Lamb Weston (LW) Q4 Earnings & Sales Top Estimates, Rise Y/Y

Lamb Weston Holdings, Inc. LW posted strong fourth-quarter fiscal 2022 results, wherein the top and bottom lines increased year over year and cruised past the respective Zacks Consensus Estimate. Results gained from the robust price/mix undertaken to counter the prevalent input, manufacturing and transportation cost inflation.

On Jul 5, the company bought an additional 40% stake in Lamb Weston Alimentos Modernos S.A. ("LWAMSA") — which is its joint venture in Argentina — taking its total ownership to 90%. Following the buyout, Lamb Weston will consolidate LWAMSA’s results as part of its consolidated financial statements.

Lamb Weston Price, Consensus and EPS Surprise

Lamb Weston price-consensus-eps-surprise-chart | Lamb Weston Quote

Quarter in Detail

LW’s bottom line came in at 65 cents per share, which surpassed the Zacks Consensus Estimate of 51 cents. Earnings surged 48% year over year. The upside was led by higher income from operations.

Net sales amounted to $1,153.1 million, up 14% year over year. The price/mix increased 15%, mainly reflecting gains from pricing actions in the company’s business segments undertaken to counter input, manufacturing and transportation cost inflation. Volumes fell 1% due to the reduced export volume. Lamb Weston’s North America volumes increased due to increased shipments to large-chain restaurant customers, partly offset by reduced shipments to retail and foodservice networks stemming from supply-chain headwinds. The top line surpassed the Zacks Consensus Estimate of $1,068 million.

Gross profit came in at $254.2 million, up $56.2 million, driven by the favorable price/mix. Escalated manufacturing and distribution costs on a per-pound basis along with reduced sales volumes were a concern for the metric. Increased costs per pound reflected double-digit cost inflation from key inputs, mainly including raw materials like edible oils and ingredients, as well as escalated transportation, packaging and labor costs. Higher costs per pound were also a result of labor and commodities shortages on production run rates. Such cost increases were somewhat offset by supply-chain productivity savings.

SG&A expenses escalated by $19.1 million to $118.2 million due to elevated compensation expenses and contribution to the Lamb Weston charitable foundation. Lower advertising and promotion expenses (A&P) and reduced consulting expenses offered some respite.

Adjusted EBITDA (including unconsolidated joint ventures) rose 21% to $201.8 million.

Image Source: Zacks Investment Research

Segment Analysis

Sales in the Global segment increased 10% to $558.4 million. Volumes remained flat, and the price/mix increased 10%. The price/mix benefited from the favorable mix and domestic and international product and freight pricing actions to counter inflation. Higher sales volumes to North America’s large QSR and casual dining restaurant chain customers were countered by reduced export shipments. The product contribution margin in the segment declined 1% to $55.7 million.

Foodservice sales soared 21% to $388.4 million. Volumes decreased 3%, and the price/mix jumped 24%. The price/mix benefited from product and freight pricing actions to counter inflation. Volumes benefited from the continued rebound in demand at full-service restaurants and in non-commercial channels like lodging and hospitality, healthcare, schools and universities, sports and entertainment and workplace environments. However, this was countered by reduced shipments owing to supply-chain headwinds, including labor restrictions. The product contribution margin increased 47% to reach $141.8 million.

In the Retail segment, sales went up 20% to $175.9 million. The price/mix advanced 22%, but volumes declined 2%. The price/mix benefited from product and freight pricing actions across the branded and private label portfolios and a favorable mix. The lower shipments of private label products hurt the sales volume. The product contribution margin surged 96% to $41.6 million.

Other Financial Details

Lamb Weston ended the quarter with cash and cash equivalents of $525 million, long-term debt and financing obligations (excluding the current portion) of $2,695.8 million and total shareholders’ equity of $360.5 million. The company generated $418.1 million as net cash from operating activities for the 52 weeks ended May 29, 2022. Capital expenditures (including IT expenditure) amounted to $306.4 million during this time. For fiscal 2023, the company expects cash used for capital expenditures in the band of $475-$525 million.

During fiscal 2022, management paid out dividends worth $138.4 million and bought back shares worth $150.7 million, thereby returning $289.1 million to its shareholders.

Guidance

For fiscal 2023, management expects net sales growth in the band of $4.7-$4.8 billion. Net sales growth is likely to be backed by pricing actions to counter the significant input and transportation cost inflation and improved volume and mix.

Lamb Weston expects SG&A expenses in the band of $475-$500 million, indicating greater investments to upgrade information systems and enterprise resource planning infrastructure, together with escalated compensation and benefit costs. Adjusted EBITDA (including unconsolidated joint ventures) is likely to come in the range of $840-$910 million. Net income is anticipated in the range of $360-$410 million. Diluted earnings per share (EPS) are envisioned in the band of $2.45-$2.85.

Management expects interest expenses of approximately $115 million in fiscal 2023 and an effective tax rate of nearly 24%. Further, it anticipates depreciation and amortization expenses of roughly $210 million.

Management expects the gross margin to remain under pressure in the first half of fiscal 2023 due to considerable inflation for key production inputs, transportation and packaging and rising raw potato costs on a per-pound basis. The gross margin is also likely to bear the adverse impacts of supply-chain hurdles, resulting in operational bottlenecks like labor and commodities shortages. That said, the gross margin is expected to improve and reach normalized annual levels of 25-26% in the second half of the fiscal.

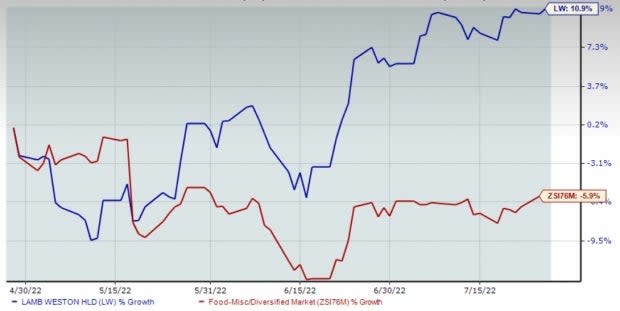

Shares of this Zacks Rank #1 (Strong Buy) company have rallied 10.9% in the past three months compared to the industry’s decline of 5.9%.

Other Solid Consumer Staple Stocks

Some other top-ranked stocks are The Chef's Warehouse CHEF, Sysco Corporation SYY and Campbell Soup CPB.

The Chef's Warehouse, which engages in the distribution of specialty food products, sports a Zacks Rank #1. The Chef's Warehouse has a trailing four-quarter earnings surprise of 372.3%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for CHEF’s current financial-year EPS suggests significant growth from the year-ago reported number.

Sysco, which engages in the marketing and distribution of various food and related products, sports a Zacks Rank #1. Sysco has a trailing four-quarter earnings surprise of 9.1%, on average.

The Zacks Consensus Estimate for SYY’s current financial-year sales suggests growth of 13.2% from the year-ago reported number.

Campbell Soup, which manufactures and markets food and beverage products, currently carries a Zacks Rank #2 (Buy). Campbell Soup has a trailing four-quarter earnings surprise of 10.8%, on average.

The Zacks Consensus Estimate for CPB’s current financial-year sales suggests growth of 0.5% from the year-ago reported figure.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Campbell Soup Company (CPB) : Free Stock Analysis Report

Sysco Corporation (SYY) : Free Stock Analysis Report

The Chefs' Warehouse, Inc. (CHEF) : Free Stock Analysis Report

Lamb Weston (LW) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research