Owens Corning (OC) Stock Down Despite Q3 Earnings Beat

Owens Corning OC reported third-quarter 2020 results, wherein both earnings and revenues surpassed the Zacks Consensus Estimate. While the bottom line beat the consensus estimate for the sixth straight quarter, the top line outpaced the same for the second consecutive quarter. Moreover, both the metrics improved year over year.

The company’s results benefited from improving customer demand in most of the company end markets. Its residential market, primarily in the United States, was driven by strong demand for new single family housing, and rise in repair and remodeling investments. Moreover, market leading businesses, innovative product and process technologies, and capabilities also contributed to the results.

Since the COVID-19 breakout, the company has been focusing on four key areas: safety of employees and other key stakeholders; close connection with customers, suppliers and markets; adapting to rapid changes in businesses to overcome near-term challenges while positioning well for long-term success; and a strong balance sheet.

Despite reporting robust results, the company’s shares declined 5.5% on Oct 28, 2020. This was due to management’s announcement that the coronavirus pandemic will continue to create uncertainty in its end markets, which upset the investors.

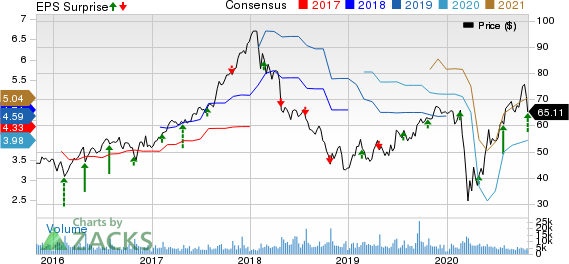

Owens Corning Inc Price, Consensus and EPS Surprise

Owens Corning Inc price-consensus-eps-surprise-chart | Owens Corning Inc Quote

Inside the Headlines

The company reported adjusted earnings of $1.70 per share, surpassing the Zacks Consensus Estimate of $1.32 by 28.8%. Moreover, the bottom line improved 6.3% year over year.

Net sales of $1.9 billion outpaced the consensus mark of $1.8 billion by 6% and also increased 1.1% year over year. The upside was driven by robust revenue growth in Roofing business, which was partially overshadowed by decline in Composites and Insulation businesses.

Segment Details

Net sales in the Composites segment dropped 2% year over year to $521 million. The decline was primarily due to lower selling prices and unfavorable product mix. Sales volumes were flat year over year. During the quarter under review, the company witnessed recovery in few regional markets. Owens Corning continues to witness robust performance in its wind and roofing downstream specialty applications.

Earnings before interest and taxes (EBIT) margin of 11% contracted 200 basis points (bps) from the year-ago quarter’s 13%. Reduced sales, production volumes and lower selling prices impacted the results.

Insulation segment’s net sales were $681 million, down 2% year over year. The decline was primarily due to lower selling prices and volumes in technical and other building insulation, which negated growth in volume in North American residential.

The Roofing segment’s net sales increased 7% year over year to $761 million driven by 12% volume growth, which was offset by year-over-year decline in selling prices and lower third-party asphalt sales. During the quarter under review, the company registered growth in asphalt shingle market in the United States. EBIT margin expanded 600 bps year over year to 26% due to higher sales volumes, input cost deflation and encouraging manufacturing performance.

Operating Highlights

Adjusted EBIT during the quarter totaled $289 million, indicating growth of 4.3% on a year-over-year.

Balance Sheet

As of Sep 30, 2020, the company had cash and cash equivalents of $647 million compared with $172 million at 2019-end. Long-term debt, net of current portion totaled $3.1 billion, rose from $3 billion at 2019-end.

The company has $1.7 billion of available liquidity at the end of the third quarter. During the quarter, it repaid $190 million in revolving credit facility and repaid the remaining $150 million on its term loan.

In the first nine months of 2020, net cash provided in operating activities was $717 million, up from $596 million a year ago. Free cash flow came in at $514 million, up from $282 million a year ago.

Through June, the company returned $159 million to shareholders in the form of share repurchases and dividends. At quarter-end, 2.3 million shares were available under the current authorization.

2020 Outlook

Owens Corning’s businesses are witnessing negative trend in global industrial production, U.S. housing starts and global commercial and industrial construction activity. It anticipates continuation of COVID-19 impacts to hurt its end markets.

Nonetheless, it expects to capitalize on near-term market demand, control costs and maintain strong conversion of adjusted earnings into free cash flow as residential, commercial, and industrial markets are rebounding.

The company increased general corporate expenses to $125 million from $105-$115 million expected earlier. Capital additions are anticipated to be in the high-end of the prior guidance of $250-$300 million. The company continues to project interest expenses in the range of $125-$130 million. Owens Corning estimates an effective tax rate of 26-28%.

Zacks Rank & Peer Release

Owens Corning, which shares space with United Rentals, Inc. URI and Installed Building Products, Inc. IBP in the same industry, currently carries a Zacks Rank #2 (Buy).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Armstrong World Industries, Inc. AWI recently reported third-quarter 2020 results, wherein earnings and revenues beat the Zacks Consensus Estimate. The company reported adjusted earnings of $1.07 per share, beating the Zacks Consensus Estimate of 95 cents by 12.6%. However, the bottom line declined 22.5% from $1.38 reported in the year-ago quarter.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by referendums and legislation, this industry is expected to blast from an already robust $17.7 billion in 2019 to a staggering $73.6 billion by 2027. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot stocks we're targeting >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Owens Corning Inc (OC) : Free Stock Analysis Report

Armstrong World Industries, Inc. (AWI) : Free Stock Analysis Report

United Rentals, Inc. (URI) : Free Stock Analysis Report

Installed Building Products, Inc. (IBP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research