MarketAxess (MKTX) Hits High Notes in Q2 Trading Volume Surge

MarketAxess Holdings Inc. MKTX announced impressive growth in its trading volumes for the second quarter of 2024. The stock gained 3.7% yesterday, showcasing positive investor sentiment. The total credit average daily trading volume (ADV) reached nearly $13.7 billion, marking a year-over-year increase of over 12%. This growth was driven by notable gains across various segments, including a 13% rise in U.S. high-grade ADV, a 23% boost in emerging markets ADV, and 8% growth in Eurobonds ADV. Total ADV rose 23% to $34.2 billion in the June quarter.

One of the standout performers was the Eurobonds segment, with ADV jumping 16% year over year in June alone. However, U.S. high-yield trading activity declined on the platform due to decreased credit spread volatility levels. It dropped 9% year over year in the second quarter, yet a lower degree than the first-quarter’s decline. Its estimated market share fell 300 basis points year over year. Nevertheless, U.S. high-yield new issuance jumped 43.9% from the year-ago period to $77.9 billion.

The company also experienced significant growth in ADV from Latin America, Europe, the Middle East, Africa, and the Asia-Pacific region, underscoring its expanding international footprint. Its order and execution workflow solution, AxessIQ, reached $135 million ADV, increasing 22.5% year over year. Client engagement with X-Pro was also robust, with 56% of portfolio trading volume executed on the trading interface in the second quarter.

Due to the product mix shift, its second quarter FPM for total credit was around $148, down 5.7% from the year-ago period. However, total portfolio trading volume surged 142.8% year over year in the second quarter to $55 billion. Higher trading volumes and continued solid Eurobonds’ performance will likely buoy MKTX’s second-quarter results.

Final Takeaway

Looking ahead, these positive trends are likely to have supported MarketAxess' second-quarter financial results. The Zacks Consensus Estimate for MarketAxess’ second-quarter earnings is pegged at $1.76 per share, which indicates 8% year-over-year growth. The revenue consensus stands at $201.9 million, suggesting a 12.2% year-over-year increase. Notably, the company has surpassed earnings estimates in three of the past four quarters and missed once, with an average surprise of 3%.

MarketAxess is demonstrating robust growth across key trading segments, particularly in Eurobonds and emerging markets. Despite some challenges in the U.S. high yield, the overall trading volume and international expansion signal strong future prospects, making it a valuable stock to hold in your portfolio. MarketAxess currently has a Zacks Rank #3 (Hold).

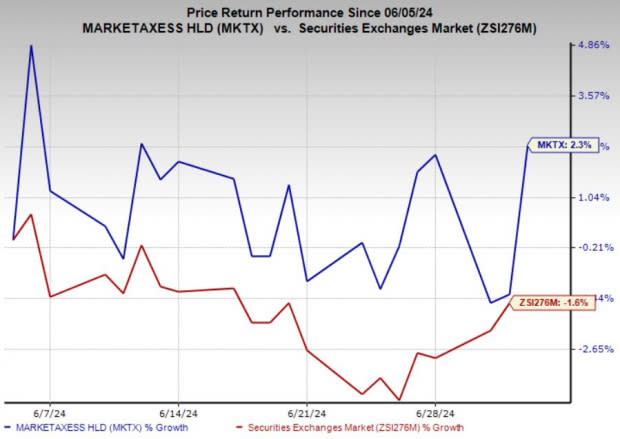

Price Performance

MarketAxess shares have gained 2.3% in the past month against the 1.6% decline of the industry it belongs to.

Image Source: Zacks Investment Research

Key Picks

Some better-ranked stocks in the broader Finance space are Coinbase Global, Inc. COIN, WisdomTree, Inc. WT and HIVE Digital Technologies Ltd. HIVE. While Coinbase Global sports a Zacks Rank #1 (Strong Buy) at present, WisdomTree and HIVE Digital carry a Zacks Rank #2 (Buy) each. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Coinbase’s current-year earnings is pegged at $7.18 per share, up from 37 cents a year ago. COIN beat earnings estimates in each of the past four quarters, with an average surprise of 364.6%. The consensus mark for its current-year revenues is pegged at nearly $6 billion, a 92.2% jump from a year ago.

The Zacks Consensus Estimate for WisdomTree’s 2024 earnings indicates 51.4% year-over-year growth. During the past two months, WT has witnessed one upward estimate revision against none in the opposite direction. It met earnings estimates thrice in the past four quarters and beat once, with an average surprise of 2.3%.

The Zacks Consensus Estimate for HIVE Digital’s current-year earnings suggests a 29.1% year-over-year improvement. During the past 30 days, HIVE has witnessed one upward estimate revision against none in the opposite direction. The consensus mark for current year revenues suggests a 36.2% jump from a year ago.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

MarketAxess Holdings Inc. (MKTX) : Free Stock Analysis Report

HIVE Digital Technologies Ltd. (HIVE) : Free Stock Analysis Report

Coinbase Global, Inc. (COIN) : Free Stock Analysis Report

WisdomTree, Inc. (WT) : Free Stock Analysis Report