nCino (NCNO) Q1 Earnings Top Estimates, Revenues Up Y/Y

nCino NCNO reported non-GAAP earnings of 19 cents per share in first-quarter fiscal 2025, surpassing the Zacks Consensus Estimate by 46.15%. The company posted earnings of 7 cents per share in the year-ago quarter.

Net revenues of $128 million beat the consensus mark by 1.18% and increased 13% year over year. The uptick can be attributed to the robust demand for its products and services.

NCNO’s success was further highlighted by the strength across its business, particularly in the U.S. enterprise and community and regional markets, with existing customers expanding their adoption of the nCino platform.

Quarter Details

Subscription (86.2% of total revenues) revenues increased 13% year over year to $110.4 million, beating the Zacks Consensus Estimate by 1.01%.

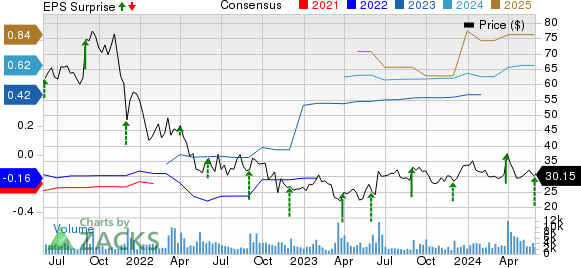

nCino Inc. Price, Consensus and EPS Surprise

nCino Inc. price-consensus-eps-surprise-chart | nCino Inc. Quote

Professional Services & Other revenues (13.8% of total revenues) increased 8.3% year over year to $17.7 million, beating the Zacks Consensus Estimate by 2.31%.

The first-quarter 2025 non-GAAP gross margin expanded 100 basis points (bps) from the year-ago quarter’s tally to 66%.

On a non-GAAP basis, research & development expenses increased 2.8% year over year to $25.8 million.

Sales and marketing expenses declined 9.7% to $21.6 million. General and administrative expenses fell 9.1% to $12.6 million in the reported quarter.

On a non-GAAP basis, operating income was $24.4 million, up from $10.9 million in the year-ago quarter. The non-GAAP operating margin expanded 950 bps from the year-ago quarter to 19%.

Expanding clientele has been a key catalyst. In first-quarter fiscal 2025, nCino partnered with M&T Bank MTB for continuous credit monitoring.

nCino signed an expansion agreement with M&T Bank for continuous credit monitoring, leveraging Rich Data Co's explainable AI platform to provide comprehensive insights into cash flow health, credit risk and lending opportunities.

During the fiscal first quarter, NCNO was also selected by a high-growth specialist lender in the U.K. SME market to leverage NCNO’s nIQ capabilities, automating processes and enhancing data consistency through the consolidation of various systems onto a single platform.

Balance Sheet

As of Apr 30, 2024, cash and cash equivalents and restricted cash were $134.8 million compared with $117.4 million as of Jan 31, 2024.

Cash flow from operations was $54.4 million in the first quarter compared with fourth-quarter fiscal 2024 figure of $57.2 million.

Free cash flow was $54.1 million compared with $7.7 million reported in the previous quarter. The cash flow margin was 42% in the first quarter.

Guidance

For second-quarter fiscal 2025, NCNO expects revenues between $130.5 million and $131.5 million.

Subscription revenues in the quarter are expected to be between $112.5 million and $113.5 million.

Operating income is expected to be $17-$18 million in second-quarter fiscal 2025.

Earnings are expected to be 12-13 cents per share.

Zacks Rank & Other Stocks to Consider

Currently, NCNO flaunts a Zacks Rank #1 (Strong Buy).

The company’s shares have declined 10.4% year to date against the Zacks Computer & Technology sector’s increase of 18.3%.

Micron Technology MU and SecureWorks SCWX are some other top-ranked stocks that investors can consider in the broader sector.

Micron Technology and SecureWorks each carry Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Micron Technology shares have increased 54.2% year to date. MU is set to report third-quarter fiscal 2024 results on Jun 26.

SecureWorks has declined 21.3% year to date. SCWX is scheduled to release first-quarter fiscal 2025 results on Jun 6.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

M&T Bank Corporation (MTB) : Free Stock Analysis Report

Micron Technology, Inc. (MU) : Free Stock Analysis Report

SecureWorks Corp. (SCWX) : Free Stock Analysis Report

nCino Inc. (NCNO) : Free Stock Analysis Report