Microsoft (MSFT) to Buy ZeniMax in All-Cash Deal Worth $7.5B

Microsoft MSFT recently announced its plan to acquire leading video game publisher Bethesda Softworks’ parent company ZeniMax Media for an all-cash deal valued at $7.5 billion.

The acquisition, subject to customary and regulatory approval, is projected to conclude in the company’s second half of fiscal 2021.

Bethesda Softworks is the owner of the popular video titles like The Elder Scrolls, DOOM, Quake, Wolfenstein, and Fallout. Post the buyout, the company’s leadership and structure will remain intact, stated Microsoft.

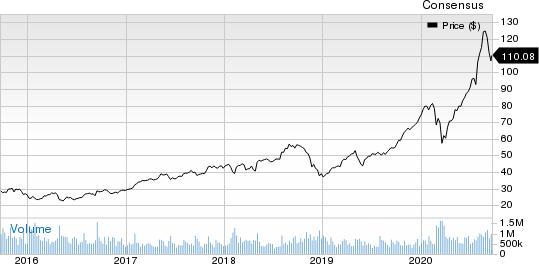

Microsoft Corporation Price and Consensus

Microsoft Corporation price-consensus-chart | Microsoft Corporation Quote

Notably, all ZeniMax’s creative studios like Bethesda Softworks, Bethesda Game Studios, ZeniMax Online Studios and Roundhouse Studios along with all their video game franchises will belong to Microsoft. This brings the number of in-house development studios to 23 from 15 for Microsoft.

The latest buyout is expected to significantly boost the subscriber base for Xbox Game Pass service as Microsoft will be adding Bethesda’s popular AAA titles to its Game Pass roster. At present, the video game subscription service boasts of 15 million users.

Moreover, Microsoft is likely to make the upcoming Bethesda game titles available on Xbox the same day these are released. By expanding the roster of games available on Xbox with Bethesda addition, Microsoft is also looking to boost the number of takers for Xbox console over its arch-rival PlayStation.

We believe the ZeniMax deal will help Microsoft to fortify its foothold in the video game market against Sony Corp SNE and Nintendo NTDOY.

Growth in Video Games Market Augurs Well

Of late, Microsoft is making tremendous efforts to boost its position in the video games market, which is witnessing significant traction.

The rapid uptake of cloud gaming has emerged as a solid driver for the gaming market. Rapid 5G deployment, and proliferation of innovative technologies like AR/VR will also boost the cloud gaming market.

The cloud gaming market is expected to reach $7.24 billion by 2027, from $0.32 billion in 2019 at a CAGR of 47.9%, according to Grand View Research report.

Also, rising interest in esports amid shelter-in-place guidelines is expected to lead to higher gaming spend.

Mordor Intelligence report cites that the gaming market is expected to reach $257 billion by the end of 2025 at a CAGR of 9.2% between 2020 and 2025.

Moreover, the growth in the video game market is being driven by COVID-19 induced stay at home trends, rapid uptake of mobile gaming as well as the launch of newer Xbox and PlayStation console devices. Per Fior Markets Data, the connected gaming console market is envisioned to hit $32.99 billion by 2027 from $13.81 billion in 2019 at a CAGR of 11.5%.

Further, mobile gaming will be the fastest growing segment owing to low barrier of entry, per a Newzoo report. The research firm also adds that mobile gaming will witness 2.6 billion users while PC and console will have 1.3 billion and 729 million gamers, respectively, in 2020.

Microsoft’s Noteworthy Video Gaming Endeavours

Microsoft has been strengthening its video game initiatives to capture a larger share of this lucrative market. Recently, the company launched its cloud gaming service for Xbox users across 22 markets in North America and Europe, simultaneously, bundled with the company’s Xbox Game Pass Ultimate subscription.

As part of Xbox Game Pass Ultimate subscription, gamers will be able to access over 100 game titles including the likes of Minecraft Dungeons, Halo, Sea of Thieves, Gears 5, Destiny 2, and Tell Me Why.

Prior to that, Microsoft introduced its smallest Xbox ever — Xbox Series S — at a price of $299 to lure more customers, especially casual gamers who do not like to spend so much money on consoles.

The company is also gearing up for the launch of the highly awaited next-generation Xbox Series X gaming console. Both the consoles are slated to hit retail shelves on Nov 10.

Also, the company is constantly integrating its Azure cloud’s capabilities into its gaming segment. This will facilitate it to improve gaming strategies and develop better content.

We believe that these developments to boost player engagement and provide immersive experience, will enhance revenues from gaming segment in the days ahead.

Zacks Rank and Key Pick

Microsoft currently carries a Zacks Rank #3 (Hold).

A better-ranked stock worth considering in the broader sector is Zoom Video Communications ZM, which flaunts a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Long-term earnings growth rate for Zoom Video is currently pegged at 25%.

These Stocks Are Poised to Soar Past the Pandemic

The COVID-19 outbreak has shifted consumer behavior dramatically, and a handful of high-tech companies have stepped up to keep America running. Right now, investors in these companies have a shot at serious profits. For example, Zoom jumped 108.5% in less than 4 months while most other stocks were sinking.

Our research shows that 5 cutting-edge stocks could skyrocket from the exponential increase in demand for “stay at home” technologies. This could be one of the biggest buying opportunities of this decade, especially for those who get in early.

See the 5 high-tech stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Sony Corporation (SNE) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Nintendo Co. (NTDOY) : Free Stock Analysis Report

Zoom Video Communications, Inc. (ZM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research