Najib received US$681m of 1MDB unit’s US$2.72b via Jho Low’s shadow companies in 2013, Bank Negara analyst’s money trail shows

KUALA LUMPUR, Sept 20 — Former prime minister Datuk Seri Najib Razak received US$681 million or RM2.081 billion in his personal AmIslamic bank account in 2013, with a detailed money trail involving banking documents showing that the money originated from a 1Malaysia Development Berhad (1MDB) subsidiary’s US$3 billion bond, the High Court heard today.

Bank Negara Malaysia (BNM) analyst Adam Ariff Mohd Roslan said money belonging to the 1MDB unit had flowed through companies owned by Malaysian fugitive Low Taek Jho’s associate Eric Tan Kim Loong before reaching Najib’s AmIslamic account.

Low is better known as Jho Low, and the prosecution on the first day of trial had described Tan as Low’s “shadow” and Low as Najib’s mirror image and alter ego.

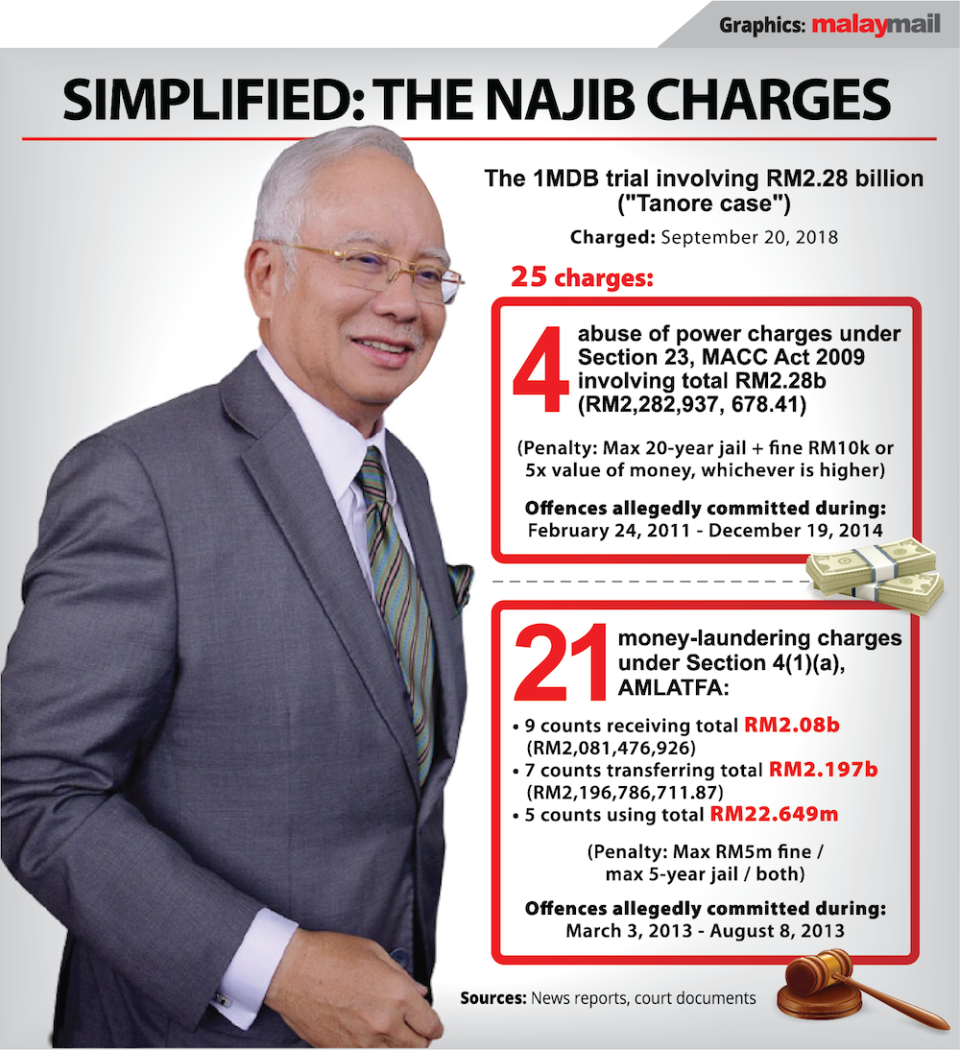

Adam Ariff was testifying as the 47th prosecution witness in Najib’s trial, which involves 1MDB’s RM2.28 billion alleged to have entered the former finance minister’s private bank accounts.

Over the last two days, Adam Ariff laid out the money trail for first and second phase of the 1MDB scheme, saying that the RM60 million and RM90 million which were sent to Najib’s AmIslamic account with the codename “AmPrivate Banking-MR” in 2011 and 2012 respectively could all be traced back to funds belonging to 1MDB and 1MDB’s subsidiary 1MDB Energy (Langat) Limited’s (1MELL).

Previously, Adam Ariff had in his written witness statement said that under the third phase, a total of RM2,081,476,926 (RM2.08 billion) banked into Najib’s “AmPrivate Banking-MR” account in March and April 2013 from Tanore Finance Corp’s Falcon Private Bank account can be traced back to a bond issued by 1GIL in 2013.

Today, Adam Ariff meticulously laid out the money trail for the third phase of the 1MDB scheme, where US$681 million (RM2.081 billion) in 2013 entered the same private bank account for Najib known as “AmPrivate Banking-MR” in a fast-paced multi-layered chain of transactions.

According to Adam Ariff, 1MDB subsidiary 1MDB Global Investments Limited (1GIL) took on debt by issuing a US$3 billion bond in 2013 to fund a purported joint venture between 1MDB and Aabar Investments PJS for the company known as Abu Dhabi Malaysia Investment Company (Admic), with 1GIL on March 19, 2013 then receiving US$2.721 billion (as a result of the US$3 billion bond) in its BSI bank account.

Based on multiple banking documents, Adam Ariff said 1GIL on March 20, 2013 then instructed BSI bank to invest US$1.59 billion in three funds known as Devonshire Capital Growth Fund, Enterprise Emerging Markets Fund (EEMF) and Cistenique Investment Fund.

Adam Ariff linked the funds sent by 1GIL for purported investments in EEMF and Devonshire as eventually passing through Jho Low’s associate Tan’s companies before reaching Najib.

Focusing on Devonshire, Adam Ariff said 1GIL’s US$646.46 million (or to be exact US$640 million plus subscription fees) was sent to Devonshire on March 21, 2013.

Devonshire on March 21, 2013 then sent out all the US$640 million (US$430 million to Granton Property Holding Limited and US$210 million to Tanore Finance Corp).

(Based on bank account opening documents, Adam Ariff said Tan was listed as the authorised signatory and beneficial owner of both bank accounts for Granton and Tanore. Tan had opened those two accounts at Falcon Private Bank, Singapore on November 7, 2012, which is just about only five months before these multi-million-dollar funds flowed in and out.)

Granton on March 21, 2013 sent out the entire US$430 million sum it had received to Tanore.

Adam Ariff said Granton had zero funds in its bank account before it received the US$430 million and passed on the entire US$430 million sum to Tanore, saying that this meant the entire Granton sum was from Devonshire — with its ultimate source being the 1MDB unit 1GIL.

“In effect, Tanore received US$640 million in total from 1GIL via Devonshire,” Adam Ariff said.

On the same day of Tanore receiving the US$640 million from Devonshire, Tanore gave instructions to its bank to transfer US$681 million into Najib’s “AmPrivate Banking-MR” account “as soon as possible”, with US$620 million then immediately transferred the same day, he said.

(Bank records show that Tanore had zero funds in its account when it transferred the U$620 million to Najib, with the transfer later covered when US$640 million came in via Devonshire.)

AmIslamic bank on March 22, 2013 received the US$620 million from Tanore, with AmIslamic bank then transferring nearly the entire sum (US$619,999,988 or over US$619 million) in eight batches to its client Najib’s AmPrivate Banking-MR account from March 22, 2013 to April 10, 2013. The US$620 million sum was converted into RM1,893,474,962.98 or over RM1.89 billion by AmIslamic bank before putting them into Najib’s account.

Before the US$620 million from Tanore came in to Najib’s account, the last balance in the former prime minister’s account was RM879,812,627.27 or over RM879 million, Adam Ariff said.

“Prior to the first credit in March 2013, the balance remaining in the account is RM879,812,627.27,” he said.

Adam Ariff concluded that this entire chain of events — 1MDB unit 1GIL’s receiving of the US$2.72 billion and the transfer of its funds through Devonshire and Granton to Tanore, and Tanore’s sending of US$620 million to Najib’s account — took place within or about the same day in March 2013.

BBank Negara Malaysia analyst Adam Ariff Mohd Roslan is pictured at the Kuala Lumpur High Court Complex on September 20, 2023. ― Picture by Shafwan Zaidon

Separately, from the US$414 million (to be exact US$410 million plus subscription fees) sent by 1GIL to be invested in EEMF on March 21, 2013, EEMF had on March 22 sent US$250 million to Tanore.

As for the US$530 million (to be exact US$525 million plus subscription fees) sent by 1GIL to be invested in Cistenique on March 21, 2013, Cistenique on March 22 sent US$375 million to Tanore. (However, Adam Ariff said 1GIL funds which went to Cistenique were not used by Tanore to transfer money to Najib as the Cistenique funds came in later, and that 1GIL funds instead flowed via EEMF and Granton and Tanore to Najib.)

On March 25, Tanore sent out the remaining US$61 million of the US$681 million to Najib’s “AmPrivate Banking-MR”. The US$61 million came from funds sent by EEMF and Granton to Tanore.

AmIslamic Bank converted nearly US$61 million (US$60,999,988) in the form of RM188,001,963.02 (RM188 million) which it credited to Najib’s AmPrivate Banking-MR account on March 26.

Asked by deputy public prosecutor Kamal Baharin Omar, Adam Ariff concluded that the total amount which Najib’s account received from 1GIL’s 2013 bond is RM2,081,476,926 (US$681 million), stressing that the RM2.08 billion funds originated from the 1MDB subsidiary.

“I do also want to add that the chain of transactions were conducted within one or two days since 1GIL sent out the funds to the investment funds,” he said, noting that the first batch of the money from 1GIL funds entered Najib’s account on March 21, 2013 while the last batch came in on April 10, 2013.

Adam Ariff then continued with his testimony on the money trail for the fourth phase of the 1MDB scheme where over RM49 million of 1MDB funds allegedly entered Najib’s bank account.

Najib’s 1MDB trial before judge Datuk Collin Lawrence Sequerah resumes tomorrow, with Adam Ariff expected to continue testifying on the money trail for the fourth phase.

On the first day of trial, the prosecution had said it would show that 1MDB funds had been transferred in multiple transactions to Najib’s accounts, namely US$20 million equivalent to RM60,629,839.43 or over RM60 million from the first phase, US$30 million equivalent to RM90,899,927.28 or over RM90 million (second phase), US$681 million equivalent to RM2,081,476,926 or over RM2 billion (third phase), and transactions in British pound that were equivalent to RM4,093,500 and RM45,837,485.70 or a combined total of RM49,930,985.70 million or over RM49 million (fourth phase).