Merit Medical (MMSI) Inks Deal to Boost Endoscopy Portfolio

Merit Medical Systems, Inc. MMSI recently executed an asset purchase agreement with EndoGastric Solutions, Inc. Per the terms, EndoGastric Solutions’ EsophyX Z+ device will become part of Merit Medical’s endoscopy portfolio.

EsophyX Z+ is a device that delivers a durable, minimally-invasive non-pharmacological treatment option for patients suffering from chronic gastroesophageal reflux disease (GERD).

The latest acquisition is expected to significantly expand Merit Medical’s endoscopy portfolio with a minimally invasive solution for patients suffering from chronic GERD and solidify its foothold in the niche space.

Rationale Behind the Acquisition

GERD is a digestive disorder that occurs when the lower esophageal sphincter does not tighten correctly, allowing acid from the stomach to enter the esophagus. When this occurs chronically, it can result in serious health conditions, such as esophageal damage and cancer. The EsophyX Z+ device is expected to treat GERD by restoring the body’s reflux barrier.

Per management, the buyout is consistent with Merit Medical’s Continued Growth Initiatives program. Management also believes that the deal will likely enhance the company’s product portfolio in existing clinical specialties while expanding its global footprint in the multi-billion-dollar gastrointestinal market.

Financial Implications

The acquired assets are expected to contribute to Merit Medical’s revenues, from the closing date through Dec 31, 2024, in the range of $13million-$15 million and are expected to dilute its previously forecasted non-GAAP operating margin, non-GAAP net income and non-GAAP earnings per share (EPS). The asset purchase is also expected to be dilutive to Merit Medical’s 2024 GAAP net income and GAAP EPS.

The acquisition is expected to be accretive to non-GAAP gross margin, non-GAAP operating margin, non-GAAP net income and non-GAAP EPS in the first full year post-close but dilutive to MMSI’s GAAP net income and EPS for that period.

Guidance Updated

Merit Medical has updated its full-year 2024 financial guidance, which now reflects the forecasted impacts of the acquisition of EndoGastric Solutions from the closing date through Dec 31, 2024.

The company is reaffirming prior full-year 2024 financial guidance ranges for the stand-alone business, which was previously announced on Apr 30, 2024.

However, after considering the projected contribution of the assets acquired from EndoGastric Solutions, Merit Medical now expects its net sales for 2024 in the range of $1.324 billion-$1.340 billion (up 5-7% from the comparable 2023 period). This is up from the prior outlook of $1.312 billion-$1.325 billion (up 4-5% from the comparable 2023 period). The Zacks Consensus Estimate currently stands at $1.32 billion.

Revenues from the Endoscopy segment are now expected to lie between $53.3 million and $55.7 million (up 45-51% from the comparable 2023 period), upped from the previous outlook of $39.7 million-$40.1 million (up 8-9% from the comparable 2023 period).

Adjusted EPS is now projected to be within $3.22-$3.31 (up 7-10% from 2023), lowered from the earlier outlook of $3.28-$3.35 (up 9-11% from 2023). The Zacks Consensus Estimate is pegged at $3.33.

Industry Prospects

Per a report by Grand View Research, the global GERD therapeutics market was estimated at $5.18 billion in 2022 and is anticipated to expand at a CAGR of approximately 1.8% between 2023 and 2030. Factors like the low success rates associated with GERD management devices and a rise in the prevalence of GERD and other gastrointestinal disorders are likely to drive the market.

Given the market potential, the latest acquisition is expected to provide a significant boost to Merit Medical’s business in the niche space.

Notable Development

In April, Merit Medical reported its first-quarter 2024 results, wherein its Endoscopy segment witnessed a solid revenue uptick both on a reported basis and at constant currency.

Price Performance

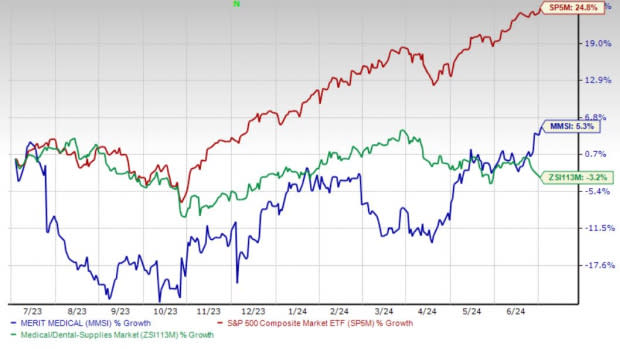

Merit Medical stock has gained 5.3% against the 3.2% decline of the industry. The S&P 500 has witnessed 24.9% growth in the said time frame.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Currently, Merit Medical carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space are DaVita Inc. DVA, Stryker Corporation SYK and Ecolab Inc. ECL.

DaVita, carrying a Zacks Rank #2 (Buy) at present, has an estimated long-term growth rate of 13.6%. DVA’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 29.4%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

DaVita’s shares have gained 37.6% compared with the industry’s 10.9% rise in the past year.

Stryker, carrying a Zacks Rank of 2 at present, has an estimated long-term growth rate of 10.6%. SYK’s earnings surpassed estimates in each of the trailing four quarters, with the average being 4.9%.

Stryker has gained 12.2% against the industry’s 3.2% decline in the past year.

Ecolab, carrying a Zacks Rank of 2 at present, has an estimated long-term growth rate of 14.3%. ECL’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 1.3%.

Ecolab’s shares have rallied 26.3% against the industry’s 16% decline in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ecolab Inc. (ECL) : Free Stock Analysis Report

Stryker Corporation (SYK) : Free Stock Analysis Report

DaVita Inc. (DVA) : Free Stock Analysis Report

Merit Medical Systems, Inc. (MMSI) : Free Stock Analysis Report