Macy's (M) to Report Q1 Earnings: What Awaits the Stock?

Macy’s, Inc. M is likely to witness top-line growth when it reports first-quarter fiscal 2021 numbers on May 18, before the opening bell. The Zacks Consensus Estimate for revenues is pegged at $4,405 million, which suggests an increase of 46% from the prior-year quarter’s reported figure.

Speaking of the bottom line, the company is likely to report a loss during the quarter in review. The Zacks Consensus Estimate for loss is pegged at 43 cents per share. In the year-ago quarter, the company reported a loss of $2.03. We note that Macy's bottom line surpassed the Zacks Consensus Estimate by 321% in the last reported quarter. Also, this well-known fashion retailer has a trailing four-quarter earnings surprise of 116.6%, on average.

Key Factors to Note

Macy’s first-quarter performance is likely to have gained from efforts undertaken as part of the Polaris Strategy. The strategy includes strengthening customer relationships, expansion of assortments and optimizing store portfolio among others. Such measures along with focus on price optimization, inventory management, merchandise planning and boosting private label offerings are likely to have driven performance during the quarter in review.

Moreover, the company has been undertaking prudent measures to boost online sales. It has been striving to bolster omni-channel capabilities, such as curbside pickup and same-day delivery as well as enhancing mobile and website features to deliver superior shopping experience. Additionally, the company has also been undertaking measures to boost customer engagement through the expansion of its loyalty programs. Such upsides are likely to have aided the company’s top line during the first quarter.

However, the impact of any business disruptions, caused by the pandemic, cannot be ruled out. Also, elevated operating expenses such as higher delivery costs are a worry.

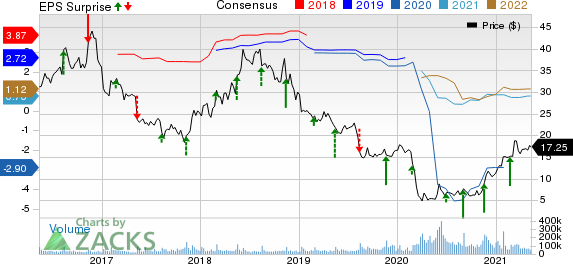

Macys, Inc. Price, Consensus and EPS Surprise

Macys, Inc. price-consensus-eps-surprise-chart | Macys, Inc. Quote

What the Zacks Model Unveils

Our proven model predicts an earnings beat for Macy’s this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Macy’s currently carries a Zacks Rank #2 and an Earnings ESP of +28.6%.

Other Stocks Poised to Beat Estimates

Here are some other companies you may want to consider, as our model shows that these also have the right combination of elements to post an earnings beat.

Abercrombie & Fitch Company ANF currently has an Earnings ESP of +22.92% and a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Best Buy Co., Inc. BBY currently has an Earnings ESP of +16.28% and carries a Zacks Rank #3.

Burlington Stores, Inc. BURL currently has an Earnings ESP of +36.98% and a Zacks Rank #3.

Zacks Top 10 Stocks for 2021

In addition to the stocks discussed above, would you like to know about our 10 best buy-and-hold tickers for the entirety of 2021?

Last year's 2020 Zacks Top 10 Stocks portfolio returned gains as high as +386.8%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys.

Access Zacks Top 10 Stocks for 2021 today >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Best Buy Co., Inc. (BBY) : Free Stock Analysis Report

Abercrombie & Fitch Company (ANF) : Free Stock Analysis Report

Macys, Inc. (M) : Free Stock Analysis Report

Burlington Stores, Inc. (BURL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research