NVIDIA (NVDA) Surges on Reports of Adding Elon Musk as Customer

NVIDIA Corporation NVDA stock soared 7% on Tuesday following reports that Elon Musk's new artificial intelligence (AI) venture, xAI, has become a customer of the AI chipmaker. This development underscores NVIDIA's dominant position in the AI hardware market and highlights the increasing demand for its advanced graphics processing units (GPUs) from leading tech innovators.

With yesterday’s gain, NVDA stock’s market capitalization reached $2.8 trillion, just about $113 billion less than Apple AAPL. At Tuesday’s closing price of $189.99, Apple’s market capitalization is $2.913 trillion.

NVIDIA has witnessed a remarkable run so far this year, showcasing a staggering 130% surge in its stock price year to date (YTD), pushing the company to the forefront of technology and innovation. NVDA stock has outperformed the Zacks Semiconductor – General industry’s growth of 81% during the same time frame.

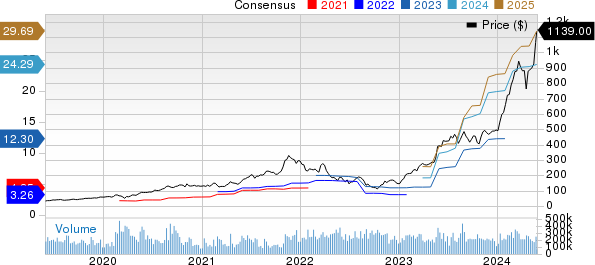

NVIDIA Corporation Price and Consensus

NVIDIA Corporation price-consensus-chart | NVIDIA Corporation Quote

Elon Musk’s xAI Invests Heavily in AI

In a blog posted on its website on May 26, xAI revealed that it raised $6 billion under its Series B funding round. The latest funding round valued the startup worth approximately $24 billion. NVIDIA is believed to be the prime beneficiary of the latest fund raised by Elon Musk’s xAI startup.

xAI plans to use the money to build infrastructure, accelerate research and development and launch its first chatbot product, Grok, to the market. The year-old startup earlier said that its Grok chatbot would compete against OpenAI’s ChatGPT and Google’s Gemini.

However, the underlying large language models used in the Grok chatbot will require plenty of computational horsepower to compete against its rivals. As xAI is not developing its own AI chips, the majority of high-computing processors are most likely to be bought from NVIDIA.

According to a report by The Information, xAI intends to make a supercomputer using NVIDIA H100 GPUs that will power its Grok chatbot. The company aims to make this supercomputer operational by the fall of 2025.

Per the report, xAI has partnered with the cloud-computing company Oracle ORCL for building a new data center. In March 2024, Oracle extended its partnership with NVIDIA to include running strategic NVIDIA AI applications on the new Oracle Cloud Infrastructure Supercluster.

GenAI Investments Aid NVDA’s Surge

NVIDIA’s robust stock price performance has been primarily driven by hopes that the company will be a prime beneficiary of growing investments in generative AI. NVIDIA dominates the market for AI chips.

The meteoric rise of OpenAI’s ChatGPT and its adoption among enterprises have already proven generative AI technology’s usefulness across multiple industries, including marketing, advertising, customer service, education, content creation, healthcare, automotive, energy & utilities and video game development.

The growing demand to modernize the workflow across industries is expected to drive the demand for generative AI applications. The global generative AI market size is anticipated to reach $967.6 billion by 2032, according to a new report by Fortune Business Insights. The market is expected to expand at a CAGR of 39.6% from 2024 to 2032.

However, generative AI requires vast knowledge to create content and needs huge computational power. As a result, enterprises looking to create generative AI-based applications will be required to upgrade their existing network infrastructure.

NVIDIA’s next-generation chips with high computing power can be the top choice for enterprises. The company’s GPUs are already being applied in AI models. This is expanding NVDA’s footprint in untapped markets like automotive, healthcare and manufacturing.

The generative AI revolution is likely to create huge demand for its next-generation high computing powerful chips. Considering surging AI investments across the data center end market, NVDA expects its second-quarter fiscal 2025 revenues to reach $28 billion from $13.51 billion in the year-ago quarter.

Zacks Rank and Another Stock to Consider

Currently, NVIDIA and Oracle each carry a Zacks Rank #2 (Buy), while Apple has a Zacks Rank #3 (Hold). ORCL stock has risen 18.4% YTD, while AAPL stock has declined 1.3% over the same time frame.

Another top-ranked stock worth considering in the broader computer and technology sector is Palo Alto Networks PANW, which carries a Zacks Rank #2. You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Palo Alto Networks’ fiscal 2024 earnings has remained unchanged at $5.50 per share in the past 60 days, which suggests year-over-year growth of 23.9%. The long-term estimated earnings growth rate for the stock stands at 22.1%. PANW stock increased 4.5% YTD.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Apple Inc. (AAPL) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Oracle Corporation (ORCL) : Free Stock Analysis Report

Palo Alto Networks, Inc. (PANW) : Free Stock Analysis Report