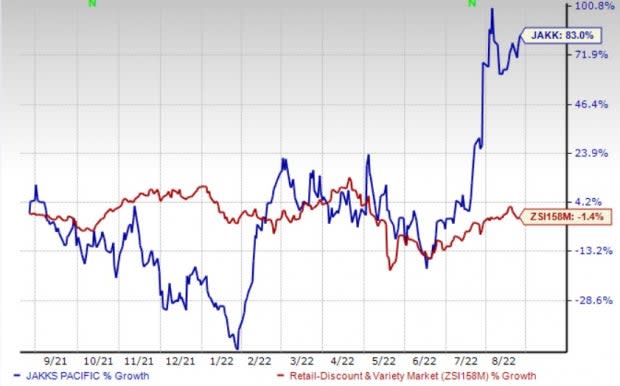

JAKKS Pacific (JAKK) Stock Up 83% in a Year: More Room to Run?

Shares of JAKKS Pacific, Inc. JAKK have performed exceptionally well in the past year. In the same time frame, shares of the company have soared 83% against the industry’s decline of 1.4%. The company has been benefiting from strategic acquisitions, solid international footprint, focus on innovation, and collaborations with popular brands and movie franchisees.

Moreover, the consensus mark for 2022 earnings has witnessed upward estimate revisions, which reflects analysts’ optimism regarding the company’s growth potential. Over the past 30 days, the Zacks Consensus Estimate for its 2022 earnings has moved up by 74.6% to $4.87 per share.

Growth Drivers

This Zacks Rank #1 (Strong Buy) company has emerged as a diversified consumer products company buoyed by a string of acquisitions over the past several years. We consider the company’s ability to successfully identify, close and integrate acquisitions to be one of its primary competitive advantages.

Image Source: Zacks Investment Research

The core, basic products and popular entertainment licenses with proven play patterns will drive growth in 2022. Notably, classic toys based on popular television shows and movies, large-scale figures based on the boys’ action entertainment brands and Pre-School toys are liked by kids. The company has undertaken universal brand development with franchises like Jurassic World, Minions, Child’s Play and Sony (including IPs like Ghostbusters and Cobra Kai), as well as Netflix’s Stranger Things, Ada Twist and Money Heist. These are likely to drive sales in the upcoming periods.

The company is benefiting from licensing partnership. Meanwhile, the company made progress related to new licenses covering ball pits, the 10 environment, play environment, outdoor furniture, the foot-to-floor ride-on and trampoline businesses. The company announced the launch of licensed ReDo Skateboards in 2022. The company’s Disguise costume business is likely to perform well in 2022. In recent quarters, several new licenses will come on board. In 2022, the company will add more offerings, from CoComelon to Squid Games, with Stranger Things and Sonic 2 movie costumes. This year the company is witnessing a robust performance of toys developed for the Disney animated film Encanto as well as the live-action and CGI film, Sonic The Hedgehog 2.

The company is witnessing solid growth in Latin America and Europe. JAKKS Pacific announced distribution partnerships in the United States as well as Asia-Pac with Wow! Stuff, a European-based toy innovation company, for two fresh product lines. During second-quarter 2022, the company’s top 10 markets witnessed double-digit growth.

Other Key Picks

Some better-ranked stocks in the Consumer Discretionary sector are Hyatt Hotels Corporation H, Marriott International, Inc. MAR and Choice Hotels International, Inc. CHH.

Hyatt currently carries a Zacks Rank #2 (Buy). H stock has increased 27.9% in the past year. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for H’s current financial year sales and EPS indicates growth of 78.1% and 93.9%, respectively, from the year-ago period’s reported levels.

Marriott currently carries a Zacks Rank #2. MAR has a trailing four-quarter earnings surprise of 1.4%, on average. The stock has increased 19.6% in the past year.

The Zacks Consensus Estimate for MAR’s current financial year sales and EPS indicates growth of 44.6% and 93.7%, respectively, from the year-ago period’s reported levels.

Choice Hotels carries a Zacks Rank #2, at present. CHH has a trailing four-quarter earnings surprise of 20.4%, on average. The stock has increased 1.7% in the past year.

The Zacks Consensus Estimate for CHH’s current financial year sales and EPS indicates growth of 13.6% and 17.7%, respectively, from the year-ago period’s reported levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Marriott International, Inc. (MAR) : Free Stock Analysis Report

Hyatt Hotels Corporation (H) : Free Stock Analysis Report

JAKKS Pacific, Inc. (JAKK) : Free Stock Analysis Report

Choice Hotels International, Inc. (CHH) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research