Oracle (ORCL) Q1 Earnings Beat Estimates, Revenues Rise Y/Y

Oracle ORCL reported first-quarter fiscal 2024 non-GAAP earnings of $1.19 per share, which beat the Zacks Consensus Estimate by 4.39% and increased 15.5% year over year. At constant currency (cc), earnings increased 14% year over year.

Revenues increased 8.8% (up 8% at cc) year over year to $12.45 billion and matched the Zacks Consensus Estimate.

Revenues from the Americas jumped 9% year over year to $7.84 billion and accounted for 63% of total revenues. Europe/Middle East/Africa climbed 11.7% year over year to $3.005 billion and contributed 24.1% of total revenues. The remaining revenues came from Asia Pacific, which gained 2.9% year over year to $1.6 billion.

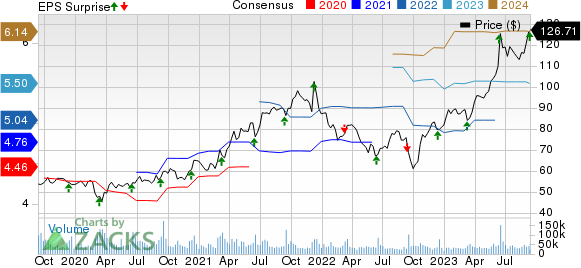

Oracle Corporation Price, Consensus and EPS Surprise

Oracle Corporation price-consensus-eps-surprise-chart | Oracle Corporation Quote

Top-Line Details

Cloud services and license support revenues surged 13% year over year (12% at cc) to $9.5 billion, driven by robust demand for cloud applications, autonomous databases and Gen 2 cloud infrastructure services.

Cloud license and on-premise license revenues declined 10% year over year (down 11% at cc) to $0.8 billion.

This Zacks Rank #4 (Sell) company reported cloud sales growth that slowed in the fiscal first quarter, dimming enthusiasm about the software maker’s expansion efforts in the competitive market. Shares of the company have declined about 9.2% in extended trading.

Cloud revenues (IaaS plus SaaS), including Cerner, came in at $4.6 billion, up 30% year over year (29% at cc), which was lower than the 54% jump in the previous quarter.

Cloud Infrastructure (IaaS) revenues came in at $1.5 billion, up 66% year over year (64% in cc). Cloud Application (SaaS) revenues of $3.1 billion increased 17% year over year (17% at cc).

Fusion Cloud ERP (SaaS) revenues came in at $0.8 billion, up 21% year over year (20% at cc). NetSuite Cloud ERP (SaaS) revenues of $0.7 billion increased 21% year over year (21% at cc).

Hardware revenues were $714 million, down 6% year over year (down 8% at cc). Services revenues increased 2% (1% at cc) to $1.38 billion.

For the first quarter of fiscal 2024, Cerner contributed $0.6 billion to total revenues.

Application subscription revenues, which include product support, were $4.5 billion, up 11% year over year. SaaS cloud revenues were $3.1 billion, up 17% at cc on a year-over-year basis.

Infrastructure subscription revenues, which also include support, were $5 billion, up 15% at cc. Infrastructure subscription revenues, which include license support, were $5.1 billion, up 14%. Infrastructure cloud services revenues were up 64%. Excluding legacy hosting services, Gen2 Infrastructure cloud services revenues grew 72% with an annualized revenues of $5.6 billion.

Oracle Cloud Infrastructure (“OCI") consumption revenues increased 91%. Exadata Cloud Services revenues surged 46% and Autonomous Database revenues were up 42%.

Gen 2 Cloud Driving Artificial Intelligence (AI) Clientele

Oracle’s Gen 2 Cloud has won a contract worth $4 billion from generative AI customers, thanks to extremely high performance and related cost savings of running generative AI workloads.

In Oracle Gen 2 Cloud, the CPUs and GPUs are interconnected using an ultra-high-performance RDMA network, in addition to a dedicated set of cloud-controlled computers that manage security and data privacy, which is helping it to perform better than its competitors.

The company also announced that it is launching a generative AI cloud service for enterprise customers. In the fiscal first quarter, the company was selected by MosaicML as the preferred cloud infrastructure partner to accelerate AI model training.

Moreover, Oracle announced free training and certification program as demand for cloud and AI keeps accelerating.

ORCL announced extension of its collaboration with VMware, Inc. VMW to assist customers in modernizing their workloads by utilizing OCI.

Moreover, the company announced the general availability of MySQL HeatWave Lakehouse, enabling customers to query data in object storage as fast as querying data inside the database.

MySQL HeatWave Lakehouse is much faster than Amazon’s AMZN version of MySQL. Oracle noted that customers are shifting from Amazon Aurora as the addition of Heatwave made query processing 1,000 times faster.

As of Aug 31, 2023, Oracle had 44 public cloud regions around the world, with another six being built. In addition, 12 of these public cloud regions interconnect with Microsoft’s MSFT cloud service, Azure.

In terms of performance, shares of ORCL have underperformed Amazon but outperformed its other hyperscaler peers like Microsoft and Alphabet year to date. While Oracle has returned 42.4%, Amazon, Alphabet and Microsoft gained 50.7%, 40.1% and 38.4%, respectively.

Operating Details

The non-GAAP total operating expenses increased 6.1% year over year (up 5% at cc) to $7.39 billion.

The non-GAAP operating income was $5.05 billion, up 13% year over year (up 12% at cc). The non-GAAP operating margin was 40.6%, which expanded 150 basis points on a year-over-year basis.

Balance Sheet & Cash Flow

As of Aug 31, 2023, Oracle had cash & cash equivalents and marketable securities of $12.08 billion compared with $10.19 billion as of May 31, 2023.

Operating cash flow and free cash flow amounted to $17.74 billion and $9.45 billion, respectively.

Remaining performance obligation (RPO) was $65 billion, up 11% year over year. Roughly 49% of total RPO is expected to be recognized as revenues over the next 12 months.

Guidance

Total revenues for the second quarter of fiscal 2024, including Cerner, are expected to grow between 3% and 5% at cc and 5% and 7% in U.S. dollars.

Total cloud growth, excluding Cerner, is expected between 27% and 29% at cc. In U.S. dollars, cloud growth is expected between 29% and 31%.

In U.S. dollars, Oracle expects non-GAAP earnings to grow between 7% and 11%. The company expects earnings in the range of $1.30-$1.34 per share. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

VMware, Inc. (VMW) : Free Stock Analysis Report

Oracle Corporation (ORCL) : Free Stock Analysis Report