Mastercard (MA) Boosts Payment Options for EV Drivers in Europe

Mastercard Incorporated MA collaborated with the municipal utility cooperation of Germany, Thuga, and the electric vehicle (EV) charging billing specialist, SMART/LAB, to devise an easy-to-use solution for enabling card payments across EV charging stations. Its shares gained 1% on Sep 28.

The SMART/LAB solution equips charging station operators to seamlessly integrate a hybrid payment terminal, which makes use of open-loop technology, within their prevailing charging station infrastructure or to new ones. The specifically built payment gateway in a plug-and-play process makes the integration and setup processes of the payment terminal hassle-free.

Subsequently, EV charging station operators can accept common contactless payment and authorization methods while being compliant with the new European Alternative Fuels Infrastructure Regulation requirements. Additionally, they can also accept closed payment systems, comprising the municipal utilities’ charging cards or other electric mobility providers.

The fast-charging stations, which can be accessed by the public and operate with a capacity of 50 kW or more, are required to offer a minimum of one contactless payment method (either in the form of debit or credit cards) from Jul 1 of next year. EV drivers can leverage NFC technology and make safe as well as seamless contactless payments from Mastercard-branded debit or credit cards, which may fetch higher revenues to the tech giant from its payment network.

Cashless payments with digital wallets like Apple Pay and Google Pay or with charging and fleet cards of well-known providers will also be accepted at the eligible EV charging stations.

The recent partnership is indicative of Mastercard’s sincere efforts to offer increased convenience, flexibility and secured payment options to EV drivers across Europe. Also, it bears testament to the tech giant’s longstanding endeavor to promote the widespread adoption of digital payments. The presence of a worldwide trusted company like MA, whose digital offerings are backed with effective fraud prevention services, may attract a wider customer base in using the newly launched solution.

And SMART/LAB seems to be the apt partner to complement MA’s endeavor as it boasts a leading background system, which will take charge of the authorization and billing of charging processes across Germany.

Additionally, the recent tie-up seems to be a well-timed move on the part of Mastercard, considering a booming EV market. Technology advancements, increased environmental awareness and encouraging government policies have led to higher adoption of EVs. According to MarketsandMarkets, the industry is anticipated to witness a CAGR of 13.7% over the 2023-2030 period.

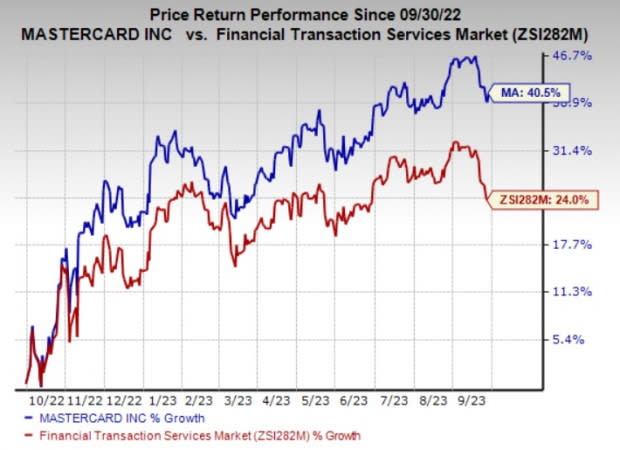

Shares of Mastercard have gained 40.5% in the past year compared with the industry’s 24% growth. MA currently carries a Zacks Rank #3 (Hold).

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks in the Business Services space are Huron Consulting Group Inc. HURN, FirstCash Holdings, Inc. FCFS and APi Group Corporation APG. Huron Consulting sports a Zacks Rank #1 (Strong Buy), and FirstCash and APi Group carry a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The bottom line of Huron Consulting outpaced estimates in each of the last four quarters, the average surprise being 21.75%. The Zacks Consensus Estimate for HURN’s 2023 earnings suggests an improvement of 31.8% from the year-ago reported figure. The consensus estimate for revenues suggests growth of 17% from the year-ago reported number. The consensus mark for HURN’s 2023 earnings has moved 2% north in the past 60 days.

FirstCash’s earnings outpaced estimates in each of the trailing four quarters, the average surprise being 7.31%. The Zacks Consensus Estimate for FCFS’s 2023 earnings suggests an improvement of 6.7% from the year-ago reported figure. The consensus estimate for revenues suggests growth of 15.5% from the year-ago reported number. The consensus mark for FCFS’s 2023 earnings has moved 0.4% north in the past 30 days.

The bottom line of APi Group outpaced estimates in three of the last four quarters and met the mark once, the average surprise being 4.27%. The Zacks Consensus Estimate for APG’s 2023 earnings suggests an improvement of 13.5% from the year-ago reported figure. The consensus estimate for revenues suggests growth of 7.9% from the year-ago actual. The consensus mark for APG’s 2023 earnings has moved 0.7% north in the past 60 days.

Shares of Huron Consulting, FirstCash and APi Group have gained 57.1%, 38.4% and 97.2%, respectively, in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Mastercard Incorporated (MA) : Free Stock Analysis Report

FirstCash Holdings, Inc. (FCFS) : Free Stock Analysis Report

Huron Consulting Group Inc. (HURN) : Free Stock Analysis Report

APi Group Corporation (APG) : Free Stock Analysis Report