Nutanix Q4 Preview: Another EPS Beat Inbound?

Tech stocks have been hit hard in 2022 amid a hawkish Fed. For example, the Zacks Computer and Technology Sector is down more than 25% YTD. Even over the last month, the sector has continued to lag the S&P 500.

Image Source: Zacks Investment Research

A company in the sector, Nutanix NTNX, is on deck to unveil Q4 results on Wednesday, August 31st, after market close.

Nutanix provides an enterprise cloud operating system that combines server, storage, virtualization, and networking software into one integrated solution.

As it stands, the company carries a Zacks Rank #3 (Hold) with an overall VGM Score of a C. How does everything shape up heading into the print? Let’s take a closer look.

Share Performance & Valuation

It’s been a harsh road for Nutanix shares in 2022, down more than 40% and vastly underperforming the S&P 500.

Image Source: Zacks Investment Research

However, the picture vividly changes upon zooming in – over the last month, Nutanix shares have tacked on nearly 20% in value, crushing the S&P 500’s -2% decline.

Image Source: Zacks Investment Research

In addition, NTNX carries a 2.4X forward price-to-sales ratio, nowhere near its five-year median of 4.5X and representing a 31% discount relative to its Zacks Sector.

Image Source: Zacks Investment Research

Quarterly Estimates

A singular analyst has upped their earnings outlook for the quarter to be reported over the last 60 days, with the Consensus Estimate Trend climbing 7%. Still, the Zacks Consensus EPS Estimate of -$0.39 reflects a steep 50% Y/Y drop in quarterly earnings.

Image Source: Zacks Investment Research

The company’s top-line appears to be undergoing some turbulence as well – the quarterly revenue estimate of $354 million pencils in a 9.4% decrease compared to year-ago quarterly sales of $391 million.

Quarterly Performance & Market Reactions

Nutanix’s quarterly performance has been outstanding – NTNX has exceeded the Zacks Consensus EPS Estimate in 16 consecutive quarters. Just in its latest print, Nutanix penciled in a substantial 77% bottom-line beat.

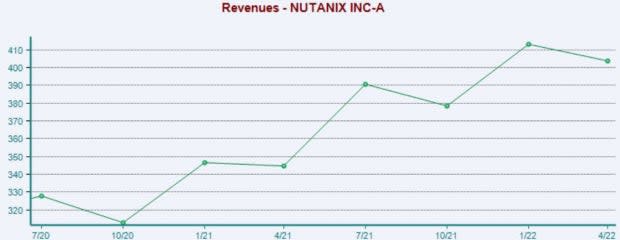

Top-line results have also been stellar; Nutanix has chained together 12 consecutive revenue beats. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

The market hasn’t reacted favorably in response to the company’s quarterly results as of late, with shares moving downwards following back-to-back prints.

Putting Everything Together

Nutanix shares have tumbled year-to-date but have crushed the general market over the last month, signaling that buyers have finally started to arrive.

The company’s forward price-to-sales ratio resides well beneath its five-year median and Zacks Sector average.

A singular analyst has lowered their quarterly earnings outlook, and estimates reflect decreases in revenue and earnings.

Further, the company has been the definition of consistency within its quarterly results, exceeding estimates regularly.

Heading into the release, Nutanix NTNX carries a Zacks Rank #3 (Hold) with an Earnings ESP Score of 4.7%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Nutanix (NTNX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research