Molson Coors (TAP) Rises as Q3 Earnings & Sales Beat Estimates

Molson Coors Beverage Company TAP has reported third-quarter 2020 results, wherein earnings and sales beat estimates. Moreover, adjusted earnings improved year over year, while sales declined. The company did not provide any financial view for 2020 and beyond due to the uncertainties regarding the pandemic. However, it provided an update on its Revitalization Plan.

Molson Coors’ underlying adjusted earnings of $1.62 per share was up 9.5% year over year and beat the Zacks Consensus Estimate of $1.04. Despite a year-over-year sales decline and lower financial volume, the company’s earnings benefited from favorable net pricing in the United States and Canada, cost savings, and lower marketing, general and administrative (MG&A) expenses.

Underlying EBITDA rose 1.4% to $712.5 million year over year. Further, underlying EBITDA improved 0.5% year over year in constant currency.

Net sales declined 3.1% to $2,753.5 million but surpassed the Zacks Consensus Estimate of $2,686 million. The year-over-year decline was mainly caused by an unfavorable channel mix across all major markets and a decline in financial volume due to on-premise restrictions from the pandemic. This was partly offset by higher net pricing in the United States and Canada as well as a positive brand and package mix in the United States. On a constant-currency basis, net sales fell 3.6%. Notably, net sales per hectoliter increased 2.1% on a brand volume basis.

Molson Coors Beverage Company Price, Consensus and EPS Surprise

Molson Coors Beverage Company price-consensus-eps-surprise-chart | Molson Coors Beverage Company Quote

However, Molson Coors’ worldwide brand volume declined 5.2% to 23.4 million hectoliters and financial volume declined 5% to 23.8 million hectoliters. The declines in the worldwide brand and financial volumes were mainly attributed to the impacts of the pandemic-led on-premise restrictions and North America packaging material constraints, while shipment timing in North America remained favorable. These impacts were visible in both economy and premium segments.

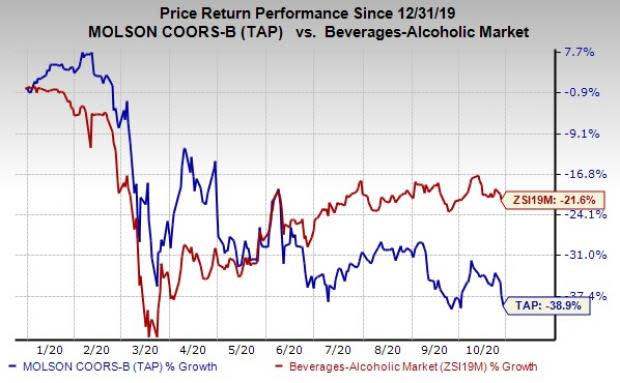

Shares of Molson Coors rose 3.3% in the pre-market trading session. The Zacks Rank #3 (Hold) company’s shares have lost 38.9% year to date compared with the industry’s decline of 21.6%.

Segmental Details

Molson Coors operates through the following geographical segments.

North America: Its North America net sales dipped 1% to $2,252.3 million on a reported basis and 0.8% in constant currency, driven by a decline in financial and brand volume, offset by improved year over year shipment timing in the United States. Notably, the shipment recovery in the United States in the third quarter has led to a reduction in the under-shipment position year to date due to aluminum can supply constraints. North America brand volume declined 5.2%, while financial volume fell 4%. The declines were attributed to restrictions in on-premise outlet operations as well as packaging concerns that led to declines in both economy and premium segments.

In the United States, brand volumes fell 5.3%, while domestic shipment was down 3.9%. In Canada and Latin America, brand volume declined 4.2% and 4.61%, respectively, in the quarter. The company expects domestic shipments in the United States to exceed brand volume trends in the fourth quarter, driven by efforts to build distributor inventories for the rest of the year.

Meanwhile, net sales per hectoliter, on a brand volume basis, rose 3.6% on favorable brand and package mix in the United States as well as higher net pricing in the United States and Canada, offset by negative brand and channel mix in Canada due to the shift of volume from on-premise to off-premise. Underlying EBITDA increased 2.3% on a reported basis to $581.5 million and 2.5% on a constant-currency basis.

Europe: The segment’s net sales on a reported basis declined 12.2% to $504.1 million and 15.3% in constant currency. The net sales decline was attributed to lower volume and drop in net sales per hectoliter due to the closure of on-premise channel amid the pandemic. Net sales per hectoliter (brand volume basis) for the segment were down 5.9%, resulting from an unfavorable channel, brand and geographic mix.

The adverse geographic mix mainly related to its high-margin U.K. business that has greater exposure to the on-premise channel, which re-opened in the third quarter but with restrictions. The segment’s financial volume fell 7.7% and brand volumes were down 5.4%. The segment reported underlying EBITDA of $120.4 million, reflecting a decline of 5.1% on a reported basis and 8% in constant currency.

Other Financial Updates

Molson Coors ended the third quarter with cash and cash equivalents of $731.3 million, and total debt of $8,371.6 million. This resulted in net debt of $7,640.3 million at the end of the quarter. Notably, the company lowered net debt by $874.0 million since Dec 31, 2019.

It had cash flow from operating activities of $1,493.2 million for the nine months ended Sep 30, 2020, with an underlying free cash flow of $1,160.3 million.

Revitalization Plan Update

Molson Coors is on track with its revitalization plan aimed at streamlining the organization and reinvesting resources into its brands and capabilities. The company is building on the strength of its iconic core brands. It aims to move beyond these segment share gains to stabilize its biggest brands in the total beer category. Notably, Coors Light and Miller Lite have increased 6% and 9.5%, respectively, in the U.S. off-premise year to date. The combined U.S. segment share for Coors Light and Miller Lite has now grown for 24 consecutive quarters six straight years, per Nielsen. In Europe, the national champion brands witnessed significant volume trend improvement compared with the second quarter, owing to the phased reopening of on-premise with restrictions.

Additionally, it has been aggressively growing its above premium portfolio. Blue Moon LightSky has become the top-selling new beer in the United States in 2020, per Nielsen. The company announced the creation of a new joint venture with Yuengling to bring its iconic beers westward in the United States for the first time. To further grow its portfolio, it acquired Atwater Brewing, launched Coors Seltzer at the end of August and entered an exclusive agreement with The Coca-Cola Company KO to manufacture, market and distribute Topo Chico Hard Seltzer in the United States.

It is also on track to expand beyond the beer aisle through Truss — its Canadian cannabis joint venture, which has become a market leader in the ready-to-drink cannabis market, with an estimated share of over 50% in key markets like Quebec. Also, the company recently launched a new line of non-alcoholic beverages in partnership with LA Libations LLC.

Apart from this, Molson Coors is investing in capabilities to expand the production capacity of hard seltzer by more than 400% and Blue Moon LightSky by nearly 400% to support continued growth. The hard seltzer capacity expansion is expected to be completed by the end of 2020. It also commissioned a sleek can production line, with a capacity to produce 750 million cans per year. During the pandemic, it improved online sales in the United States by 200% through the three-tier structure. Moreover, it is now creating new e-commerce and direct-to-consumer channels for its Canada business.

Better-Ranked Beverage Stocks

The Boston Beer Company, Inc. SAM delivered an earnings surprise of 23.1%, on average, in the trailing four quarters. It sports a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Brown-Forman Corporation BF.B currently has a Zacks Rank #2 (Buy). It delivered an earnings beat of 8.2%, on average, in the trailing four quarters.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by referendums and legislation, this industry is expected to blast from an already robust $17.7 billion in 2019 to a staggering $73.6 billion by 2027. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot stocks we're targeting >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Molson Coors Beverage Company (TAP) : Free Stock Analysis Report

BrownForman Corporation (BF.B) : Free Stock Analysis Report

CocaCola Company The (KO) : Free Stock Analysis Report

The Boston Beer Company, Inc. (SAM) : Free Stock Analysis Report

To read this article on Zacks.com click here.