Invest Like Warren Buffett With These 3 Stocks

Investors are highly familiar with Warren Buffett, also known as the “Oracle of Omaha.”

Buffett is the CEO of Berkshire Hathaway, a diversified holding company whose subsidiaries engage in insurance, freight rail transportation, energy generation and distribution, manufacturing, and many others.

Throughout time, investors have loved to mimic Buffett’s investing style.

And with such a successful track record, it’s easy to understand why.

In 2022, three of Buffett's buys include Occidental Petroleum OXY, McKesson Corp. MCK, and Citigroup C.

Below is a chart illustrating the year-to-date performance of all three stocks, with the S&P 500 blended in as a benchmark.

Image Source: Zacks Investment Research

For those interested in investing like the Oracle of Omaha, let’s take a deeper dive into each one.

Citigroup

Citigroup, a globally diversified financial services holding company, provides various financial products and services to consumers, corporations, governments, and institutions.

For those that seek income, Citigroup has got that covered; the company’s annual dividend yield currently sits at 4.5%, well above its Zacks Finance sector average of 2.4%.

Further, Citigroup carries a sustainable payout ratio of 26% paired with a 9% five-year annualized dividend growth rate.

Image Source: Zacks Investment Research

Shares appear reasonably priced; the company’s price-to-book ratio comes in at 0.5X, beneath its 0.8X five-year median and nowhere near its Zacks Finance sector average of 3.2X.

Image Source: Zacks Investment Research

For the cherry on top, Citigroup has an impressive earnings track record, exceeding both revenue and earnings estimates in three consecutive quarters. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

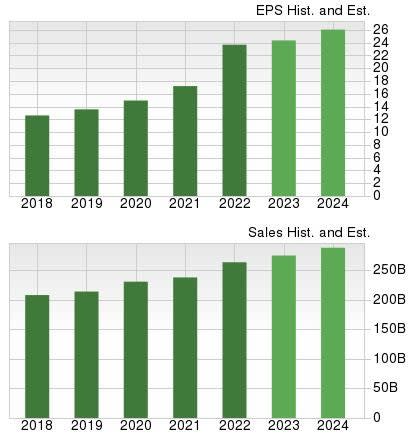

McKesson Corp.

McKesson Corp. is a healthcare services and information technology company operating through two segments: Distribution Solutions and Technology Solutions.

Analysts have been bullish regarding their earnings outlook over the last several months, helping land MCK into a favorable Zacks Rank #2 (Buy).

Image Source: Zacks Investment Research

The company is projected to grow at a solid pace; earnings are forecasted to climb 4.5% in its current fiscal year (FY23) and a further 6.7% in FY24.

The projected earnings growth comes on top of forecasted Y/Y revenue upticks of 4.3% and 4.6% in FY23 and FY24, respectively.

Image Source: Zacks Investment Research

In addition, the company pays a small dividend; MCK’s annual dividend yield sits at 0.6%, below its Zacks Medical sector average of 1.5% by a fair margin. Still, the company’s payout has grown 7.8% over the last five years.

Image Source: Zacks Investment Research

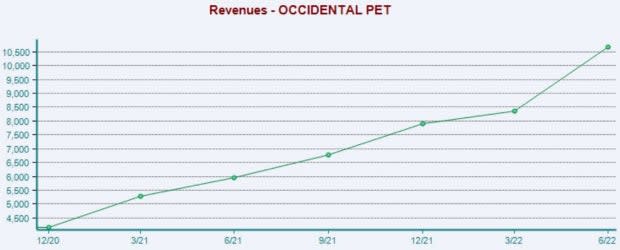

Occidental Petroleum

Easily one of Buffett’s most famous buys in 2022, Occidental Petroleum is an integrated oil and gas company with significant exploration and production exposure.

OXY has been firing on all cylinders, exceeding earnings and revenue estimates in three consecutive quarters. Just in its latest print, the company penciled in a 7.9% EPS surprise paired with a 10.2% revenue beat.

Image Source: Zacks Investment Research

Keep an eye out for OXY’s upcoming print on November 8th; the Zacks Consensus EPS Estimate of $2.48 suggests a Y/Y earnings increase of more than 180%.

Furthermore, Occidental Petroleum knows how to generate serious cash – in its latest quarter, the company reported free cash flow of $4.4 billion, penciling in a sizable 66% sequential increase.

Image Source: Zacks Investment Research

Bottom Line

Many investors mimic Warren Buffett, closely following all of his moves. With his track record of success, it’s easy to see why.

In 2022, he’s been on the offensive, buying shares of Occidental Petroleum OXY, McKesson Corp. MCK, and Citigroup C.

For those looking to invest like the Oracle of Omaha, all three would provide precisely that.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Citigroup Inc. (C) : Free Stock Analysis Report

Occidental Petroleum Corporation (OXY) : Free Stock Analysis Report

McKesson Corporation (MCK) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research