Najib’s 1MDB trial: Joanna Yu says Jho Low would name-drop PM, BNM governor, royalty in meetings

KUALA LUMPUR, Dec 13 — Former AmBank banker Joanna Yu today told the High Court that Low Taek Jho — a wanted man in Malaysia over his role in the 1Malaysia Development Berhad (1MDB) financial scandal — had claimed to meet prominent figures such as the prime minister of Malaysia and the governor of Bank Negara Malaysia.

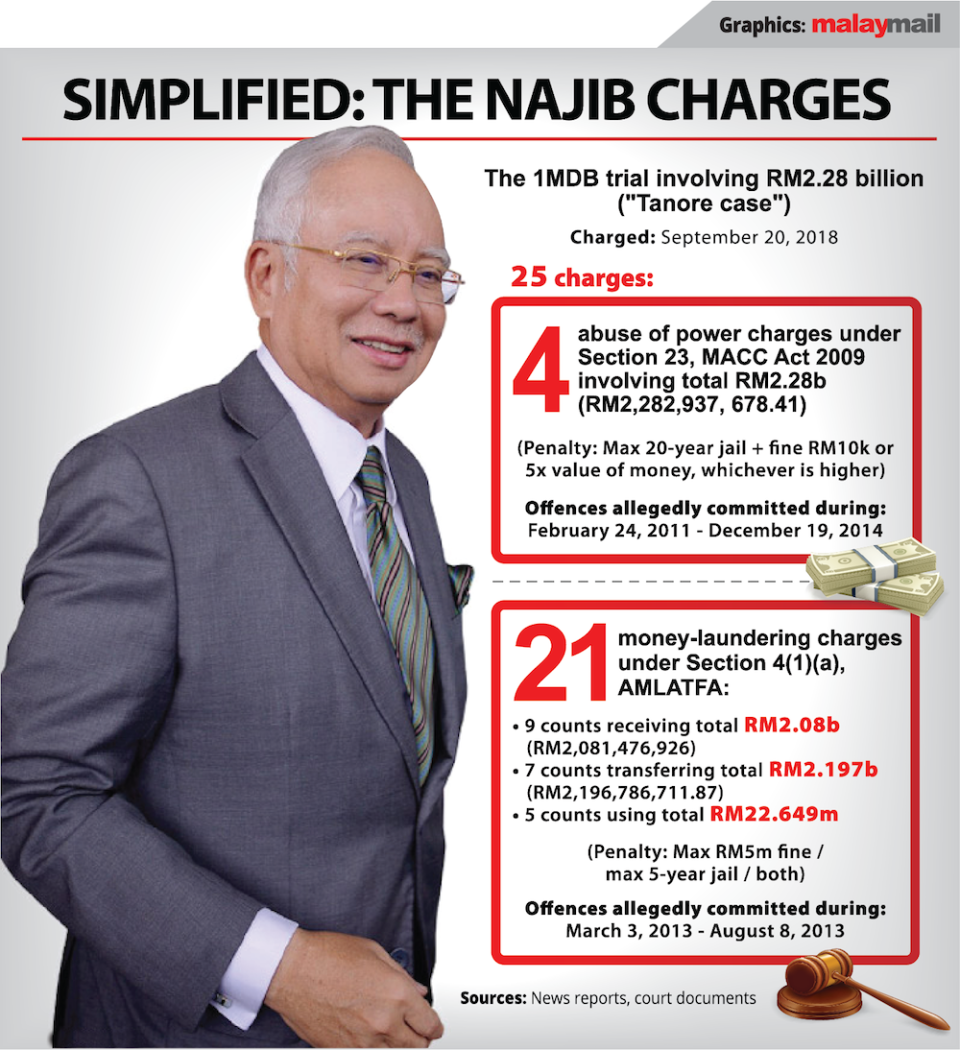

Yu said this while testifying as the 41st prosecution witness in former prime minister Datuk Seri Najib Razak’s trial over the misappropriation of more than RM2.28 billion of 1MDB’s funds which were alleged to have entered Najib’s personal bank accounts.

Under cross-examination by Najib’s lead defence lawyer Tan Sri Muhammad Shafee Abdullah, Yu agreed that Low presented his projects for AmBank’s consideration to give out loans “impressively”.

She also agreed by saying “yes, I guess” when Shafee suggested that Low would tend to dishonestly sell himself or “oversell” himself.

Shafee: But of course, this you will learn subsequently. During the material time, you were quite convinced what he said is true, during the material time you were dealing with him. But now you know the truth, some of the things he overdid, in terms of representation to the bank.

Yu: Yes.

Yu disagreed that Low — better known as Low Taek Jho, had told her he was very close to many leaders of many Middle East countries but said Low tends to name-drop such figures.

“I can’t remember but he would drop names, he was going to meet somebody from Kuwait and here and there, I would just let it pass, it didn’t matter to me,” she said, adding that Low would drop such names during conversations with other individuals present at meetings on banking matters.

“He did also say he met with the governor of Bank Negara, or PM,” she said, confirming that Low had been referring to the prime minister of Malaysia. She did not specify who these individuals were.

“Also mentioned Queen Rania or something, he would mention his meetings or travels,” she said, agreeing that Low had also made references to a prince of Saudi Arabia.

“We were having a meeting on loan but he would mention it to his friends who’s at the meeting, Shahrol or Casey, or even Chan Wan Seong,” she said, referring to her then AmBank superior Chan and 1MDB officials Datuk Shahrol Azral Ibrahim Halmi and Casey Tang.

While not recalling any mention by Low of the late Saudi ruler King Abdullah or a Prince Abdulaziz Al Saud, Yu recalled that Low mentioned a Prince Turki and Tarek Obaid as they were involved in a loan for Majestic Masterpiece Sdn Bhd — which was linked to Low. She also did not recall Low specifically mentioning Abu Dhabi individuals as people he was close with.

Shafee today claimed to have recently discovered that Low had dropped out of the University of Pennsylvania’s business school Wharton School and had never graduated from there, with Yu saying she did not know this and agreeing that she was convinced that Low was a Wharton graduate.

Having known Low since 2007 during the time of the Majestic Masterpiece loan, Yu commented that he was “always late”.

Lawyer Tan Sri Muhammad Shafee Abdullah arrives at Kuala Lumpur High Court December 12, 2022. — Picture by Hari Anggara

While cross-examining Yu regarding matters involving Najib’s personal bank accounts at AmBank, Shafee made several snide remarks to show his dissatisfaction with the answers that she was giving or when she tried to provide explanations.

At one point, he said: “I would rather the steak without the sauce, you seem to give more sauce than steak.”

At another point, he metaphorically claimed that Yu was giving a “duck answer” when he was asking about “chicken”, and asked her to provide an answer according to the “chicken format”.

When foreign currency such as US dollars enter a local bank account such as Najib’s, Yu explained, AmBank would contact the client to obtain their agreement to the prevailing foreign exchange rate for conversion into the ringgit before the funds were actually deposited.

Yu confirmed, however, that in Najib’s letters authorising Nik Faisal Ariff Kamil to handle his personal AmBank accounts for him, it was not stated that he also permitted Nik Faisal to approve the conversion rates for incoming foreign funds.

Yu said she was uncertain what would happen to the foreign funds and if they would be automatically converted even if the client did not confirm the conversion rate, adding that she had never encountered a situation where the client did not agree with the conversion rate.

Asked if Najib had been offered a bank account at AmBank that could receive funds directly in US dollars, Yu said she was unsure if AmBank had such bank accounts at the time, but confirmed that such an account was not offered to Najib.

For the more than RM2 billion that entered Najib’s personal accounts in the form of foreign currency, Yu said AmBank officials including her would call Nik Faisal to get a confirmation rate, and then call Low if they could not get hold of Nik Faisal.

Yu said she was unsure whether Nik Faisal referred to Najib on the conversion rate, but Shafee remarked that Nik Faisal was not even authorised in the mandate letters to handle the conversion rate.

Yu denied the mandate letters had specifically excluded mention of authorising Nik Faisal to handle the conversion rate, explaining that it was a format prepared by the bank branch that was typically not used to having funds come in the form of foreign currency as incoming funds to current accounts was usually in ringgit Malaysia.

Yu said she assumed that questions posed by the bank to Nik Faisal would flow to Najib, and went on to say that cheques issued out from Najib’s AmBank accounts would for example have to be confirmed by Nik Faisal if the bank were to query.

“Nik was appointed to manage the account, when cheques are issued by the account holder, to ask to confirm, Nik Faisal would have to confirm with account holder whether it was his cheques, so —” she said, and was cut off by Shafee.

Shafee interjected with a remark: “Those are asking about cheques, I’m asking chicken, you give me a duck answer, you must give me chicken format.”

Ultimately, Yu confirmed she did not directly contact Najib regarding the incoming foreign funds, but said she was uncertain if anyone else in the bank did contact Najib.

Shafee asked why Yu was “easy” or at ease about these incoming foreign funds in Najib’s accounts, with Yu then pointing out: “Um, this was funds coming into Datuk Seri’s account and it’s not to go out, issuance of cheques.”

Shafee insisted Yu should have contacted Najib to enable the latter to deal with the conversion rate and to spark the idea that he should have a US dollar account to avoid losing out in the conversion, and Yu said she never contacted Najib and had no access to him.

Shafee suggested that a call could have been made to the Prime Minister’s Office and for a message to be left to say the prime minister must contact Yu to prevent the transaction from being stuck and insisted that this was the reasonable thing to do.

But Yu said she was unsure if anyone from the prime minister’s office would have contacted her, with Shafee then said this was because she had never tried to do so. Yu agreed she did not contact Najib.

Najib’s 1MDB trial before High Court judge Datuk Collin Lawrence Sequerah resumes tomorrow.