Jabil (JBL) Q4 Earnings Beat Estimates, Revenues Fall Y/Y

Jabil Inc. JBL reported relatively modest fourth-quarter fiscal 2023 results (ending Aug 31, 2023), with the bottom line beating the Zacks Consensus Estimate but the top line missing the same. The company reported a revenue contraction year over year, owing to demand softness in several key end markets.

Net Income

GAAP net income during the quarter declined to $155 million or $1.15 per share from $315 million or $2.25 per share in the year-ago quarter. The year-over-year decline was primarily attributable to lower revenues and higher income tax expenses.

Non-GAAP net income in the reported quarter was $328 million or $2.45 per share compared with $329 million or $2.34 per share in the year-ago quarter. The bottom line surpassed the Zacks Consensus Estimate of $2.31.

For fiscal 2023, net income on a GAAP basis was $818 million or $6.02 per share compared with $996 million or $6.90 per share in fiscal 2022. Non-GAAP net income improved to $1,172 million or $8.63 per share from $1,105 million or $7.65 per share in fiscal 2022.

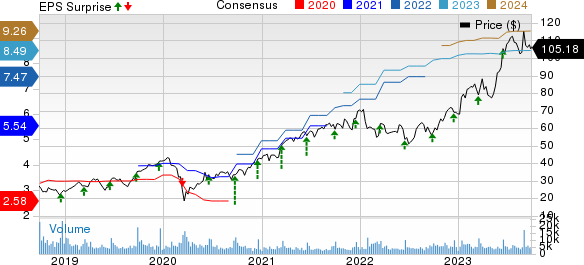

Jabil, Inc. Price, Consensus and EPS Surprise

Jabil, Inc. price-consensus-eps-surprise-chart | Jabil, Inc. Quote

Revenues

Net sales during the quarter totaled $8,458 million, down from $9,030 million in the prior-year quarter. The top line missed the consensus estimate of $8,498 million. Weak demand trends in the Electronics Manufacturing Services vertical impacted the top line.

Revenues from Diversified Manufacturing Services (DMS) remained relatively flat year over year. However, net sales from Electronics Manufacturing Services (EMS) were down 13% from the prior-year quarter.

For fiscal 2023, the company generated $34,702 million in revenues compared with $33,478 million in fiscal 2022. Positive momentum in auto & transportation, and healthcare supported the top line. However, weakness in 5G wireless, cloud and connected devices impeded the revenue growth.

For fiscal 2023, net sales from the DMS vertical were $18 billion, up 8% from fiscal 2022. The top line beat our estimate of $17.8 billion. Revenues from the EMS vertical remained flat at $16.7 billion. The top line fell short of our revenue estimate of $17 billion.

Other Details

Gross profit was $766 million, up from $729 million in the year-ago quarter. Non-GAAP operating income rose to $477 million from $447 million in the year-ago quarter, owing to improved gross margin.

Cash Flow & Liquidity

In fiscal 2023, Jabil generated $1,734 million of net cash from operating activities compared with $1,651 million in fiscal 2022. As of Aug 31, 2023, the company had $1,804 million in cash and cash equivalents, with $2,875 million of notes payable and long-term debt with respective figures of $1,478 million and $2,575 million in the year-ago period.

Outlook

For first-quarter fiscal 2024, revenues are estimated in the range of $8.4-$9 billion. Revenue from the DMS segment is anticipated to be around $5.1 billion and net sales from the EMS vertical are estimated around $3.6 billion. Non-GAAP operating income is expected in the band of $474-$534 million. Management expects non-GAAP earnings per share within the range of $2.40-$2.80.

With the divesture of the Mobility business, management is aiming to accelerate investment in secular growth areas such as electric vehicle, healthcare, renewable energy and AI cloud data centers.

Zacks Rank & Stocks to Consider

Jabil currently has a Zacks Rank #3 (Hold).

Motorola Solutions, Inc. MSI, carrying a Zacks Rank #1 (Strong Buy) at present, delivered an earnings surprise of 5.62%, on average, in the trailing four quarters. In the last reported quarter, it pulled off an earnings surprise of 5.58%. You can see the complete list of today’s Zacks #1 Rank stocks here.

It provides services and solutions to government segments and public safety programs, along with large enterprises and wireless infrastructure service providers. It develops and services both analog and digital two-way radio, voice and data communications products and systems for private networks, wireless broadband systems and end-to-end enterprise mobility solutions to a wide range of enterprise markets.

NVIDIA Corporation NVDA, currently sporting a Zacks Rank #1, delivered an earnings surprise of 9.79%, on average, in the trailing four quarters. In the last reported quarter, it pulled off an earnings surprise of 29.19%.

NVIDIA is the worldwide leader in visual computing technologies and the inventor of the graphic processing unit or GPU. Over the years, the company’s focus has evolved from PC graphics to artificial intelligence-based solutions that now support high-performance computing, gaming and virtual reality platforms.

Arista Networks, Inc. ANET, carrying a Zacks Rank #2, is likely to benefit from strong momentum and diversification across its top verticals and product lines. The company has a software-driven, data-centric approach to help customers build their cloud architecture and enhance their cloud experience. Arista has delivered an earnings surprise of 12.8%, on average, in the trailing four quarters.

It holds a leadership position in 100-gigabit Ethernet switching share in port for the high-speed data center segment. Arista is increasingly gaining market traction in 200 and 400-gig high-performance switching products and remains well-positioned for healthy growth in data-driven cloud networking business with proactive platforms and predictive operations.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Jabil, Inc. (JBL) : Free Stock Analysis Report

Motorola Solutions, Inc. (MSI) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report