PayPal (PYPL) Q3 Earnings Beat Estimates, Revenues Rise Y/Y

PayPal Holdings, Inc. PYPL reported non-GAAP earnings of $1.08 per share for third-quarter 2022, beating the Zacks Consensus Estimate by 13.7%. However, the figure declined 2% on a year-over-year basis.

Net revenues of $6.85 billion exhibited year-over-year growth of 12% on an FX-neutral basis and 11% on a reported basis. The figure surpassed the Zacks Consensus Estimate of $6.82 billion.

Growing transaction and other value-added services’ revenues drove the top line year over year in the reported quarter. Also, accelerating U.S. and international revenues contributed well.

Shares of PayPal dropped 9.7% in after-hours trading due to a weak revenue outlook for 2022. PYPL trimmed its guidance for revenue growth in anticipation of an economic downturn, which might slow down consumer spending.

On a year-to-date basis, PayPal has lost 59.4% compared with the industry’s decline of 61.9%.

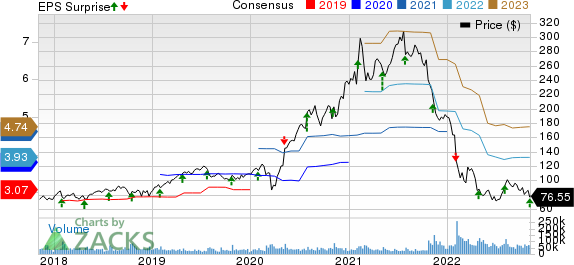

PayPal Holdings, Inc. Price, Consensus and EPS Surprise

PayPal Holdings, Inc. price-consensus-eps-surprise-chart | PayPal Holdings, Inc. Quote

Top Line in Detail

By Type: Transaction revenues amounted to $6.23 billion (91% of net revenues), up 11% from the year-ago quarter’s level. Other value-added services generated revenues of $612 million (accounting for 9% of net revenues), up 6% year over year.

By Geography: Revenues from the United States totaled $3.98 billion (58% of net revenues), up 14% on a year-over-year basis. International revenues were $2.9 billion (42% of net revenues), up 6% from the prior-year quarter’s level.

Key Metrics to Consider

PayPal witnessed year-over-year growth of 4% in total active accounts, with 2.9 million net new active accounts added in the reported quarter. The total number of active accounts was 432 million in the quarter under review.

The total number of payment transactions was 5.64 billion, up 15% on a year-over-year basis.

PYPL’s payment transactions per active account were 50.1 million, which improved 13% from the year-ago quarter’s level.

Total payment volume (TPV) amounted to $336.97 billion for the reported quarter, reflecting year-over-year growth of 9% on a spot rate basis and 14% on a currency-neutral basis.

Year-over-year growth in TPV was primarily driven by Venmo, which accounted for $63.6 billion of TPV, rising 6% on a year-over-year basis.

Operating Details

PayPal’s operating expenses were $5.7 billion in the third quarter, up 11.5% from the prior-year quarter’s figure. As a percentage of net revenues, the figure expanded 60 basis points (bps) on a year-over-year basis.

The non-GAAP operating margin was 22.4%, contracting 140 bps from the year-ago quarter’s level.

Balance Sheet & Cash Flow

As of Sep 30, 2022, cash equivalents and investments were $10.8 billion, up from $9.3 billion as of Jun 30, 2022.

PayPal had a long-term debt balance of $10.24 billion at the end of the third quarter compared with $10.19 billion at the end of the second quarter.

PYPL generated $1.9 billion cash from operations, up from $1.5 billion in the previous quarter.

Free cash flow was $1.8 billion in the reported quarter, up from $1.3 billion in the prior quarter.

PayPal returned $939 million to its shareholders by repurchasing 10 million shares.

Guidance

For fourth-quarter 2022, PayPal projects revenues of $7.375 billion, suggesting growth of 7% on a current spot rate basis from the year-ago quarter’s reported figure and 9% on a currency-neutral basis. The Zacks Consensus Estimate for revenues is pegged at $7.74 billion.

Non-GAAP earnings are expected to be $1.18-$1.20 per share. The Zacks Consensus Estimate for earnings is pegged at $1.18 per share.

For 2022, PayPal now projects revenues at $27.5 billion, indicating growth of 8.5% on a spot rate and 10% on a currency-neutral basis. The Zacks Consensus Estimate for 2022 revenues is pegged at $27.85 billion. Previously, management had expected revenues of $27.85 billion, implying growth of 10% on a spot rate and 11% on a currency-neutral basis.

Management raised the non-GAAP earnings guidance from $3.87-$3.97 per share to $4.07-$4.09. The Zacks Consensus Estimate for the same is pegged at $3.93 per share.

TPV for 2022 is likely to exhibit growth of 8.5% on a spot rate basis and 12.5% on a currency-neutral basis.

Zacks Rank and Stocks to Consider

Currently, PayPal carries a Zacks Rank #3 (Hold).

Investors interested in the broader Zacks Computer & Technology sector can consider some better-ranked stocks like US Foods USFD, The Trade Desk TTD and Tencent Music Entertainment Group TME, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

US Foods is set to report third-quarter 2022 results on Nov 10. The Zacks Consensus Estimate for USFD’s earnings is pegged at 59 cents per share, suggesting an increase of 22.9% from the prior-year period’s reported figure. USFD has lost 17.4% in the year-to-date period. Its long-term earnings growth rate is currently projected at 20%.

The Trade Desk is scheduled to release third-quarter 2022 results on Nov 9. The Zacks Consensus Estimate for TTD’s earnings is pegged at 24 cents per share, suggesting an increase of 33.3% from the prior-year quarter’s reported figure. TTD has lost 46.3% in the year-to-date period. TTD’s long-term earnings growth rate is currently projected at 24%.

Tencent Music is scheduled to release third-quarter 2022 results on Nov 15. The Zacks Consensus Estimate for TME’s earnings is pegged at 11 cents per share, suggesting an increase of 22.2% from the prior-year quarter’s reported figure. TME has lost 44.7% in the year-to-date period. TME’s long-term earnings growth rate is currently projected at 17.9%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

PayPal Holdings, Inc. (PYPL) : Free Stock Analysis Report

US Foods Holding Corp. (USFD) : Free Stock Analysis Report

The Trade Desk (TTD) : Free Stock Analysis Report

Tencent Music Entertainment Group Sponsored ADR (TME) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research