NIO Q3 Loss Narrower Than Expected Due to Higher Deliveries

NIO Inc. NIO incurred a loss per American Depositary Share of 37 cents in the third quarter of 2023, narrower than the Zacks Consensus Estimate of a loss of 43 cents. However, the reported loss is wider than the year-ago period's reported loss of 36 cents.

This China-based electric vehicle maker posted revenues of $2,613.3 million, which lagged the Zacks Consensus Estimate of $2,631.1 million but increased roughly 43% year over year due to higher delivery volumes.

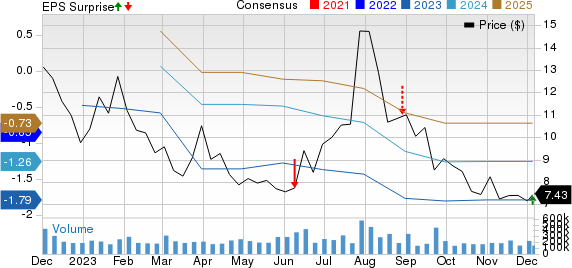

NIO Inc. Price, Consensus and EPS Surprise

NIO Inc. price-consensus-eps-surprise-chart | NIO Inc. Quote

Key Details

NIO delivered 55,432 vehicles in the third quarter, up 75.4% year over year, including 37,585 SUVs and 17,847 sedans.

Revenues generated from vehicle sales amounted to $2,386.1 million, up 42.2% year over year. The increase in sales was mainly attributable to higher delivery volume. Other sales of $227.2 million rose 51.2%. Strong sales of used cars and car accessories and the provision of power solutions contributed to the growth.

Gross profit came in at $208.8 million, down 14.4% year over year. Vehicle margin in the reported quarter fell to 11% from 16.4% in third-quarter 2022 due to changes in product mix. Gross margin was 8%, down from 13.3% in the year-ago quarter.

Research & development and selling, general & administrative costs amounted to $416.5 million and $494.7 million, respectively, indicating a year-over-year increase of 0.6% and 29.7%.

As of Sep 30, 2023, cash and cash equivalents totaled $3,301 million and long-term debt amounted to $1,666 million.

For fourth-quarter 2023, NIO projects deliveries in the range of 47,000-49,000 vehicles, implying a 17.3-22.3% increase year over year. Revenues are estimated to be between $2,204 million and $2,289 million.

Zacks Rank & Key Picks

NIO currently carries a Zacks Rank #3 (Hold).

Some better-ranked players for investors interested in the auto space are Volvo VLVLY, Renault SA RNLSY and BYD Company Limited BYDDY, each sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for VLVLY’s 2023 sales and earnings indicates year-over-year growth of 4.2% and 65.6%, respectively. The EPS estimate for 2023 and 2024 has increased 3 cents and 2 cents, respectively, in the past 30 days.

The Zacks Consensus Estimate for RNLSY’s 2023 sales and earnings indicates year-over-year growth of 4.5% and 128.1%, respectively. The EPS estimate for 2023 and 2024 has increased 15 cents and 2 cents, respectively, in the past 30 days.

The Zacks Consensus Estimate for BYDDY’s 2023 sales indicates year-over-year growth of 160.2%. The EPS estimate for 2023 and 2024 has increased 59 cents and 55 cents, respectively, in the past 60 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AB Volvo (VLVLY) : Free Stock Analysis Report

RENAULT (RNLSY) : Free Stock Analysis Report

NIO Inc. (NIO) : Free Stock Analysis Report

Byd Co., Ltd. (BYDDY) : Free Stock Analysis Report