Lessons From Nature: The Industry Group Phenomenon

Picture a flock of birds flying perfectly in sync, coordinating their movements as if the collective group were being governed by some invisible hand. Lessons from the natural world can help us understand human behavior. Like animals in nature, stocks tend to move in groups. The company a stock keeps can help us determine which industry groups are leading the market. The majority of past stock market winners were in top industry groups before they went on major runs.

How can we identify which industries are leading the market? Fortunately for investors, our Zacks Industry Rank makes the process simple. Zacks classifies all stocks into one of approximately 250 industry groups based on the Zacks Rank of the individual stocks. The average Zacks Rank is calculated for every industry group each trading day.

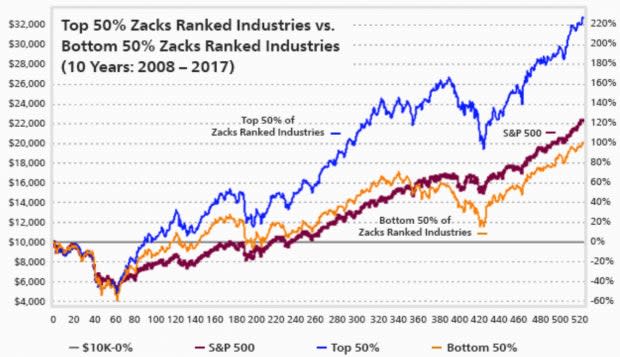

We put the Zacks Industry Rank to the test and compared how the top half (industries with the best average Zacks Rank) and the bottom half (industries with the worst average Zacks Rank) fared against the S&P 500. This study was conducted over a ten-year period, and the results speak for themselves.

Image Source: Zacks Investment Research

Over this timeframe, using a one-week rebalance, the top half beat the bottom half by a factor of more than 2 to 1. Clearly, investing in stocks contained within the top industry groups can give investors a leg up on the market.

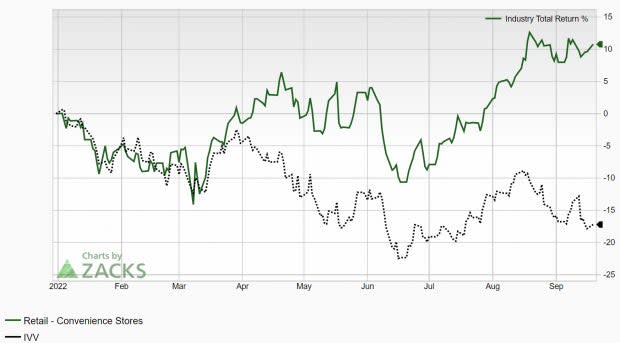

Let’s take a look at a current example. The Zacks Retail – Convenience Stores industry group is ranked in the top 2% of all Zacks Ranked Industries. This means that more stocks within this industry are experiencing positive earnings estimate revisions, which is at the heart of the Zacks Rank and is the most powerful force impacting stock prices. Below we can see the outperformance of this industry group (green line, +10.78%) versus the iShares Core S&P 500 ETF (black dotted line, -17.21%) year-to-date.

Image Source: Zacks Investment Research

Quantitative research studies have shown that approximately half of a stock’s future price appreciation is due to its industry grouping. By investing in stocks within the best groups, we can provide a constant tailwind to our investing success. Below we will analyze a leading individual stock within this top group.

TravelCenters of America (TA)

TravelCenters of America operates travel centers, truck service facilities, and restaurants in the United States and Canada. TA centers offer various products and services such as diesel fuel and gasoline, truck repair and maintenance, general merchandise, and grocery items. The company’s restaurants operate under the Iron Skillet, Country Pride, IHOP, Black Bear Diner, Fuddruckers, Bob Evans, Subway, Burger King, Pizza Hut, Taco Bell, Popeye’s Chicken, Dunkin’ and Starbuck’s Coffee brands. TravelCenters of America was founded in 1972 and is based in Westlake, Ohio.

A Zacks Rank #1 (Strong Buy) stock, TA has strung together a noteworthy history of earnings surprises, surpassing estimates in each of the past four quarters. The company most recently reported Q2 EPS in August of $4.34/share, a +291% surprise over the $1.11 consensus estimate. TA has delivered a staggering +1,738.6% average earnings surprise over the past four quarters, aiding the stock’s 39% return in the past year.

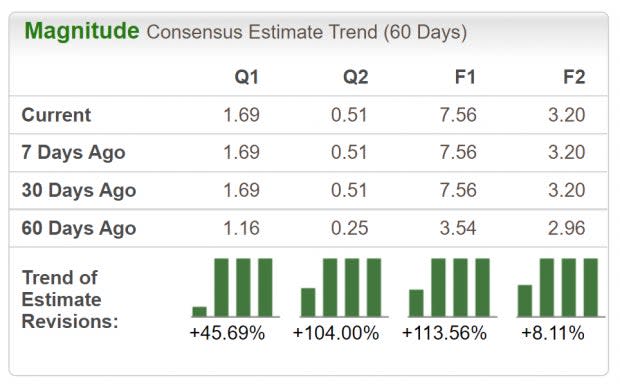

Image Source: Zacks Investment Research

Full-year earnings estimates have been revised upward by +113.56% over the past 60 days. The 2022 Zacks Consensus EPS Estimate is now $7.56/share, reflecting potential growth of 83.94% relative to last year.

Image Source: Zacks Investment Research

Make sure to put TA on your watchlist and keep an eye on the Retail – Convenience Stores industry.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

TravelCenters of America LLC (TA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research