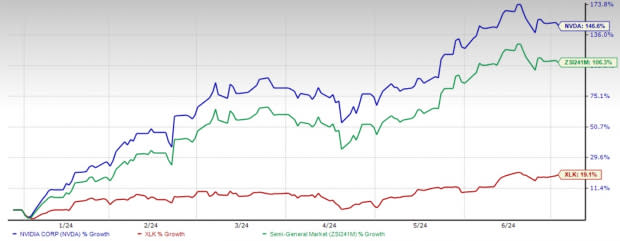

NVIDIA (NVDA) Up 147% YTD: Is It Too Late to Buy the Stock Now?

NVIDIA Corporation NVDA has experienced an impressive 146.6% surge in its stock price year to date (YTD), outperforming the Zacks Semiconductor – General industry and The Technology Select Sector SPDR Fund XLK ETF’s gains of 106.3% and 19.1%, respectively. This YTD performance makes the graphic processing unit (GPU) maker the third publicly traded U.S. company alongside Microsoft Corporation MSFT and Apple Inc. AAPL, which currently have a valuation of more than $3 trillion.

With a market capitalization of $3.414 trillion as of Jul 2, Microsoft is the most valuable company in the world. Apple holds the second spot with a market capitalization of $3.378 trillion, while NVIDIA is in the third position with a market capitalization of $3.058 trillion.

As a leading player in the semiconductor industry, NVIDIA has benefited from its dominance in GPUs and strategic expansion into artificial intelligence (AI), data centers and autonomous vehicles. Given this remarkable growth, the question arises whether it is too late to buy into NVIDIA or if there is still room for further appreciation.

YTD Price Performance

Image Source: Zacks Investment Research

Why Could NVDA Stock Further Appreciate?

NVIDIA's remarkable stock performance has been primarily driven by the anticipation that the company will reap substantial benefits from the growing investments in generative AI. Given NVIDIA's leading position in this space and the vast opportunities generative AI presents, the stock seems poised to maintain its upward trajectory throughout the year.

The increasing demand for workflow modernization across various industries is expected to elevate the need for generative AI applications. According to a recent report by Fortune Business Insights, the global generative AI market is projected to reach $967.6 billion by 2032, growing at a compound annual growth rate (CAGR) of 39.6% from 2024 to 2032.

However, generative AI requires extensive expertise for content creation and significant computational power. As a result, enterprises developing generative AI-based applications will need to upgrade their existing network infrastructure.

NVIDIA's next-generation chips, renowned for their high computing power, are likely to become the preferred choice for enterprises. The company’s GPUs are already widely used in AI models, which is expanding NVIDIA’s presence in emerging markets such as automotive, healthcare and manufacturing.

The generative AI revolution is expected to drive substantial demand for NVIDIA's next-generation, high-computing power chips. With the increasing AI investments in the data center sector, NVIDIA anticipates its second-quarter fiscal 2025 revenues to reach $28 billion from $13.51 billion in the year-ago quarter.

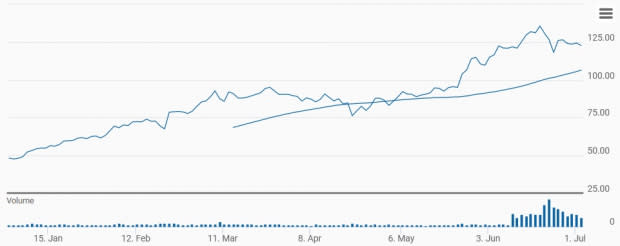

Not Too Late to Buy NVDA Stock

NVIDIA's strong product portfolio, leadership in AI and relentless innovation present a compelling investment opportunity. Moreover, the shares of NVIDIA are trading above the 50-day moving average, indicating a bullish trend.

NVDA Stock Trades Above 50-Day Average

Image Source: Zacks Investment Research

The company enjoys high market esteem, and savvy investors should consider leveraging NVDA’s potential for sustained long-term growth. NVIDIA boasts an impressive long-term expected earnings growth rate of 37.6%, significantly outpacing the Zacks Semiconductor – General industry’s growth rate of 18.9%. This semiconductor company’s earnings have consistently exceeded the Zacks Consensus Estimate over the past four quarters, with an average surprise of 24%.

The Zacks Consensus Estimate for fiscal 2025 revenues is pegged at $117.55 billion, which indicates a year-over-year increase of approximately 93%. The consensus mark for fiscal 2025 earnings has been revised upward by a penny to $2.53 per share over the past seven days, which calls for year-over-year growth of 113.4%.

Financially, NVIDIA is on solid ground, with ample cash reserves that provide a cushion against market volatility. As of Apr 28, 2024, the company reported cash and cash equivalents of $31.44 billion, up from $25.98 billion on Jan 28, 2024.

However, NVIDIA’s stock trades at a one-year forward price-to-sales (P/S) ratio of 23.01, which is higher than the Semiconductor – General industry’s forward P/S multiple of 19.2. While this might be perceived as a risk, the premium is justified due to NVIDIA's consistent financial performance and substantial growth prospects in emerging sectors such as automotive, healthcare and manufacturing.

Image Source: Zacks Investment Research

Additionally, NVIDIA sports a Zacks Rank #1 (Strong Buy) and currently boasts a Growth Score of A, making it a highly attractive investment option, according to Zacks' proprietary methodology. You can see the complete list of today's Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Apple Inc. (AAPL) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Technology Select Sector SPDR ETF (XLK): ETF Research Reports