Liberty (LBRT) Up 22% Following Narrower-Than-Expected Q1 Loss

The stock of Denver-CO-based Liberty Oilfield Services Inc. LBRT has gained more than 22% since its first-quarter earnings announcement on Apr 27. The company’s better-than-expected top and bottom-line performance and investor optimism, backed by a dividend initiation, the successful integration of its newly-bought OneStim business and a positive outlook, prompted the rally.

What Did Liberty Oilfield’s Earnings Unveil?

Liberty Oilfield Services reported first-quarter 2021 net loss per share (excluding special items) of 21 cents, narrower than the Zacks Consensus Estimate of a loss of 26 cents. The outperformance reflects strong execution and contribution from the onshore hydraulic fracturing business in the United States and Canada that the company acquired from Schlumberger SLB in January.

However, the bottom line compared unfavorably with the year-ago quarter’s adjusted profit of 2 cents due to tepid activity levels and weather-related disruptions.

Total revenues came in at $552 million, ahead of the Zacks Consensus Estimate of $488 million. Moreover, the top line rose 16.9% from the year-ago level of $472.3 million.

The first-quarter adjusted EBITDA fell 45.1% to $31.7 million. Meanwhile, Liberty’s fleet count most likely stayed around the low 30s throughout the quarter.

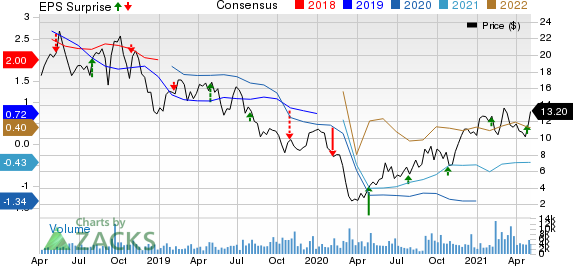

Liberty Oilfield Services Inc. Price, Consensus and EPS Surprise

Liberty Oilfield Services Inc. price-consensus-eps-surprise-chart | Liberty Oilfield Services Inc. Quote

Balance Sheet & Capital Expenditure

As of Mar 31, Liberty had approximately $69.5 million in cash and cash equivalents. The pressure pumper’s long-term debt of $105.3 million represented a debt-to-capitalization of 8%. Further, the company’s liquidity — cash balance, plus revolving credit facility — amounted to $258 million.

In the reported quarter, the company spent $41.9 million on its capital program.

Guidance

The firm reiterated its 2021 capital expenditure in the band of $145-$175 million (including $60 million for investment in technology) and believes that it will be cash flow positive. Liberty management sees “a pathway to normalized margins at some point in 2022,” driven by successful vaccine rollouts, accommodative policies worldwide and strong pent-up demand. Per the company, the way forward to normal margins would include improved efficiency and pricing gains. Liberty expects its second-quarter deployed fleet count to stay essentially flat sequentially.

Zacks Rank & Stock Picks

Liberty currently carries a Zacks Rank #3 (Hold).

Some better-ranked players in the energy space are Exxon Mobil Corporation XOM and Suncor Energy SU. Both companies sport a Zacks Rank #1 (Strong Buy).

You can see the complete list of today’s Zacks #1 Rank stocks here.

ExxonMobil has an expected earnings growth rate of 1,139.39% for the current year.

Suncor Energy has an expected earnings growth rate of 223.64% for the current year.

Zacks Top 10 Stocks for 2021

In addition to the stocks discussed above, would you like to know about our 10 best buy-and-hold tickers for the entirety of 2021?

Last year's 2020 Zacks Top 10 Stocks portfolio returned gains as high as +386.8%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys.

Access Zacks Top 10 Stocks for 2021 today >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Exxon Mobil Corporation (XOM) : Free Stock Analysis Report

Schlumberger Limited (SLB) : Free Stock Analysis Report

Suncor Energy Inc. (SU) : Free Stock Analysis Report

Liberty Oilfield Services Inc. (LBRT) : Free Stock Analysis Report

To read this article on Zacks.com click here.