The J.M. Smucker (SJM) Up About 15% YTD: Will Momentum Stay?

The J. M. Smucker Company SJM looks well placed, thanks to its impressive net price realization, as well as growth in the digital channel. Also, a revival in the Away From Home division, with pandemic-related restrictions being lifted, is an upside. That said, escalated costs have been an obstacle, which was evident in fourth-quarter fiscal 2021, wherein earnings and sales declined year over year. Sales were negatively impacted by divestitures and the lapping of the year-ago period’s solid demand, which together with high costs hurt the bottom line.

Let’s take a closer look.

The Hurdles

In fourth-quarter fiscal 2021, The J. M. Smucker’s adjusted gross profit declined 10% to $727 million due to adverse volume mix and escalated costs. Further, adjusted gross margin declined to 37.9% from 38.5% reported in the year-ago quarter. SG&A costs rose on account of higher marketing investments and incentive compensation. Management stated that it saw additional marketing investments of $40 million in the fourth quarter. Consequently, adjusted operating income declined 28% to $311.6 million accountable to reduced gross profit and increased SG&A costs. Adjusted operating margin came in at 16.2%, down from 20.6% reported in the year-ago quarter. Apart from these, we note that the company’s selling, distribution and administrative expenses have been increasing year over year for a while.

For fiscal 2022, management expects gross profit margin to be 37-37.5%, indicating a year-over-year decrease of 85 bps (at the midpoint of the guidance range). This can be accountable to escalating costs, which are expected for the full year, including increased costs of commodities, ingredients and packaging. These are likely to be somewhat compensated by improved pricing, productivity savings and gains from divestitures. Talking of fiscal 2022, management expects the pandemic to continue affecting results. While management expects to see softness in at-home consumption trends, away-from-home channels are likely to rebound.

For fiscal 2022, The J. M. Smucker expects a net sales decline of 2-3% year over year. The projection includes an impact of $355.6 million associated with Crisco and Natural Balance divestitures. Nonetheless, prudent divestitures help The J. M. Smucker increase concentration on areas with higher growth potential.

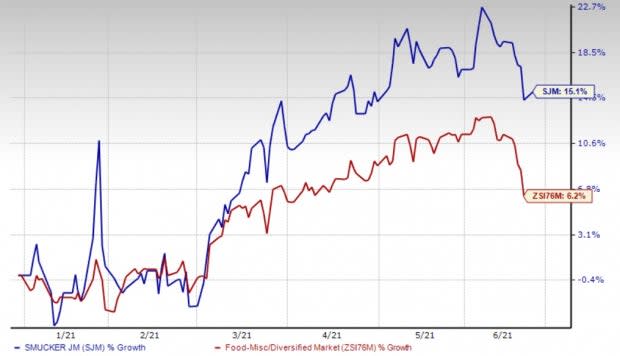

Image Source: Zacks Investment Research

Factors Offering Respite

Although The J. M. Smucker’s top line declined year over year in the fourth quarter of fiscal 2021, the company benefited from improved net price realization. During the quarter, the company saw favorable net price realization to the tune of 1 percentage point, mostly driven by the U.S. Retail Consumer Foods and U.S. Retail Pet Food units. Apart from these, the Away From Home division saw a rebound, with sales rising 7%. While net sales are expected to decline in fiscal 2022, on a comparable basis, they are expected to grow about 2% (at the mid-point of the net sales view). This upside is likely to be backed by higher net pricing in several categories, a revival in away-from-home channels and continued sales growth in Smucker's Uncrustables brand.

Additionally, The J. M. Smucker is benefiting from efforts to bolster its e-commerce channel, given the increasing trend of online customers. On its fourth-quarter fiscal 2021 earnings call, management said that e-commerce sales formed 12% of the company’s U.S. sales. Management anticipates witnessing continued strength in the e-commerce channel in the forthcoming periods, as consumers adapt to online shopping amid the pandemic.

Apart from these, The J. M. Smucker’s focus on its core strategy, which includes driving commercial excellence, simplifying cost structure, unleashing organization to win and reshaping portfolio, bodes well. Shares of this Zacks Rank #3 (Hold) company have surged 15.1% so far this year, outpacing the industry’s growth of 6.2%.

3 Stocks Worth Relishing

Medifast MED, which currently carries a Zacks Rank #1 (Strong Buy), has a trailing four-quarter earnings surprise of 12.7%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

Darling Ingredients DAR, with a Zacks Rank #1, has a trailing four-quarter earnings surprise of 29.8%, on average.

Nomad Foods NOMD has a Zacks Rank #2 (Buy) and its bottom line outpaced the Zacks Consensus Estimate by 10.3% in the trailing four quarters, on average.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The J. M. Smucker Company (SJM) : Free Stock Analysis Report

Darling Ingredients Inc. (DAR) : Free Stock Analysis Report

MEDIFAST INC (MED) : Free Stock Analysis Report

Nomad Foods Limited (NOMD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research