Lamb Weston (LW) Gears Up for Q4 Earnings: What's in Store?

Lamb Weston Holdings, Inc. LW is likely to register top- and bottom-line growth when it reports fourth-quarter fiscal 2023 earnings on Jul 25. The Zacks Consensus Estimate for revenues is pegged at $1.65 billion, suggesting an increase of 43.5% from the prior-year quarter’s reported figure. The consensus mark for fiscal 2023 net sales is pegged at $5.31 billion, suggesting an increase of 29.6% from the year-ago period’s reported figure.

The Zacks Consensus Estimate for the fiscal fourth-quarter bottom line has moved up by a penny in the past 30 days to $1.06 per share. The projection indicates growth of 63.1% from the year-ago quarter’s reported figure. The consensus mark for fiscal 2023 earnings per share (EPS) is pegged at $4.52, suggesting an improvement from earnings of $2.08 posted in the year-ago period.

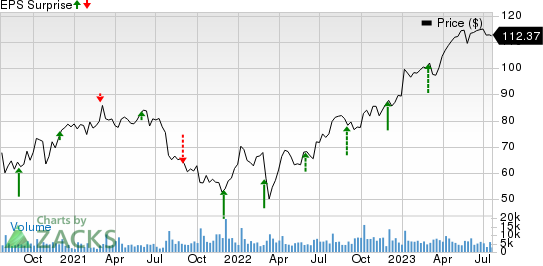

Lamb Weston has a trailing four-quarter earnings surprise of 47.6%, on average. This frozen potato product company delivered an earnings surprise of 45.9% in the last reported quarter.

Lamb Weston Price and EPS Surprise

Lamb Weston price-eps-surprise | Lamb Weston Quote

Things To Consider

Lamb Weston has been benefiting from efforts to boost capacity to meet rising demand conditions for snacks and fries. The company’s top line is gaining on robust pricing efforts undertaken across core business units to counter input, manufacturing and transportation cost inflation. We expect year-over-year price/mix increase of 32.2% in the to-be-reported quarter.

For fiscal 2023, management expects net sales growth in the range of $5.25-$5.35 billion, which includes the consolidation of the European joint venture. Adjusted EBITDA (including unconsolidated joint ventures) is likely to be in the range of $1,180-$1,210 million in fiscal 2023. Excluding the consolidation of LW EMEA, management expects a gross margin of 28-28.5%. Adjusted EPS is envisioned in the range of $4.35-$4.50 during this time.

Notably, our model suggests gross margin of 27.4% in fiscal 2023.

What the Zacks Model Unveils

Our proven model doesn’t conclusively predict an earnings beat for Lamb Weston this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Lamb Weston carries a Zacks Rank #2 and has an Earnings ESP of -2.65%.

Stocks With the Favorable Combination

Here are three companies worth considering, as our model shows that these have the right combination of elements to beat earnings this time.

Celsius Holdings, Inc. CELH currently has an Earnings ESP of +10.04% and a Zacks Rank #2. The company’s top and the bottom line are expected to increase year over year when it reports second-quarter 2023 results. The Zacks Consensus Estimate for Celsius Holdings’ quarterly revenues is pegged at $278.9 million, calling for growth of 81.1% from the figure reported in the prior-year quarter. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for the quarterly EPS is pegged at 31 cents, indicating an improvement from 12 cents reported in the year-ago quarter. CELH has a trailing four-quarter negative earnings surprise of 99.1%, on average.

Coty COTY currently has an Earnings ESP of +28.6% and a Zacks Rank #2. The company’s top and the bottom line are expected to increase year over year when it reports fourth-quarter fiscal 2023 results. The Zacks Consensus Estimate for Coty’s quarterly revenues is pegged at $1.3 billion, suggesting a rise of 13.2% from the figure reported in the prior-year quarter.

The Zacks Consensus Estimate for the quarterly EPS is pegged at 2 cents, which indicates 300% growth from the year-ago period figure. COTY has a trailing four-quarter earnings surprise of 145%, on average.

Beyond Meat BYND currently has an Earnings ESP of +14.6% and a Zacks Rank of 2. BYND is expected to register a top-line decline when it reports second-quarter 2023 numbers.

The Zacks Consensus Estimate for Beyond Meat’s quarterly revenues is pegged at nearly $111.3 million, calling for a decline of 24.3% from the prior-year quarter’s reported figure. The Zacks Consensus Estimate for the bottom line is pegged at a loss of 81 cents, which suggests a rise of 47.1% from the figure reported in the year-ago fiscal quarter. BYND has a trailing four-quarter negative earnings surprise of 14.1%, on average.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Coty (COTY) : Free Stock Analysis Report

Lamb Weston (LW) : Free Stock Analysis Report

Celsius Holdings Inc. (CELH) : Free Stock Analysis Report

Beyond Meat, Inc. (BYND) : Free Stock Analysis Report