MACC investigator: Najib did not tell Cabinet about MOF Inc-owned 1MDB units’ issuance of US$3.5b bonds; RM90m entered his account

KUALA LUMPUR, Jan 8 — Then prime minister and finance minister Datuk Seri Najib Razak did not highlight to the Cabinet two 1Malaysia Development Berhad (1MDB) subsidiaries’ taking on of debts via the issuance of bonds totalling US$3.5 billion in 2012, an investigator with the Malaysian Anti-Corruption Commission (MACC) told the High Court today.

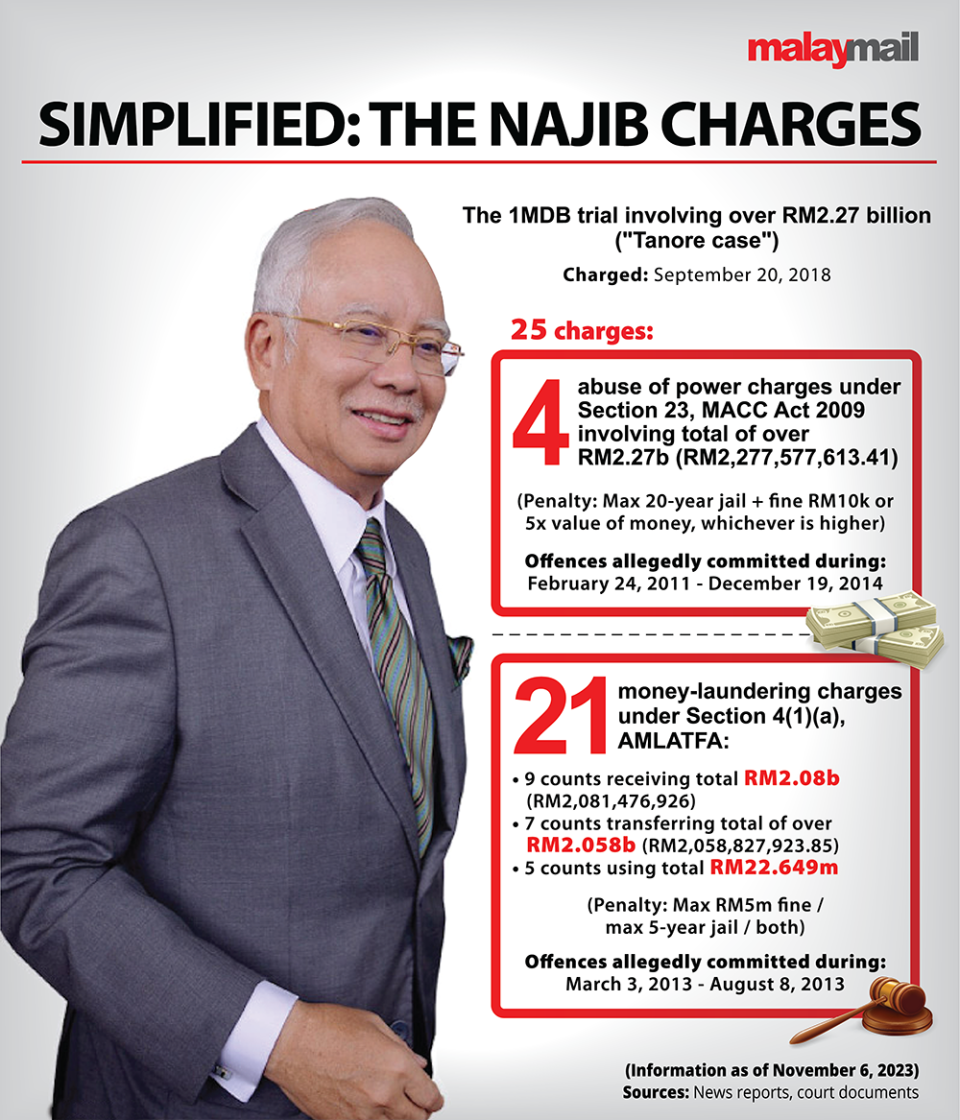

MACC investigating officer Senior Superintendent Nur Aida Arifin said this while testifying as the 49th prosecution witness in Najib’s trial over the misappropriation of more than RM2.2 billion of 1MDB funds.

Sharing the outcome of her investigations on alleged power of abuse offences by Najib in relation to 1MDB, Nur Aida highlighted that the two 1MDB subsidiaries’ issuance of US$1.75 billion bonds — to buy over two independent power producers — were not raised to Cabinet despite the potential effect on Malaysia’s finances.

“Datuk Seri Najib as finance minister did not bring to the Cabinet’s attention the US$3.5 billion bond issuance, when the borrowing obligations by an MoF-Inc company will give implications to the country’s finances.

“The Finance Ministry does not have knowledge about the issuance of the two bonds at US$1.75 billion each for the acquisition of Tanjong Energy Holdings Sdn Bhd and Genting Sanyen,” she told the High Court.

1MDB is owned by the Finance Ministry via the Minister of Finance (MoF) Incorporated, while the two companies which had each issued a US$1.75 billion bond were 1MDB Energy Limited (1MEL) and 1MDB Energy (Langat) Limited (1MELL).

Nur Aida today also testified that her investigations had shown that Najib had carried out official conduct by approving 1MDB Energy Sdn Bhd’s bidding for Tanjong Energy’s acquisition with a bidding price of RM10.6 billion, and through his approval for 1MDB to acquire Mastika Lagenda Sdn Bhd — which controls Genting Sanyen Kuala Langat Power Station’s owner Genting Sanyen Power Sdn Bhd — at RM2.75 billion.

Nur Aida also said that two shareholder resolutions already signed by Najib as finance minister had been attached to directors’ circular resolutions (DCR) — which all members of the 1MDB board of directors would have to sign — and this showed that the “ultimate decision had been made and that the board of directors only had to follow any such mandate in line with the top down approach in 1MDB”.

“This can be seen clearly in the acquisition of Genting Sanyen which was done very swiftly, and all decisions were obtained through DCR without being brought to and discussed in detail in 1MDB board of directors’ meeting, despite involving a decision for an investment with a very high value,” she said regarding her investigation findings.

Deputy public prosecutor Ahmad Akram Gharib informed the High Court that all these portions of Nur Aida’s court testimony are based on the statements of other prosecution witnesses in Najib’s 1MDB trial.

Najib’s lead defence lawyer Tan Sri Muhammad Shafee Abdullah reiterated his earlier objection to the allegation of a “top-down” approach in 1MDB, challenging this part of Nur Aida’s court testimony.

Najib’s lawyer Tania Scivetti also objected to Nur Aida’s testimony, claiming that Najib was never shown these resolutions to ask if he had signed these documents during investigations: “So this is just a one-sided statement by the investigating officer without testing against the defence.”

Akram however said several prosecution witnesses — namely, former 1MDB CEO Datuk Shahrol Azral Ibrahim Halmi, former 1MDB CEO Mohd Hazem Abd Rahman and former 1MDB director Tan Sri Ismee Ismail — had confirmed that this was the “order of the day” or how things were done, where the signed shareholder’s resolutions would come with the DCR which directors just need to sign.

MACC investigating officer Senior Superintendent Nur Aida Arifin today also testified that her investigations had shown that Datuk Seri Najib Razak had carried out official conduct by approving 1MDB Energy Sdn Bhd’s bidding for Tanjong Energy’s acquisition with a bidding price of RM10.6 billion, and through his approval for 1MDB to acquire Mastika Lagenda Sdn Bhd at RM2.75 billion. — Picture by Firdaus Latif

Shafee claimed that he had cross-examined these prosecution witnesses and that they were uncertain if the 1MDB shareholder resolutions had been signed earlier than the 1MDB board of directors’ resolutions.

“Yang Arif will remember I did say the board has got to be either stupid or insane that they allow the shareholders to dictate to the board,” he said.

But Akram said the prosecution witnesses had — during the prosecution’s re-examination — reaffirmed that the two shareholder resolutions were already signed by Najib and were attached to the DCR which they had to sign, stating that this is a “fact”.

After hearing both sides, trial judge Datuk Collin Lawrence Sequerah then said he will take note of the objections made by Najib’s legal team to Nur Aida’s testimony regarding the alleged top-down approach and when Najib had signed the shareholder resolutions.

Earlier today, Nur Aida had said that then finance minister Najib’s pre-signing of approvals on behalf of 1MDB’s shareholder MoF Inc to approve — 1MELL’s acquisition of Genting Sanyen’s holding company Mastika Lagenda at RM2.75 billion and 1MELL’s borrowing of up to RM1 billion from banks and issuance of US$1.75 billion — was the reason why the 1MDB board of directors signed off on a directors’ circular resolution which also approved the same matters.

Nur Aida had at that point said her investigations showed that 1MDB was being managed using a “top-down approach” where its management would allegedly carry out big and important projects only after allegedly receiving Najib’s blessings.

Asked to clarify her basis for making the assertion of the alleged top-down approach in 1MDB’s management, Nur Aida had said this was based on the statements of witnesses such as Shahrol Azral, Hazem, Ismee, former 1MDB chairman Tan Sri Mohd Bakke Salleh in their witness statements in this case, which is the examination-in-chief stage.

Shafee had at that point raised his objection as he claimed Nur Aida’s remarks and forming of a conclusion do not take into account the admission by the same witnesses during cross-examination, accusing her of “cherry picking”.

The judge then said he understood and had taken note of Shafee’s objection over the alleged inaccurate account of events by Nur Aida, saying that the matter is not closed yet and should be addressed at a later stage of the trial in submissions.

How RM90 million ended up in Najib’s account

The two 1MDB units’ bonds of US$1.75 billion each (or with the two bonds totalling US$3.5 billion) are part of the second phase of the 1MDB scheme which the prosecution is seeking to establish in this trial.

Among other things, Nur Aida said a fake British Virgin Islands company known as Aabar Investment PJS Limited (which was strikingly similar in name to the actual Abu Dhabi company Aabar Investment PJS) had ended up receiving US$576.9 million from 1MEL’s US$1.75 billion bond in May 2012 and also US$790.3 million from 1MELL’s US$1.75 billion bond in October 2012.

Nur Aida today testified that these 1MDB bonds’ money which went to the fake Aabar were then further sent to other entities, before some of the proceeds were sent to now-fugitive Low Taek Jho’s associate Tan Kim Loong’s company Blackstone Asia Real Estate Partners Limited, and with some of these funds then making it to Najib’s private AmIslamic bank account.

“In the end, Blackstone distributed those funds through two transactions to Najib’s AmPrivate Banking account,” she said, referring to two transactions of US$5 million in October 2012 and US$25 million in November 2012 which totalled US$30 million (or more than RM90 million).

“As a whole, between October 30, 2012 and November 20, 2012, there was influx of money amounting to RM90,899,927.28 from Blackstone Asia Real Estate Partners’ Standard Chartered Bank, Singapore account into Datuk Seri Najib’s AmPrivate Banking-MR account number 211-202-200969-4, where the inflow of that money is sourced from the US$1.75 billion bond issued by 1MDB Energy (Langat) Limited),” she had earlier said.

Najib’s 1MDB trial is scheduled to resume January 24, with Nur Aida expected to continue testifying.

For more on the two bonds of US$1.75 billion bond each and how 1MDB lost billions of ringgit to a fake entity, click here to read a quick recap.