Meta Platforms Q2 Preview: Can Shares Stop Their Bleeding?

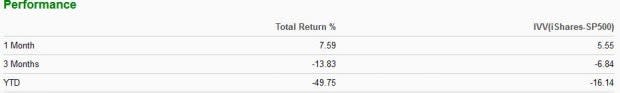

The Zacks Internet – Software Industry has tumbled year-to-date, losing nearly 50% in value. However, over the last month, the industry has a 7.8% return, slightly better than the S&P 500’s 5.5%, signaling buyers are returning.

Image Source: Zacks Investment Research

One titan in the industry, Meta Platforms META, is slated to release quarterly results on July 27th after the market closes. Meta Platforms is the world’s largest social media platform, evolving its portfolio from its Facebook app to others like Instagram and WhatsApp.

With META being an investor favorite, the quarterly report will be watched like a hawk. It’ll give investors a more precise image of what has been transpiring behind the scenes amidst a brutal macroeconomic backdrop.

Let’s see how the social media giant shapes up heading into its quarterly report.

Share Performance & Valuation

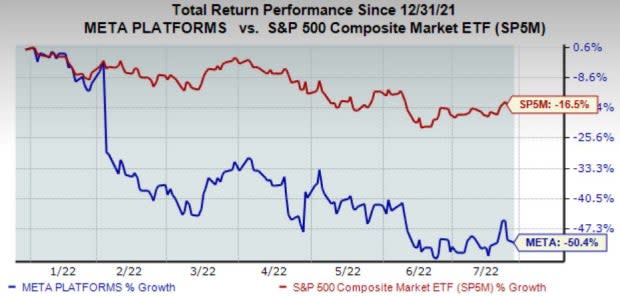

2022 has been anything but enjoyable for Meta Platforms, with its shares losing more than half of their value and extensively underperforming the S&P 500.

Image Source: Zacks Investment Research

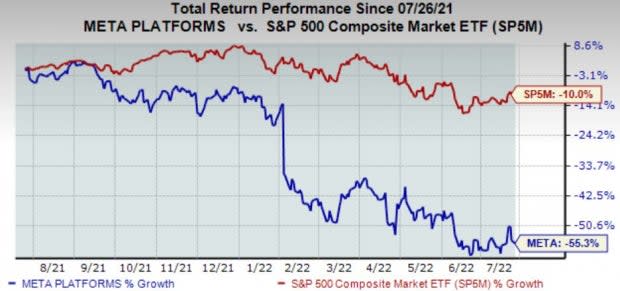

Upon widening the timeframe to encompass the last year of share performance, we can see that META shares have been stuck in a deep downtrend for some time now, with shares breaking off following the company’s worse-than-expected earnings report in February.

Image Source: Zacks Investment Research

However, the company does boast attractive valuation metrics, further displayed by its Style Score of a B for Value. META’s forward earnings multiple has come down to 15.1X, nowhere near its five-year median of 24.1X and a fraction of highs of 37.1X in 2020.

In addition, the value represents a 15% discount relative to the S&P 500.

Image Source: Zacks Investment Research

Quarterly Estimates

Analysts have lowered their outlook for the upcoming quarterly release, with three downwards estimate revisions hitting the tape over the last 60 days. In addition, the $2.51 Zacks Consensus EPS Estimate for the quarter reflects a concerning 30% decrease in quarterly earnings year-over-year.

Image Source: Zacks Investment Research

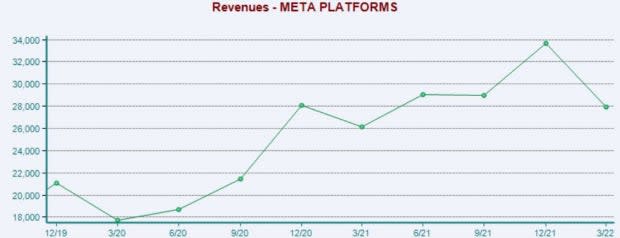

The company’s top-line looks to remain flat; the $28.8 billion quarterly revenue estimate pencils in a marginal 0.9% decrease in revenue year-over-year. The chart below illustrates the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

Quarterly Performance & Market Reactions

Meta Platforms has found bottom-line success as of late, exceeding the Zacks Consensus EPS Estimate in five of its previous six quarters. Additionally, the company recorded a solid 7% bottom-line beat in its latest report.

Top-line results have primarily been reported above expectations as well; Meta Platforms has recorded four top-line beats over its previous six earnings reports.

Expect META shares to be highly volatile following the quarterly report; in its latest report, shares surged 14% but tanked 25% following its quarterly report in February.

Bottom Line

It’s been a fall from glory in 2022 for Meta Platforms, with shares losing more than half of their value. It’s one of the deeper valuation slashes we’ve seen, and it reflects the challenging environment that the company has faced.

Earnings are forecasted to decline notably, and revenue is projected to remain stagnant. However, the company does sport much more reasonable valuation metrics following the sell-off.

In addition, the company is a Zacks Rank #4 (Sell), and shares are highly volatile following quarterly releases. Heading into the quarterly release, META carries an Earnings ESP Score of -4.3%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Meta Platforms, Inc. (META) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research