PayPal (PYPL) Boosts Focus on Small Businesses With Terminal

PayPal PYPL rolled out a digital point-of-sale solution, PayPal Zettle Terminal, in the United States to deliver an enhanced payment experience to small businesses and their customers.

Notably, Terminal is an in-store solution, which comes with a pre-loaded SIM card and Zettle point-of-sale app pre-installed. It does not require any second device to pair with and features robust Wi-Fi and cellular connectivity.

Terminal enables merchants to accept payments from customers via credit cards, digital wallets,

PayPal and Venmo QR Codes, seamlessly and securely.

It also helps businesses in sales, inventory, reporting and payments management.

We believe that all these features will aid the company in gaining solid momentum among small businesses, which, in turn, will strengthen its seller base.

The latest move is likely to boost the total number of payment transactions and total payment volume (TPV) in the days ahead.

In second-quarter 2022, PayPal’s total number of payment transactions was 5.5 billion, up 16% on a year-over-year basis. TPV amounted to $339.8 billion, reflecting year-over-year growth of 9% on a spot rate basis and 13% on a currency-neutral basis.

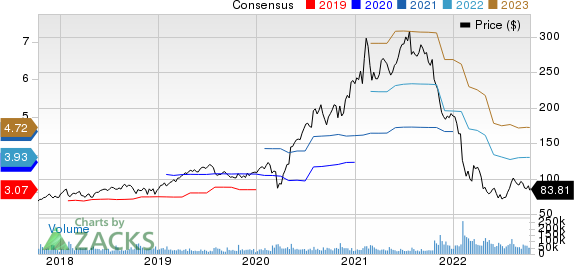

PayPal Holdings, Inc. Price and Consensus

PayPal Holdings, Inc. price-consensus-chart | PayPal Holdings, Inc. Quote

Growing Focus on Small Businesses

We note that the latest move bodes well for PayPal’s growing efforts toward strengthening offerings for small businesses.

Apart from the latest move, the company recently launched PayPal Business Cashback Mastercard, its business credit card backed by Mastercard and issued by WebBank, with the help of which it strives to cater to the daily financing needs of small businesses.

Expanding the global reach of PayPal Business Debit Mastercard remains noteworthy. Notably, the card, which is ideal for small businesses, does not carry any monthly fees or foreign exchange fees. The card allows users to access the funds stored in their PayPal accounts at more than 52 million Mastercard acceptance locations throughout the world.

The company offers PayPal Working Capital and PayPal Business Loans, which are focused on catering to the needs of small businesses.

We believe that all these endeavors will boost the small merchant base of PayPal, which, in turn, will drive its top-line growth in the days ahead.

Growing Digital Payment Initiatives

The latest move is in sync with the company’s strengthening digital payment endeavors.

In addition to the latest launch, PayPal’s unveiling of a payment card, namely the PayPal Cashback credit card issued by Synchrony, remains a positive. The card allows customers to gain more rewards while shopping online and offline, and paying with PayPal.

The card offers a 3% cash back when paying with PayPal at checkout — online, mobile, or in-store with PayPal QR Code. It gives an unlimited 2% cash back on all other purchases made through Mastercard, wherever accepted.

PayPal’s partnership with United, under which PayPal QR Code was made available as a payment option for passengers on boarding flights of the latter, remains noteworthy.

We believe that all the above-mentioned efforts will continue to expand PayPal’s footprint in the booming digital payment world.

Per a report from Statista, this market is expected to generate a transaction value of $8.7 trillion in 2022, which is expected to see a CAGR of 12.8% between 2022 and 2026, and hit $14.1 trillion by 2026.

We believe that the company’s growing prospects in this promising market will help it win investor confidence in the near term.

Notably, PayPal has lost 55.5% on a year-to-date basis compared with the industry’s decline of 57.5%.

Zacks Rank & Stock to Consider

Currently, PayPal carries a Zacks Rank #3 (Hold).

Investors interested in the broader Zacks Computer & Technology sector can consider some better-ranked stocks like Arista Networks ANET, Agilent Technologies A and Aspen Technology AZPN. While Arista Networks sports a Zacks Rank #1 (Strong Buy), Agilent Technologies and Aspen Technology carries a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Arista Networks has lost 27.9% in the year-to-date period. The long-term earnings growth rate for ANET is currently projected at 15.7%.

Agilent Technologies has lost 21.3% in the year-to-date period. The long-term earnings growth rate for A is currently projected at 10%.

Aspen Technology has returned 60.4% in the year-to-date period. The long-term earnings growth rate for AZPN is currently projected at 18.2%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Agilent Technologies, Inc. (A) : Free Stock Analysis Report

Aspen Technology, Inc. (AZPN) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

PayPal Holdings, Inc. (PYPL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research