano Bonini, an associate professor of finance at Stevens Institute of Technology, told TheWrap that Comcast also faces “intense pressure” from the shift to streaming — not just in NBCU but in its core cable TV business. And Comcast’s “debt is high, which limits acquisition flexibility,” he noted.

Also Read:

Disney CEO Bob Iger Is Open to Selling Hulu – But Finding a Buyer Will Be a Challenge | Analysis

A network of raw nerves

The hardest challenge for Cavanagh may be smoothing the frayed nerves of NBCU’s workforce. Shell was terminated with cause on Sunday after Comcast investigated allegations that he engaged in inappropriate conduct with a female employee, later identified as Hadley Gamble. Gamble, a CNBC anchor and senior international correspondent, filed a complaint alleging sexual harassment, her lawyer said.

Two sources familiar with Gamble’s situation at CNBC told TheWrap that her contract was up and hadn’t been renewed, a decision she learned of prior to her decision to pursue a complaint against Shell. Gamble’s attorney Suzanne McKie didn’t respond to a request for comment about Gamble’s status at the network, while a CNBC representative declined to comment.

Also Read:

Jeff Shell Ouster: CNBC Anchor Hadley Gamble’s Attorney Says She Lodged Sexual Harassment Complaint

Bonini added that one of the critical challenges for Cavanagh will be to “develop visibility in the media world.”

“As a finance person, he’s obviously made a huge career for himself,” he said. “Yet he’s very limitedly known in Hollywood.”

Cavanagh worked for years at JPMorgan Chase, rising to the role of co-CEO of its corporate and investment bank and winning praise from CEO Jamie Dimon there.

Former ABC executive Brian Frons told TheWrap he’s not surprised that Roberts gave a former banker Jeff Shell’s portfolio, emphasizing that Comcast and NBCUniversal’s current challenges are all about “capital allocation.” In addition to figuring out its strategy with Hulu, Frons noted that Cavanagh and his colleagues will also have to determine how European operation Sky fits into its plans.

Also Read:

Jeff Shell Ousted as NBCUniversal CEO Over ‘Inappropriate Relationship’

Strategic moves, fewer surprises

During the company’s fourth quarter earnings call in January, Cavanagh said Peacock is “absolutely the right strategy for our company,” agreeing with remarks Shell had made.

“Jeff has repeatedly said, we’re not going to play somebody else’s hand,” he told analysts. “We have an excellent business in NBC and our cable networks. We spend quite a bit of money creating content, and so migrating some of that content as eyeballs move to a more streaming universe.”

When asked about the Hulu stake during Morgan Stanley’s Technology, Media & Telecomm Conference in March, Cavanagh reiterated that the company put “a very clear and good agreement for a put call” in 2019 — the deal we mentioned earlier that would allow Disney or Comcast to force a sale of Comcast’s stake. Under the agreement, Disney would have to pay at least $9 billion. Any other deal, Cavanagh said, would have to be “better in our minds than that.”

Shell had expressed some openness to M&A, saying he liked “bolt-on” acquisitions that fit well with the company’s current portfolio. Cavanagh drew a more conservative line, saying that the company likes “the opportunities we have for investing in growth and generating free cash flow growth from the existing set of businesses we have.”

“Our bias has to be investing behind our businesses themselves where we control, operate, know what we’re doing, have momentum, no surprises,” he added.

With Shell’s departure, Comcast has had enough surprises lately.

Also Read:

Fired NBCU Chief Jeff Shell’s ‘Inappropriate Relationship’ May Have Cost Him $25 Million

Deutsche Bank, which maintained a buy rating and $50 price target on Comcast stock, published a research note this week after the management change in which analyst Bryan Kraft called 2023 “a transition year from a growth perspective.”

Peacock’s subscriber additions and the potential for price increases will be a focus, he wrote, as well as any changes Cavanagh has in mind as he takes over.

In addition to its earnings call Thursday, Comcast will deliver presentations at NewFronts next week and traditional broadcast upfronts on May 15.

Additional reporting by Scott Mendelson.

Also Read:

The Ouster of Jeff Shell as NBCUniversal CEO – Have Powerful Men Learned Nothing?